Va Loan Program Requirements

Find out how to apply for a certificate of eligibility coe to show your lender that you qualify for a va backed loan based on your service history and duty status.

Va loan program requirements. At manhattan bank we want to make the house purchasing procedure smooth as well as worry complimentary whether you are buying your initial residence need to transfer to a bigger residence or refinance your existing home loan. The home must be for your own personal occupancy. Learn about va home loan eligibility requirements. Interest rate reduction refinance loan irrrl.

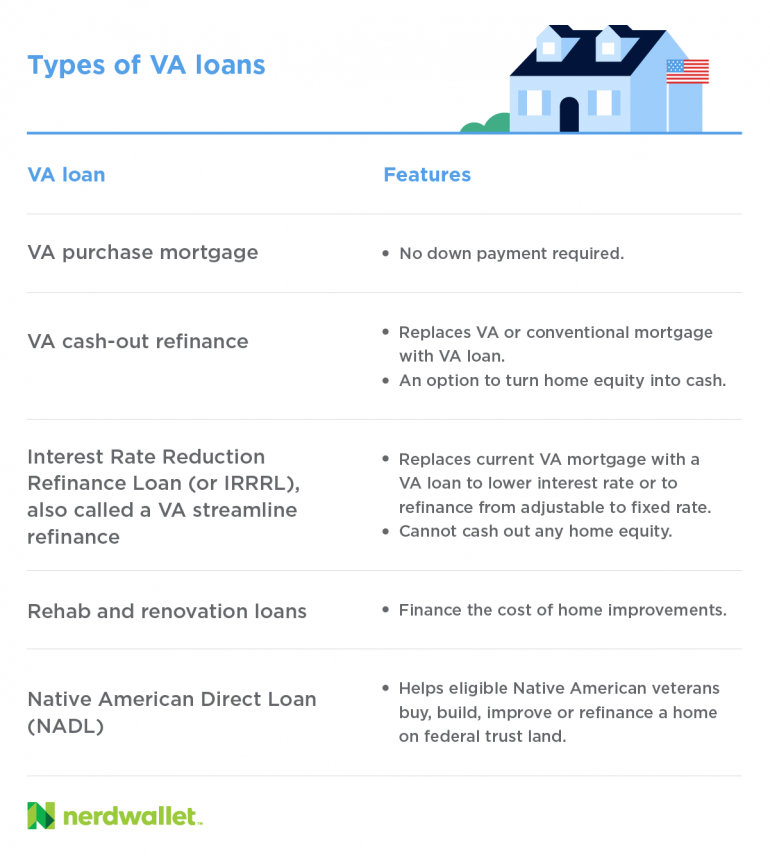

This may be a good way to avoid using a cash out refinance or getting a second mortgage. The program is for american veterans military members currently serving in the u s. California va loans are allowed for purchase of an owner occupied home california veterans may receive 100 financing 0 down payment for the refinance of a current va loan even if it has been converted to a rental or second home and sometimes allowed for conversion from another loan type lender restrictions apply. A va loan is a mortgage loan in the united states guaranteed by the united states department of veterans affairs va.

In contrast loan providers who choose to make nonconforming loans are exercising a greater threat tolerance and do so knowing that they deal with more obstacle in marketing the loan. Helps eligible native american veterans finance the purchase construction or improvement of homes on federal trust land or reduce the interest rate on a va loan. One of the most common home loan in canada is the five year fixed rate shut home loan as opposed to the u s. Also called the streamline refinance loan can help you obtain a lower interest rate by refinancing your existing va loan.

Va loan refinance rates. In case of direct payback the routine settlement will slowly reduce. This includes current va loan homeowners. This guaranty which protects the lender against total loss should the buyer default provides incentive for private lenders.

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries. Military reservists and select surviving spouses provided they do not remarry and can be used to purchase single family homes condominiums multi unit properties manufactured homes and. A va renovation loan can also be used for refinancing to fund upgrades to your home. Although the va loan is a federal program the government generally does not make direct loans to veterans.

You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan. To use this loan program as a refinance homeowners must still follow the same improvement restrictions as new homebuyers. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs.