Types Of Reverse Mortgages

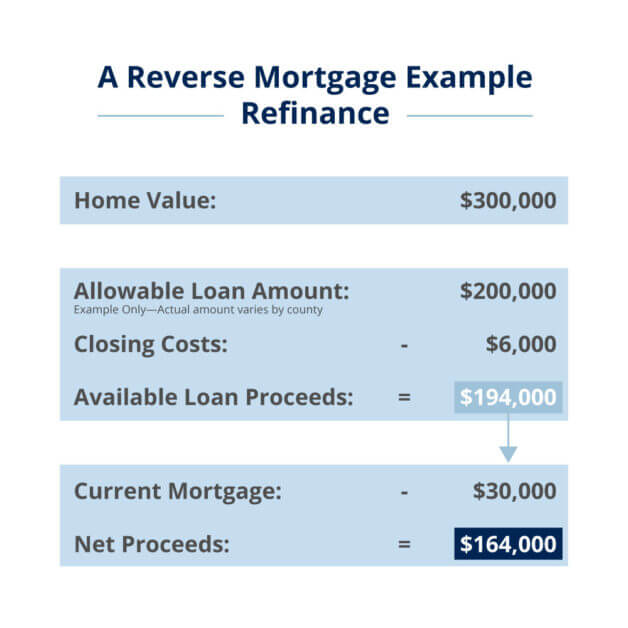

The counselor also should be able to help you compare the costs of different types of reverse mortgages and tell you how different payment options fees and other costs affect the total cost of the loan over time.

Types of reverse mortgages. There are three types of reverse mortgage loans available to homeowners aged 62 and older. Most of the same hecm rules restrictions and options apply to the hecm for purchase program except for one main difference. You can visit hud for a list of counselors or call the agency at 1 800 569 4287. It is a common misconception that reverse mortgages are best used only as a last resort.

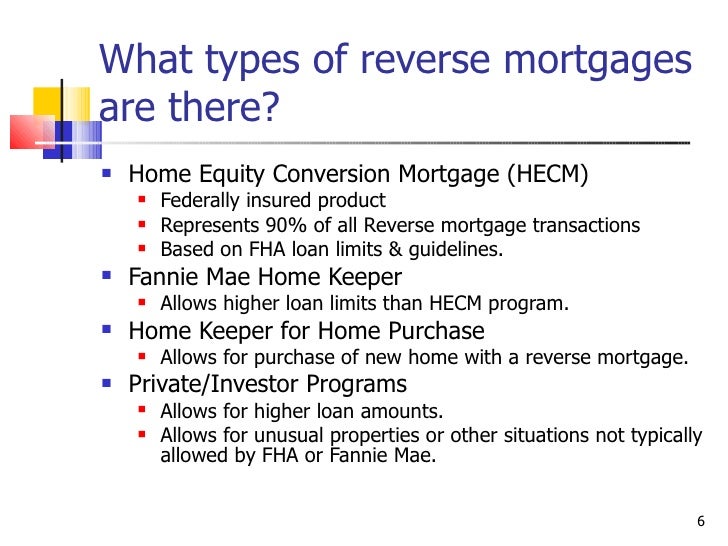

The hecm for purchase can be used to buy a new home. Hecm hecm for purchase proprietary and single purpose reverse mortgages. Types of reverse mortgages home equity conversion mortgage hecm pronounced hekum is the commonly used acronym for a home equity conversion mortgage a reverse mortgage created by and regulated by the u s. In addition to hecm loans some lenders may offer proprietary reverse mortgage loans which are not insured by the federal government and are typically designed for borrowers with.

Types of reverse mortgages. There are 4 main types of reverse mortgage. Though some other financial products are designed for a single purpose the truth is that reverse mortgages are not a one size fits all loan. Department of housing and urban development hud.

It s now available in all 50 states and falls under the reverse mortgage types that are fha insured. Department of housing and urban development. Understand the differences pros cons risks and which is right for your situation.

:max_bytes(150000):strip_icc()/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg)