Traditional Ira Brokerage Account

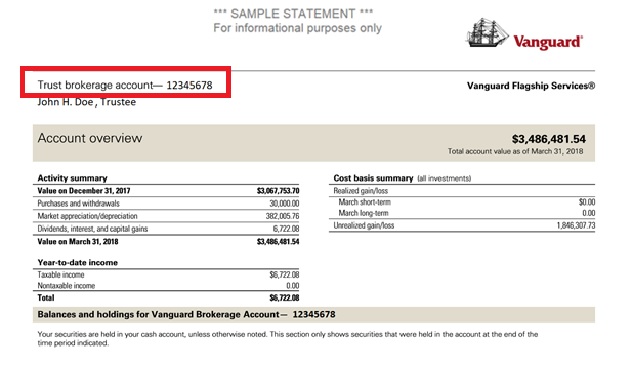

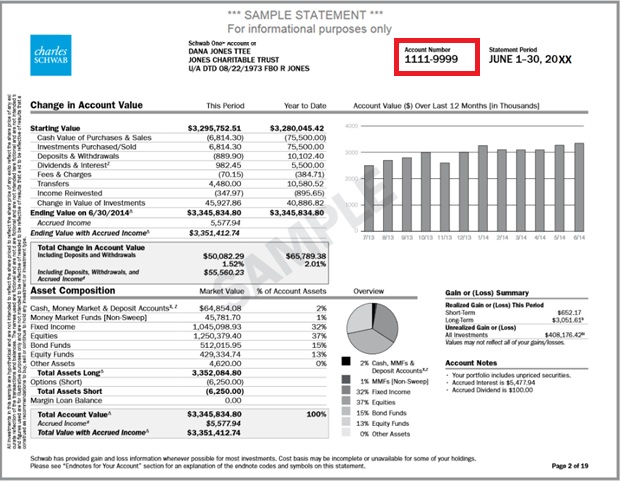

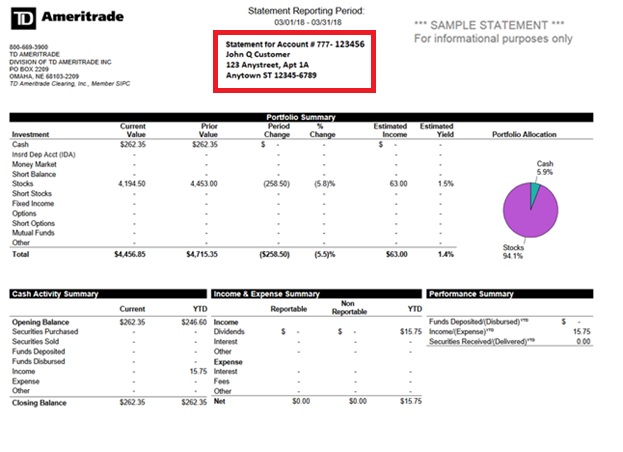

Transfers from brokerage accounts and ira rollovers.

Traditional ira brokerage account. A traditional ira brokerage account a roth ira and a traditional brokerage account all have different tax advantages. In contrast with a traditional brokerage account taxes may eat into your savings every year depending on how you invest. It doesn t give you the tax. There s no contribution limit associated with a taxable brokerage account.

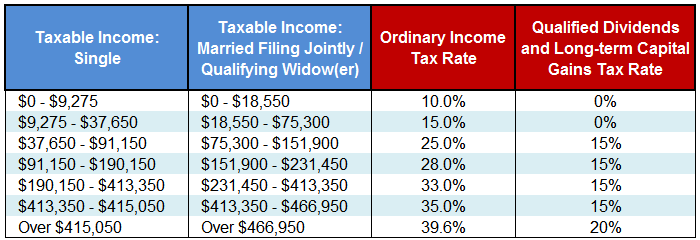

The process for transferring an account from one brokerage firm to another is largely automated. Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a traditional ira. That tax free treatment is extremely unusual and sets apart roth iras both from regular taxable brokerage accounts and from several other types of tax favored retirement accounts. You pay taxes on your investment gains only when you make withdrawals in retirement.

The 2019 ira contribution limits are 6 000 for investors under 50 and. The secure act signed into law on december 20 2019 removed the age limit in which an individual can contribute to an ira. Other traditional ira advantages. Whether you prefer a traditional or roth ira it s important to choose an account that includes the features you want without charging unnecessary fees.

An individual retirement account or ira. In order to take the traditional ira. When you compare a brokerage account to an ira there are different processes involved with transferring a brokerage account vs ira rollovers. If you are able to save more open a taxable brokerage account or joint brokerage account and save as much as possible there.

You can find an ira at most banks and brokerage firms so how do you know which is the best. A traditional ira is a type of individual retirement account that lets your earnings grow tax deferred. A brokerage account on the other hand is a platform for making traditional investments and trades these can be taxed as income in the traditional sense.