Term Life Insurance Smoker

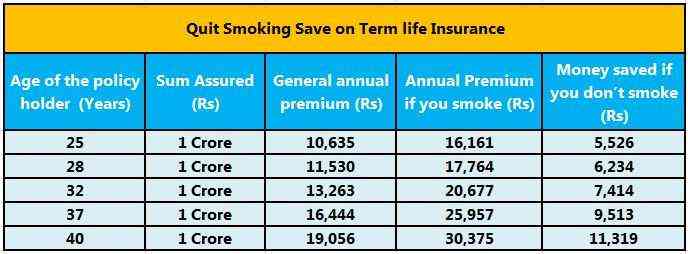

As discussed earlier some companies will give you the best rate as a non smoker after 3 years and others after 5 years.

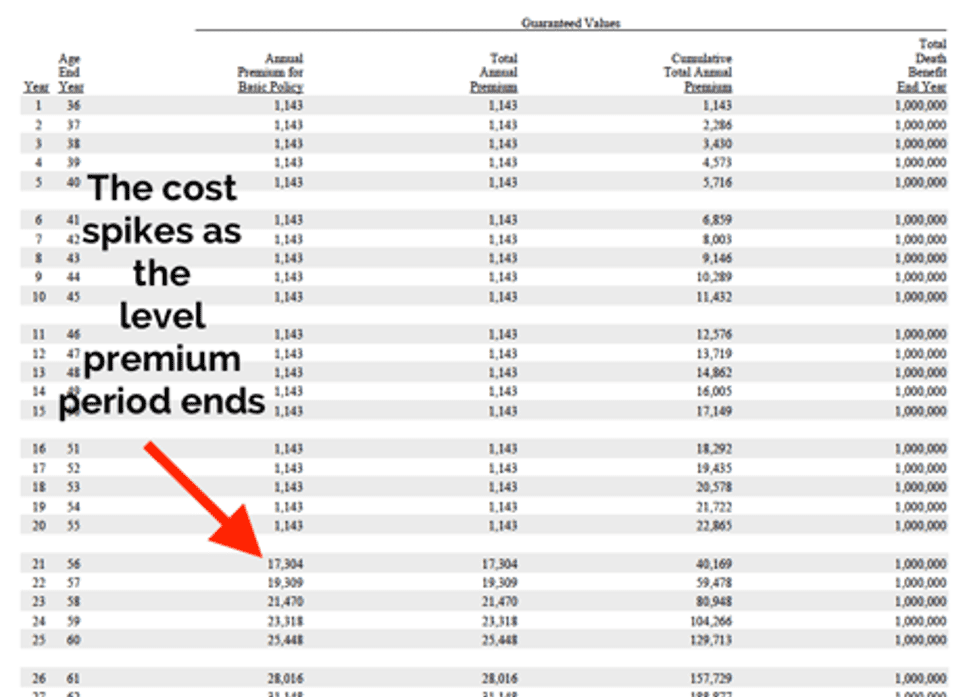

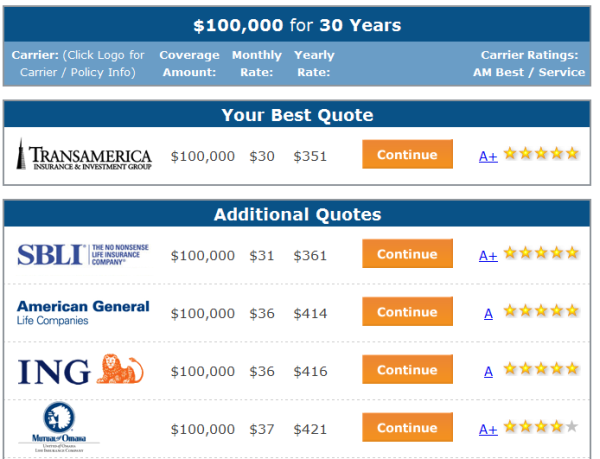

Term life insurance smoker. Life insurance shopping for smokers. You can also check out our life insurance calculator to find how much you need. Luckily there are ways for smokers to get a good deal on life insurance and it starts with comparing multiple providers to find the most affordable option to fit their needs. Choosing the wrong broker will lead to paying even more.

