Va Funding Fee Rolled Into Loan

First off let me say this va loans are the best loan products out there.

Va funding fee rolled into loan. The funding fee can be rolled into the va loans and does not have to come out of pocket. Not only do borrowers not need to put anything down but they can also finance the va funding fee as well. Give us a call at 855 223 0705. Now getting to the question yes.

When the va funding fee is rolled into the monthly balance the lender then applies the overpayment to the va loan balance. See how much it costs in 2020. The va funding fee is a one time charge that can be paid upfront or rolled into the mortgage. The funding fee is the only closing cost va buyers can roll into their loan balance and that s how most borrowers approach this fee.

Prior to july 1 2019 a provision in va pamphlet 26 7 chapter 8 topic 8 directed lenders to apply funding fee refunds to an outstanding loan balance in cases where veterans had financed the funding fee. The funding fee doesn t need to be paid separately and is typically rolled into the loan. Let s say you re using a va backed loan for the first time and you re buying a 200 000 home and paying a down payment of 10 000 5 of the 200 000 loan. We hoped this answered the question can closing costs be rolled into a va loan.

This is a big benefit to borrowers looking to take advantage of the 0 down benefit of the va loan. If you have further questions about the va loan process. In this article we will discuss and cover understanding the va funding fee on va home loans. The funding fee applies only to the loan amount not the purchase price of the home.

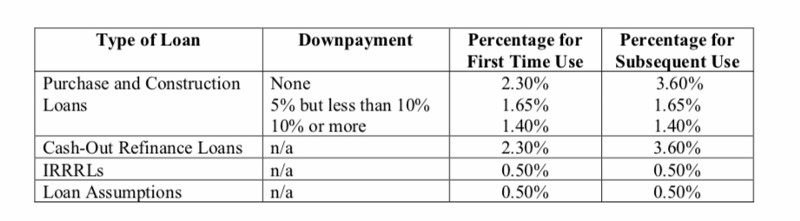

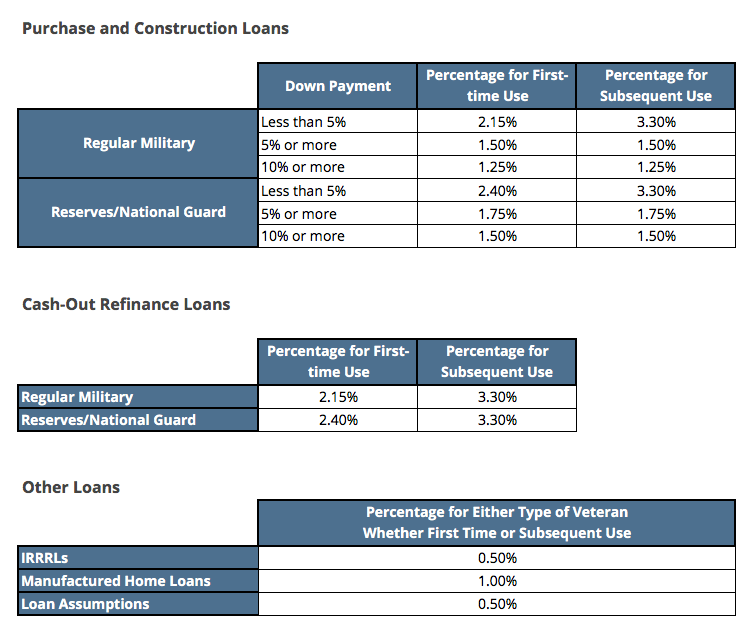

Making a down payment to shrink the funding fee is an option but it s typically one worth discussing with your va loan lender and real estate agent. Buyers who receive va disability compensation are exempt from paying this fee. For most first time va buyers this fee is 2 30 percent of the loan amount provided you re not making a down payment. We at low va rates strive to make the loan process as easy and as comprehensible as possible for our borrowers.

Thank you for taking the time to visit our page today. Veterans can roll the va funding fee into their va loans thus financing it rather than having to bring that money to closing. Native americans involved in the va native american direct loan program are only required to pay a funding fee of 1 25 percent. For any funding fee refund issued on or after july 1 2019 va is to pay the refund directly to the veteran regardless of the loan balance.

Gustan cho associates is a national mortgage company licensed in multiple states with no lender overlays on va loans. For buyers assuming a va loan mortgage the funding fee 0 5 percent.