Types Of Stock Brokers

One very common type is referred to as speed trading or high frequency trading.

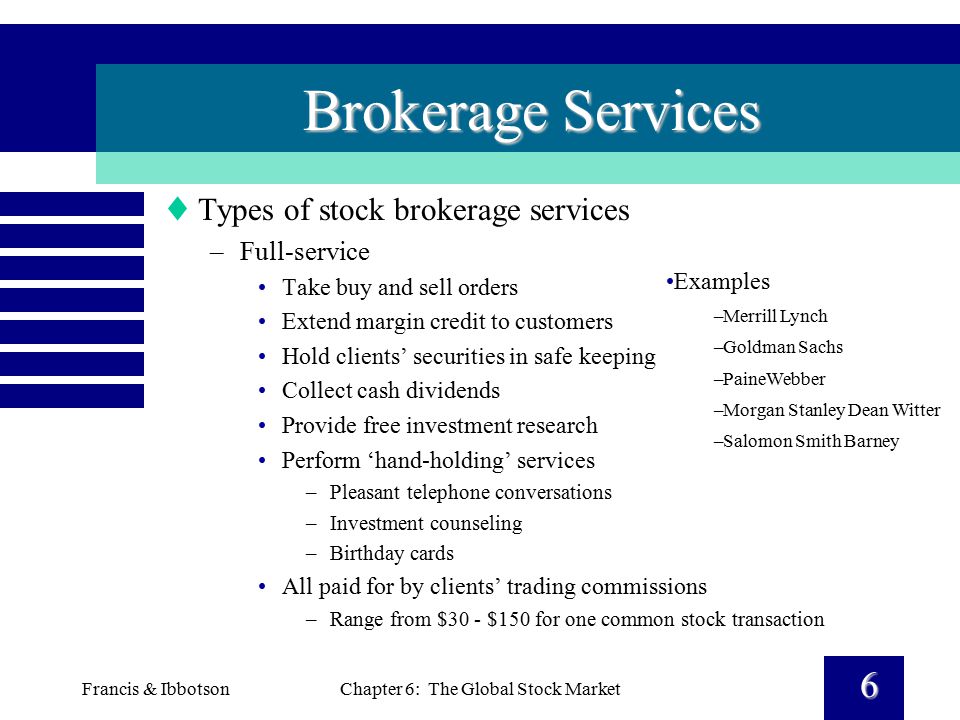

Types of stock brokers. They are briefly explained as follows. Share brokers in india are governed by the securities and exchange board of india act 1992 and brokers must register with the securities and exchange board of india. Full service brokers controlled the market and their high commissions were the standard. After you ve chosen a stockbroker you are going to want to begin trading shares before you do that you should learn the 13 types of trade orders you can.

All financial market transactions have to be executed through a broker. Position trading is like the slow but steady approach to trading. Speed is the cardinal factor in this kind of trade. The agency broker model resembles one used in trading stocks.

A broker also known as a brokerage is a company that connects buyers and sellers of investment vehicles like stocks and bonds. Investing in the stock market requires the assistance of a stockbroker to execute your orders even if you don t feel like you need their advice. Even within the construct of intra day trading there are different types of stock trading options. What are stock brokers.

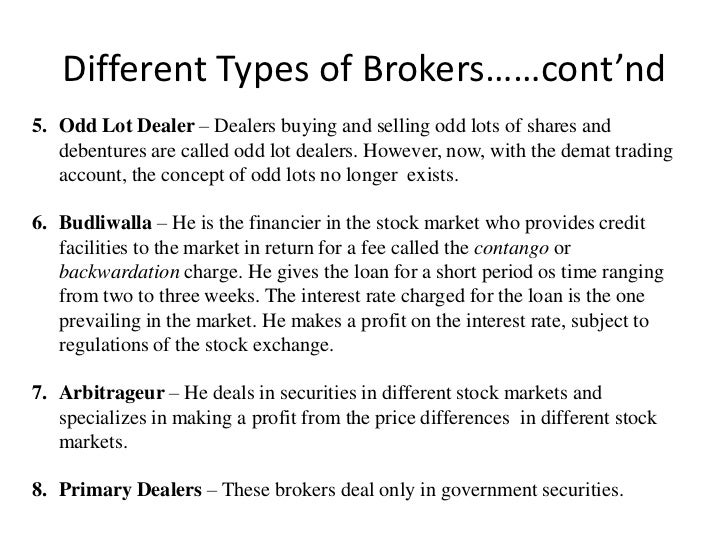

Different types of brokers. Types of members or brokers at stock exchange. A stock broker or brokerage is licensed and regulated financial firm that facilitates buying and selling transactions in various financial instruments for investor clients institutions and or for the firm. In this model the broker acts as the customer s agent.

Many investors today don t remember a time when you had no choice about the type of stockbroker to use. A brokerage account is often where an investor keeps assets. In this beginner s stock trading step by step tutorial part of our guide to trading stocks online you will learn about the different kinds of trading orders you can place with your online broker. The 13 primary types of stock order.

In this case the trick is all about manipulating the bid and ask price at a great speed. Members or brokers of a stock exchange can be classified into floor brokers commission brokers jobbers tarawaniwalas odd lot dealers badliwalas arbitrageurs and sub brokers or remisiers. It s vital for scalpers to have access to low trading commissions. Stock xyz is presently trading at 50 per share and you want to buy it at 49 90.