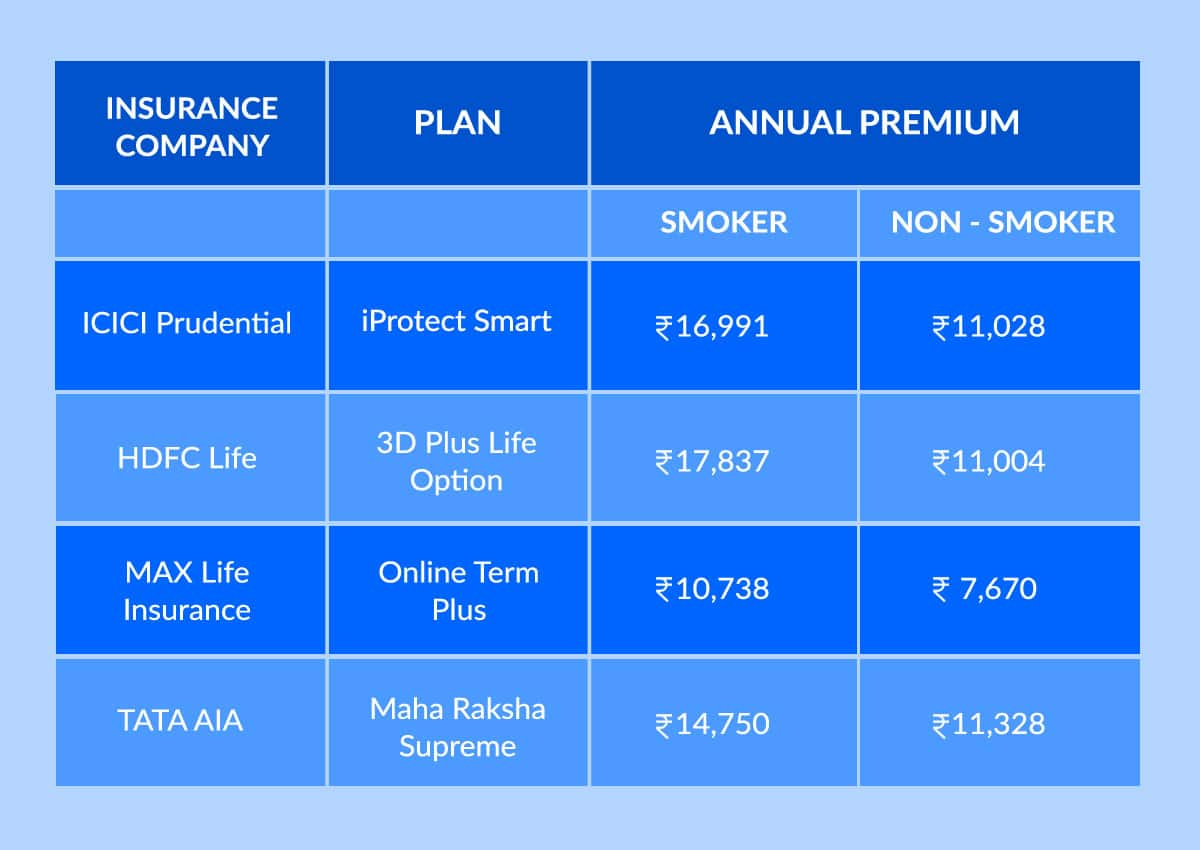

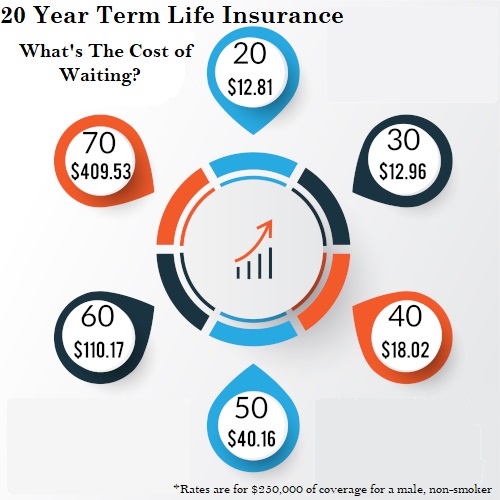

Every smoker should have a life insurance plan as the probability of a smoker passing away earlier than other non smokers is higher. Underwriters at life insurance companies see smoking as a risk as smoking increases the chances of death by 12 27 when compared to non smokers. A 20 year level term policy for a 50 year old woman non smoker with no health problems in the amount of 200 000 will cost only an average of 37 per month. Bearing this in mind insurance companies now offer term insurance plans for smokers.

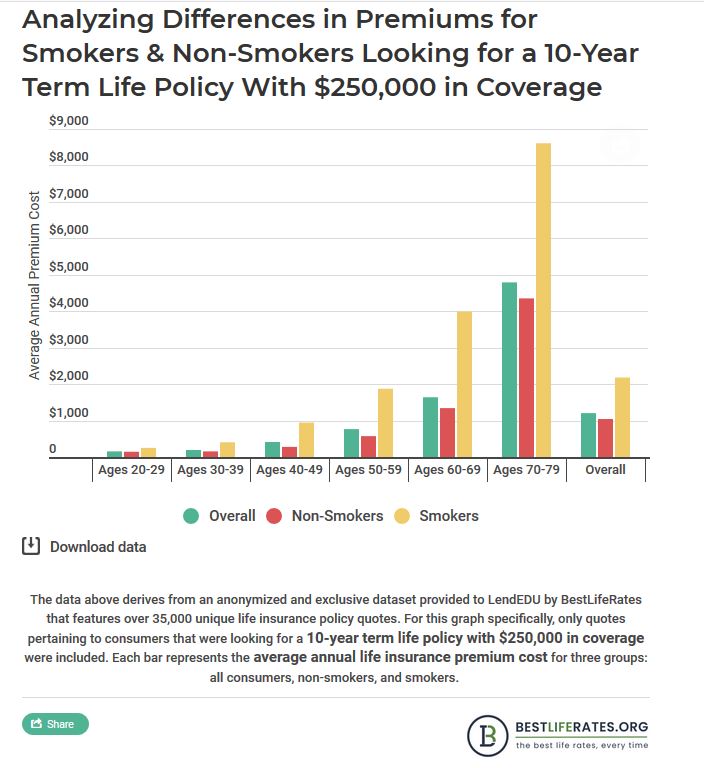

Term life insurance rates are at least 50 higher for tobacco users she says and some insurers will include e cigarettes smokeless tobacco cigars pipe smoking and other forms of nicotine use that don t require inhaling tobacco smoke in those higher rates. Getting a term life insurance policy can be a wise financial decision for your family. A 10 year level term policy for a 55 year old man non smoker in good health in the amount of 500 000 will cost around 80 per month from a a rated company. So it s pointless to hide the fact that you smoke when applying for coverage.

It may sound extreme but this will give your loved ones enough money to pay off all debts pay for funeral expenses and other final expenses as well as give them enough time to recover the lost salary. For example if you make 50 000 every year you should purchase a 500 000 life insurance policy and read term life insurance for smokers. You can start by entering your information into our life insurance advisor to see what s best for your situation. Life insurance for smokers is expensive.

Whole life insurance rates can be about 20 higher for smokers. There have been cases wherein customers hide the fact that they smoke from insurance companies. Since smoking results into poor quality of life and untimely death life insurers are cautious before issuing policy to a smoker. Your life insurance medical exam which is required as part of your application for term life insurance for smokers will detect the presence of nicotine in your system as part of the life insurance nicotine test.