Understanding Automobile Insurance Coverage

Auto insurance policies are confusing and boring documents filled with legal jargon that can be an absolute nightmare to read.

Understanding automobile insurance coverage. Stay tuned for the rest. Understanding the simple basics of auto insurance will make you confident that the car insurance policy you choose will take care of your needs in the event of an accident. You can read part one here part two and part three. The importance of having insurance for your vehicle is to act as a guarantee that in case the worst ever happens you and your car will be covered protected by the insurance company.

While basic auto insurance policies are standardized to some extent it s still important to compare policies in terms of coverage as the particular amounts and range of coverage for example. People do not understand what coverage is on their car insurance policy. I ve been working claims in the car insurance industry for an entire year now and it has taught me one thing. This article is part four in a series on auto insurance coverage.

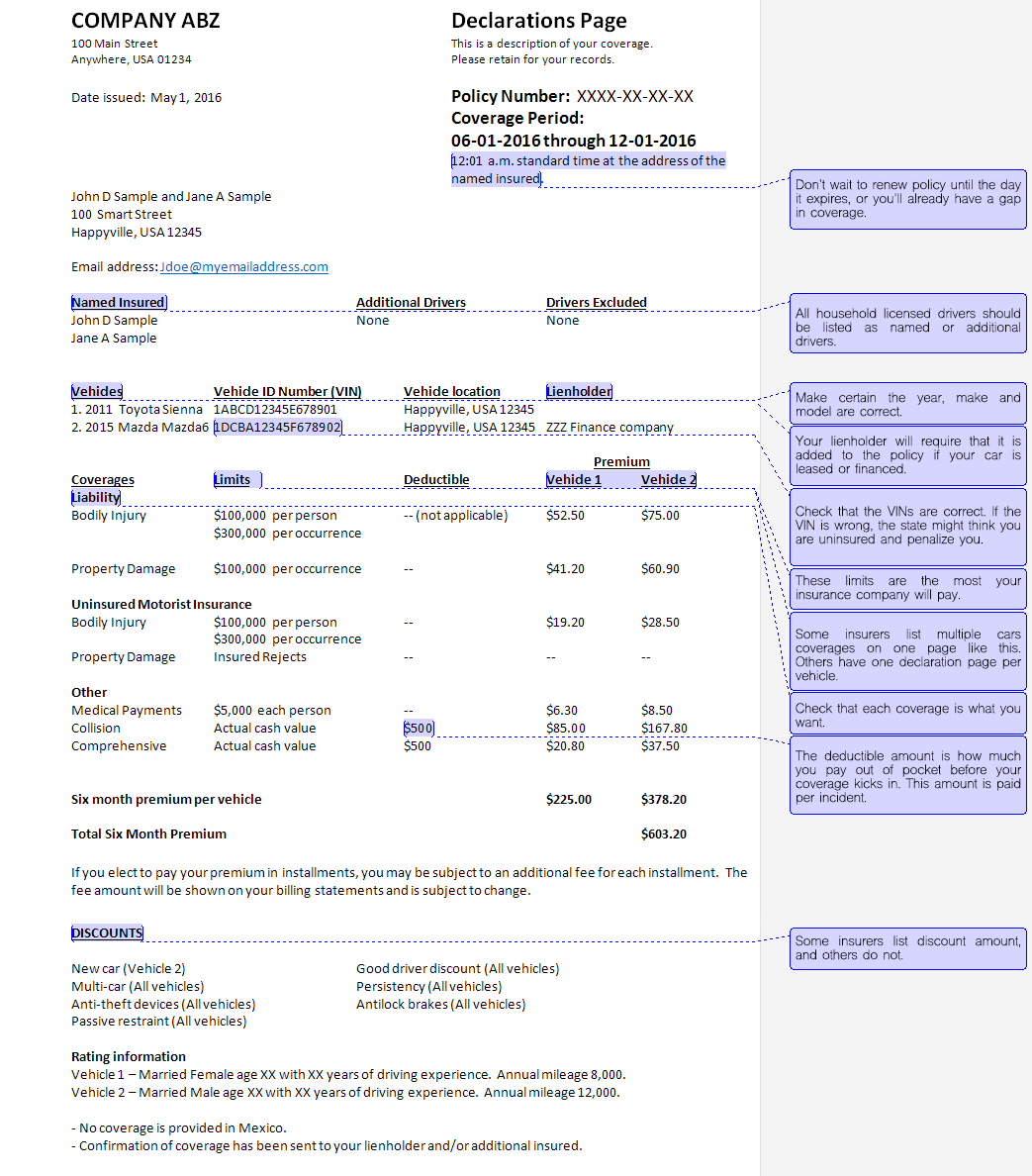

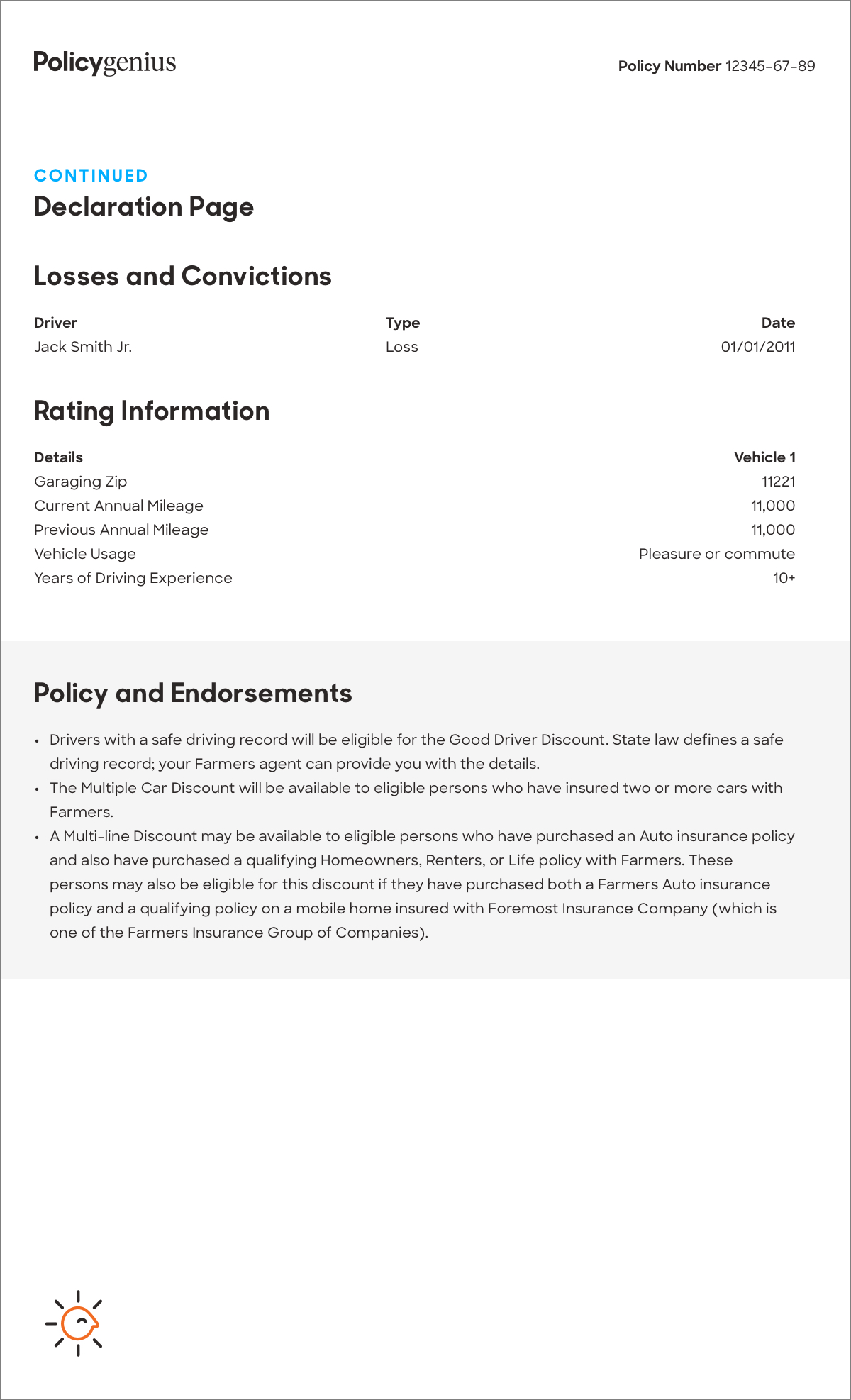

This is a huge problem. Liability limits often appear in shorthand numbers for example 100 300 50 means you have up to 100 000 bodily injury coverage for each injured person up to 300 000 bodily injury coverage. Deductibles limits and optional coverages may differ from company to company. In this article we will walk you through the types of coverage that insurance companies offer and discuss possible insurance needs.

Understanding your car insurance coverage. Comprehensive coverage pays to repair your vehicle subject to. If you re in an automobile accident regardless of who is at fault collision insurance provides protection to replace or repair your vehicle subject to a deductible. Uninsured motorist coverage provides coverage for injury or property damage if you are injured by a hit and run driver or a driver who does not have auto liability insurance.

If you live in a state that has no fault laws meaning there is no need to determine who is at fault to receive payment for injury claims parties seek recovery from their own insurers instead of. Most states in the u s. Some auto insurers however are now offering supplemental insurance products at additional cost that extend coverage for vehicle owners providing ride sharing services. Understanding car insurance policy for dummies car insurance is a cover that is provided for all types of cars ranging from trucks passenger cars and suvs.

In the event of hail damage or a tree limb falling on your car risks not involving an automobile collision this coverage insures you. Require all car owners to have some form of auto insurance to protect from the high costs associated with car accidents.

:max_bytes(150000):strip_icc()/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)