Types Of Refinance Mortgage Loans

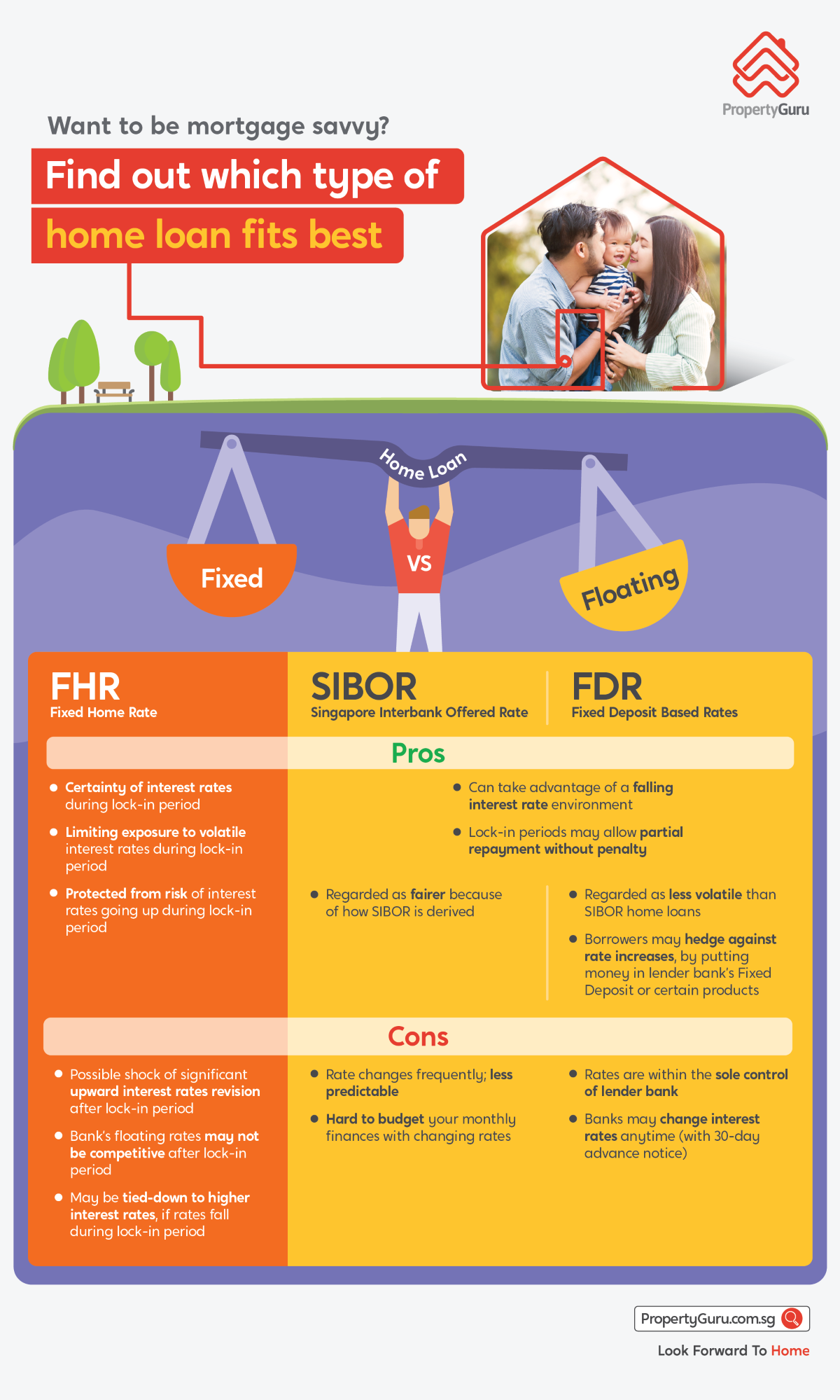

Rate and term refinance the rate and term refinance is is the most common type of refinance where the original loan is paid off and replaced with a fresh loan with a new rate and set of terms.

Types of refinance mortgage loans. Rate and term refinance a rate and term refinance allows you to lower your rate change your loan program e g 5 year arm to a 30 year fixed or both. Cash out refinancing is an option that allows you to receive part of your home s equity in the form of cash at the same time you refinance your loan. Your new loan will be larger than your current loan and you can use the money however you want from paying off high interest credit cards to affording a college education. Rate and term refinance cash out refinance and cash in refinance.

Each type has its advantages and ideal. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs. Generally you can find three main loan types for mortgage refinance. If you would like to take advantage of lower rates and a different loan program this type of refinance loan is a good option.

Rate and term refinance is the most common type of mortgage. So let s take a look at five different types of refinance loans. 8 types of mortgage loans for home buyers and refinancers common types of mortgage loans include fixed rate adjustable rate fha va and jumbo mortgages.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/GettyImages-1171659710-149c5671e12b4e4d855730507df022ef.jpg)