The Coverage Included In An Automobile Insurance

The coverage included in an automobile insurance policy that covers property damage is insurance.

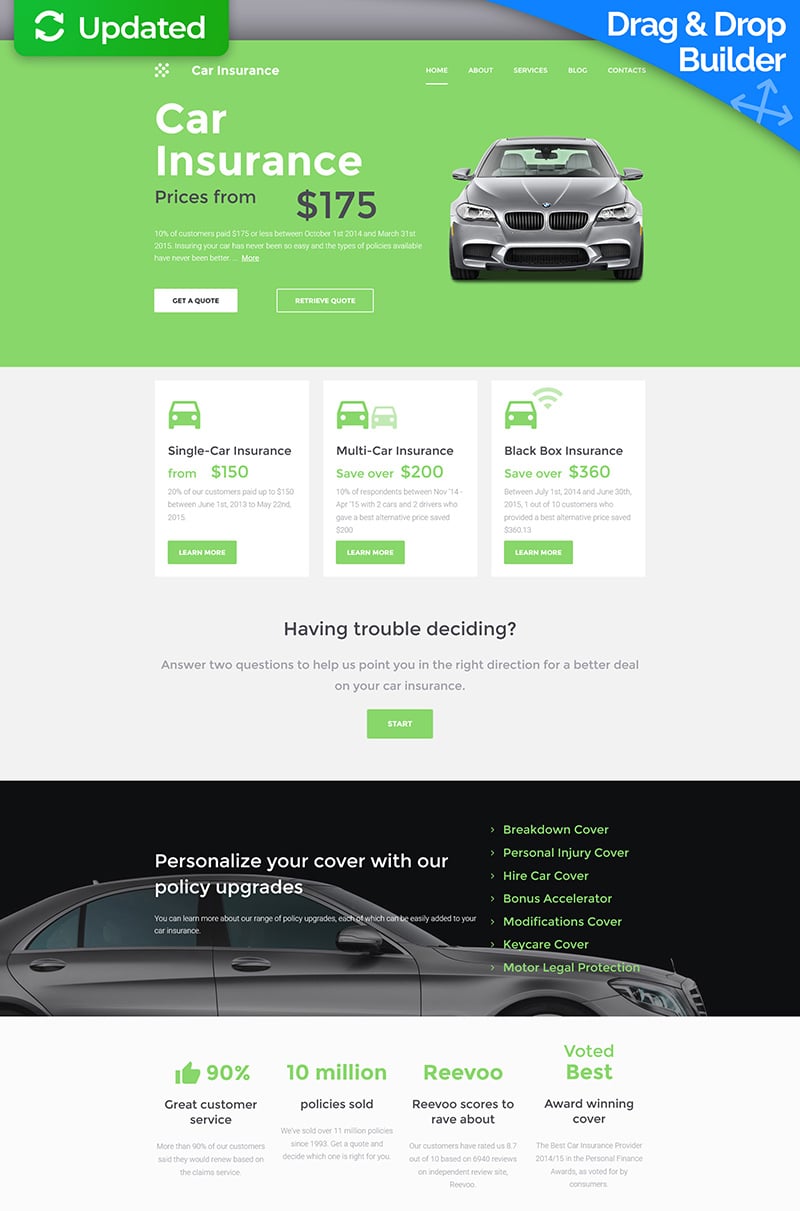

The coverage included in an automobile insurance. The coverage included in an automobile insurance policy that covers property damage is liability insurance. Can set its state minimum requirements for auto insurance. Some states also require insurance for uninsured or underinsured motorists and some require medical payments coverage. Getting car insurance is a crucial part of making sure you and your vehicle are protected in case of an accident on the road.

Liability insurance is a part of general insurance is also known as third party insurance which is compulsory insurance without this insurance no vehicle can be plied on road is a system of risk financing to prevent the customer from any lawsuits imposed for any accident. Requirements for liability car insurance. Each state sets a minimum for how much liability coverage a motorist must carry. The coverage included in an automobile insurance policy that covers property damage is insurance.

Up to 500 000 in coverage. Definitely verify with your insurance agent what coverage is offered by a home insurance policy. Bodily injury liability personal injury protection property damage liability collision comprehensive and uninsured underinsured motorist. Up to 250 000 in coverage with pip medical exclusion s exclusion is available for a named insured with non medicare health coverage that covers auto accident injuries and or for household members if they have health insurance that will cover auto accident injuries.

Unlike say life insurance which is a good idea but optional car insurance is mandated for most drivers at least some amount of auto insurance is required in most states and even in states where car insurance isn t required by law it s still a good idea. For example a state might require all drivers to have liability. Some insurance carriers might let you add an endorsement to your home owner s policy if the vehicle is an antique. Every state in the u s.

Note that each type of coverage is priced separately so there is variability in. These typically include bodily injury liability and property damage liability. The only place to find coverage is on an auto policy. For these activities you ll be required to pay a higher premium and get a more inclusive policy.

The coverage included in an automobile insurance policy that covers property damage is liability insurance.

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg)

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)