What Banks Offer Va Loans

Va home loans have been around since 1944 and are.

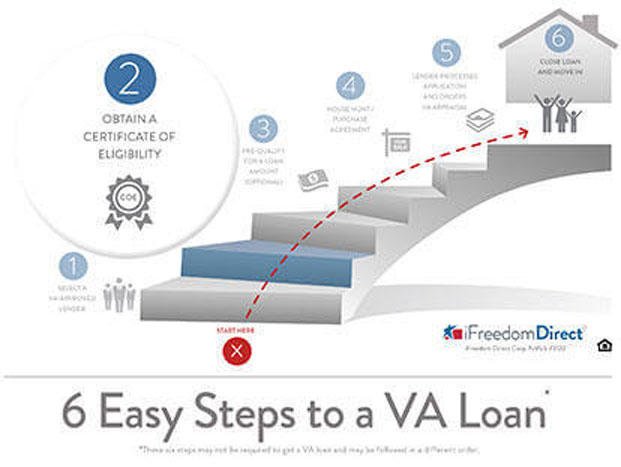

What banks offer va loans. The company has more than 20 branch locations located around the. But lenders can have their own requirements which typically range from 580 to 620. Va loans can offer savings and a fast track to homeownership for borrowers with military service. The department of veterans affairs which guarantees va loans doesn t set a minimum credit score.

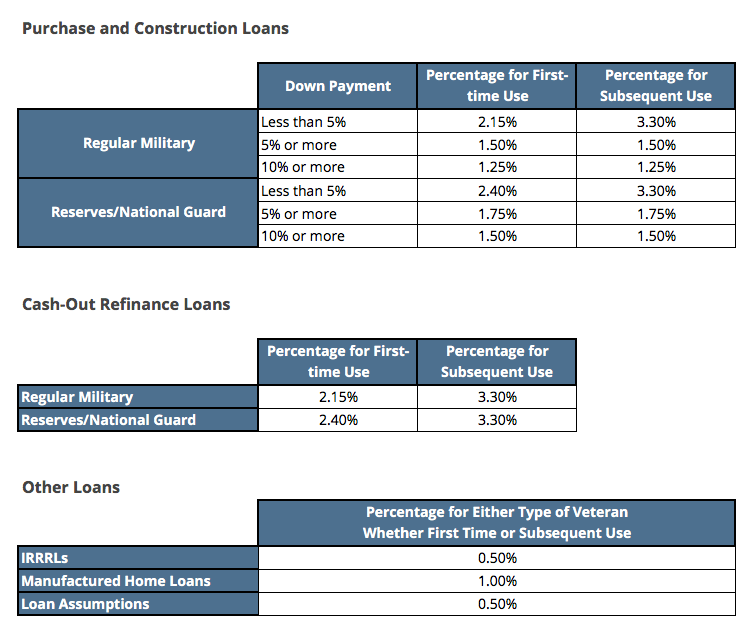

Understanding the va construction loan process by steven roberts updated on 7 20 2017. Department of veterans affairs va footnote 2 offer government mortgage loans that have features such as low down payment options and flexible credit and income guidelines that may make them easier for first time homebuyers to obtain. They offer fixed rate va loans with terms of 30 20 and 15 years as well as adjustable rate mortgages. As an approved lender for the va home loan guarantee program u s.

The company offers va loans for both purchases and refinancing. Bank offers 15 and 30 year options. Department of veteran affairs va allows eligible military borrowers to acquire a va mortgage loan to fund the purchase of both existing and new home constructions. This guide covers the fundamentals of va loans and offers recommendations for the top va lenders so you can find the best va loan.

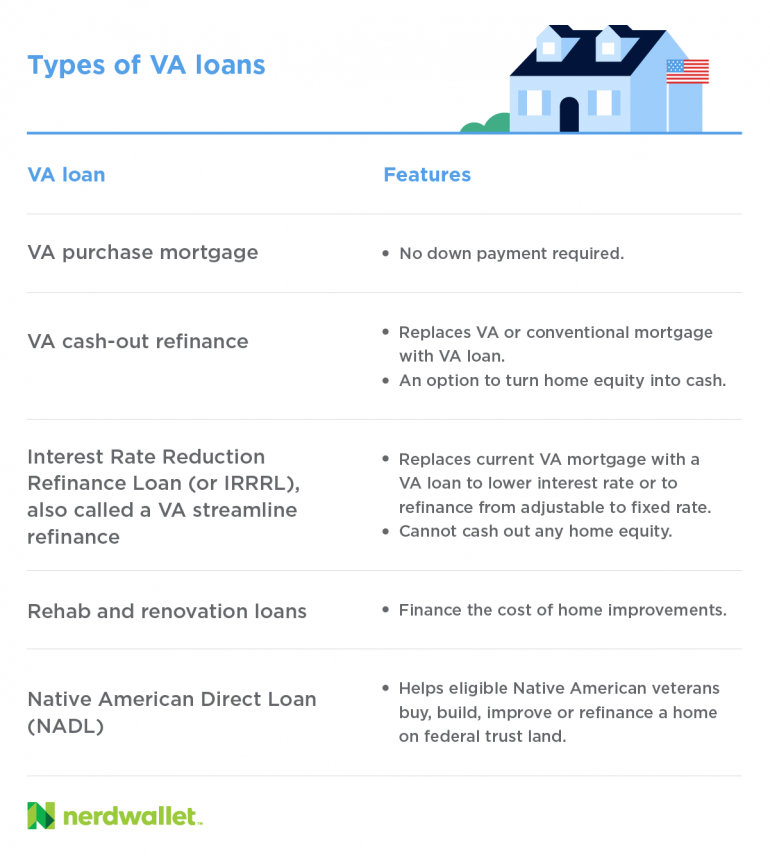

Consider the following factors for va construction loans and the process of constructing a home with va funding. This helps military service members and their families buy a home with no down payment and easier qualification requirements. The federal housing administration fha footnote 1 and the u s. On the refinancing side they offer the interest rate reduction refinance loan as well as cash out refinances.

The loans can be forgiven if a business maintains its payroll for eight weeks at employees regular salary levels and uses the loan proceeds for qualifying purposes. Bank can offer service members veterans and eligible surviving spouses favorable terms on all types of home mortgage products. Atlantic union bank located in virginia and beyond offers a wide range of financial solutions including checking accounts savings accounts business loans and more. The federal housing administration fha and the u s.

Fha refinance loans and va refinance loans allow homeowners the option to reduce payments or loan terms and they have more flexible qualification requirements than conventional loans. Bank online or visit one of our conveniently located branches or atms today. Va loans are a type of mortgage loan backed by the united states department of veterans affairs or the va.

:max_bytes(150000):strip_icc()/VeteransFirstMortgage-5be2020dc9e77c0051ead316.jpg)