Us Bank Home Refinance Rates

Loans are available up to 90 percent loan to value without mortgage insurance.

Us bank home refinance rates. Sometimes homeowners simply need a bit of extra cash to make ends meet. It s available with fixed rates and a loan term up to 20 years. The us bank smart refinance is a type of no closing cost refinance. Mortgage rate lock period of 45 days in all states except ny which has a rate lock period of 60 days.

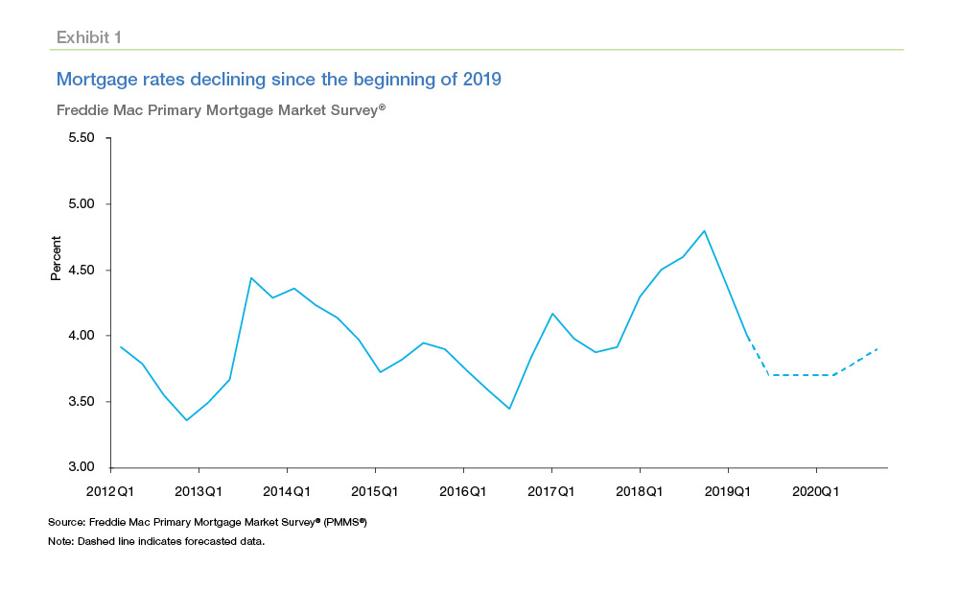

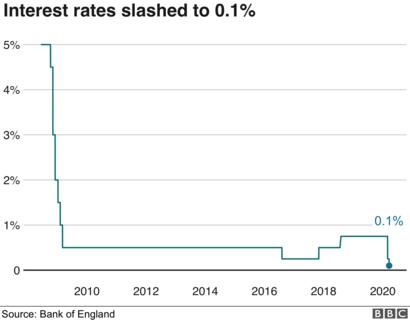

We offer a variety of home refinancing options and are ready to help you find the right choice for your needs. The current mortgage rates listed below assume a few basic things about you including you have very good credit a fico credit score of 740 and you re buying a single family home as your primary residence check out the mortgage rates charts below to find 30 year and 15 year mortgage rates for each of the different mortgage loans u s. What are today s refinance rates. At the same time mortgage lenders are less willing to take on risk because of market uncertainty prompted by the coronavirus.

Use our compare home mortgage loans calculator for rates customized to your specific home financing need. The bank offers a broad range of loan types including refinance and home equity loans as well as first time homebuyer loan programs and education. Rates shown are not available in all states. Arm interest rates and payments are subject to increase after the initial fixed rate period 5 years for a 5 1 arm 7 years for a 7 1 arm and.

You can apply for the us bank smart refinance refinance online. Us bank offers further savings by locking your interest rate on a loan with terms up to 20 years. Loan to value of 80. Conforming loan amounts of 300 000 to 349 999.

Refinance rates valid as of 11 sep 2020 10 12 am edt and assume borrower has excellent credit including a credit score of 740 or higher. Customer profile with excellent credit. On sunday september 13 2020 according to bankrate s latest survey of the nation s largest refinance lenders the benchmark 30 year fixed refinance rate is. The bank accepts down payments as low as 3.

Use annual percentage rate apr which includes fees and costs to compare rates across lenders rates and apr below may include up to 50 in discount points as an upfront cost to borrowers and assume no cash out. Home mortgage equity rates. Mortgage refinance rates are historically low and many homeowners could save by refinancing to a lower mortgage rate. Select product to see detail.

Refinancing a mortgage with u s. Us bank s no cost mortgage refinancing.

:max_bytes(150000):strip_icc()/us-bank-inv-be8736c5fbca4290a47a31b9656b0823.png)