Treasury Bill Note Bond

Investors can find treasury bills notes and bonds posted with active bids and offers.

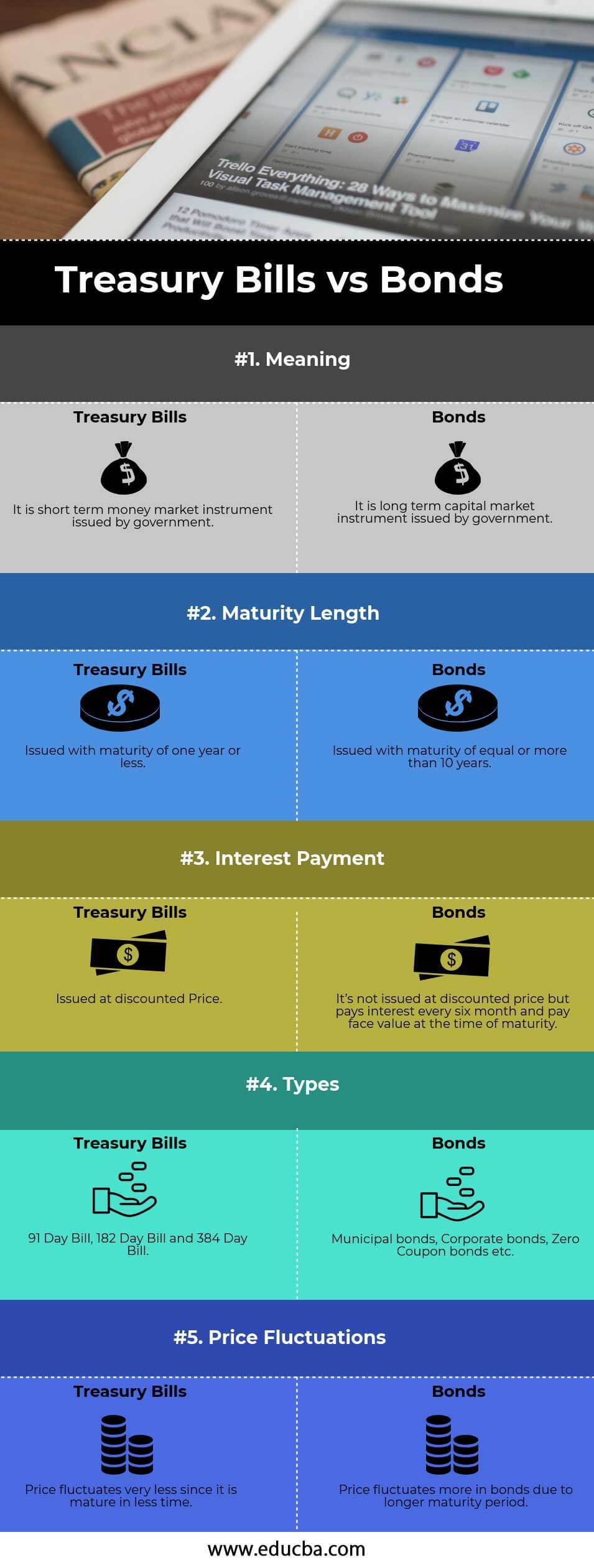

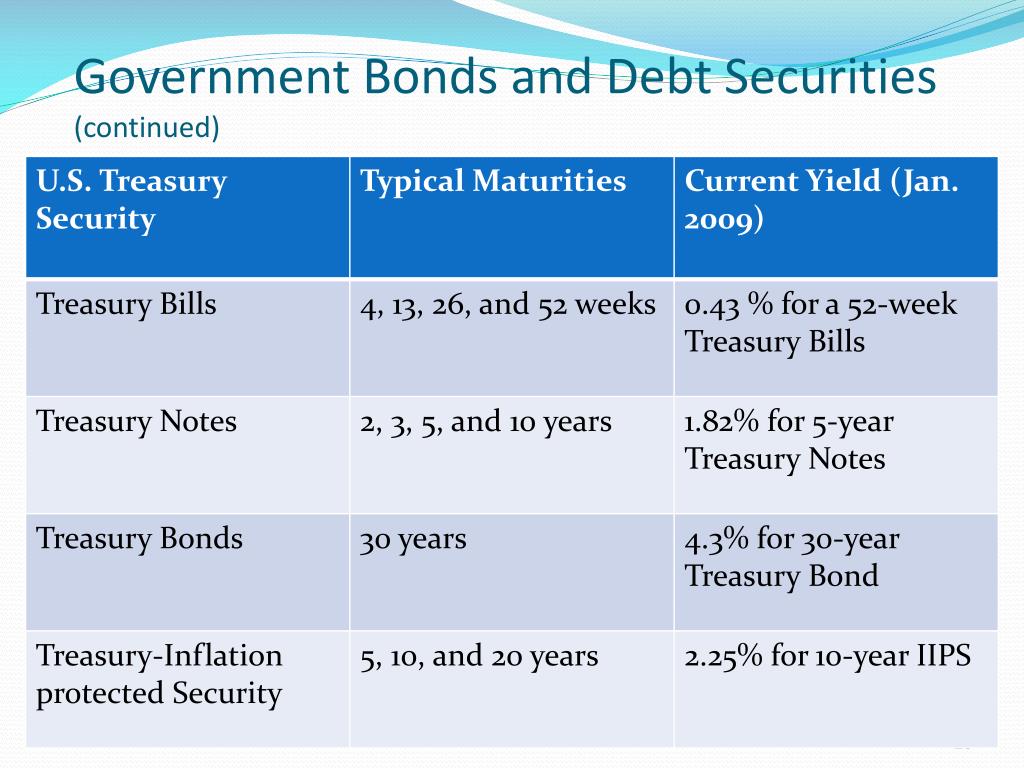

Treasury bill note bond. From february 18 2002 to february 8 2006 treasury published. View the latest bond prices bond market news and bond rates. Government used budget surpluses to pay down federal debt in the late 1990s the 10 year treasury note. Treasury bonds t bonds also called a long bond have the longest maturity at thirty years.

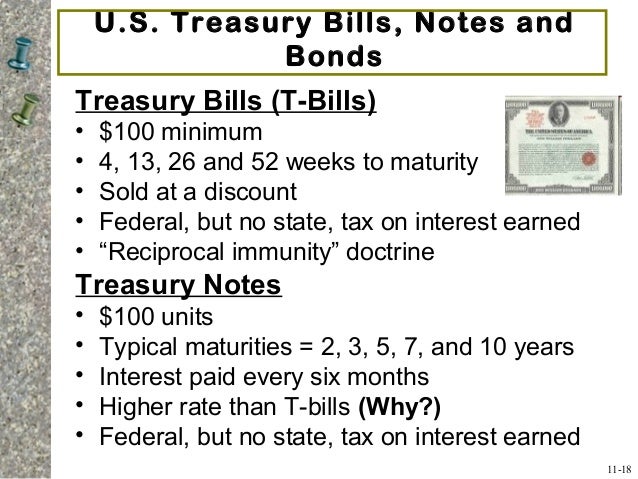

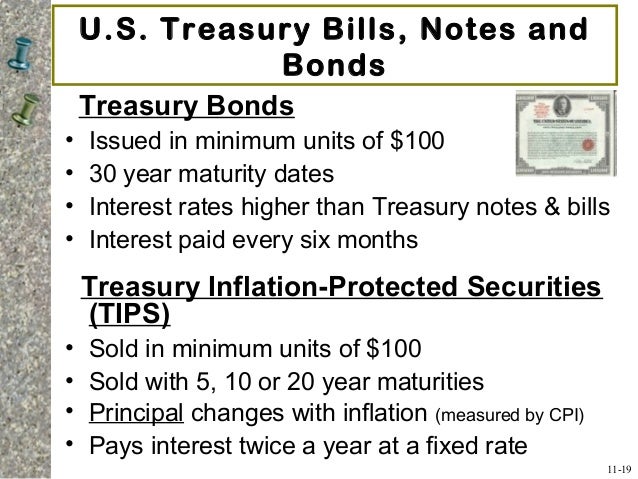

30 year treasury constant maturity series was discontinued on february 18 2002 and reintroduced on february 9 2006. Federal government suspended issuing 30 year treasury bonds for four years from february 18 2002 to february 9 2006. Treasury bonds bills and notes are all investment products issued by the federal government to help finance its operations. Currently there are 17 authorized securities dealers primary dealers that are obligated to bid.

10 year treasury note bond overview by marketwatch. Tmubmusd10y a complete u s. Bills only pay interest at maturity. A formal bidding process that is scheduled on a regular basis by the u s.

The bills like savings bonds are sold at a discount from their face value. Name coupon price yield 1 month 1 year time edt gb3 gov. You get the full amount when the bill matures. The treasury department pays the interest rate every six months for notes bonds and tips.

Investors considering treasury securities have opportunities to buy bonds both at regularly scheduled auctions see auction schedule and in the secondary market which is one of the world s most actively traded markets. They have a coupon payment every six months like t notes. The notes and bonds on the other hand are sold at their face value have a fixed interest rate and kick off interest payments once every six months. Find information on government bonds yields muni bonds and interest rates in the usa.

/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

:max_bytes(150000):strip_icc()/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

/shutterstock_27231070_treasury-5c7d189346e0fb0001edc87d.jpg)

:max_bytes(150000):strip_icc()/GettyImages-52182315-a98362bebb534068acac6dcf05f7fa20.jpg)