What Do Lenders See On Your Credit Report

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

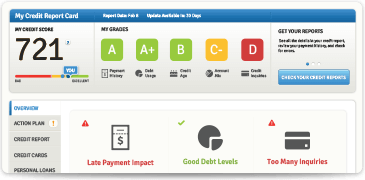

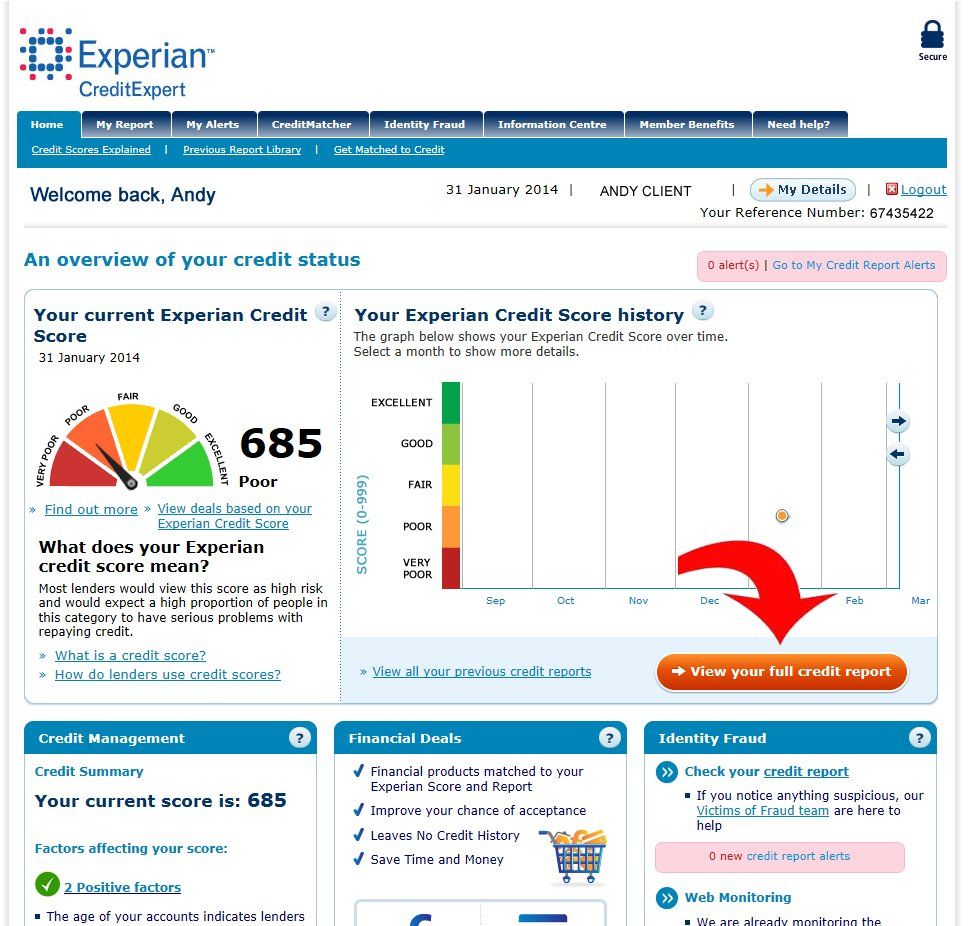

Keep in mind that the credit score you see could be different from the score a lender uses based on the factors we discussed above but it still can be used as a gauge to see where you stand when it comes to your credit history.

What do lenders see on your credit report. What can lenders and other companies see on my credit report. What can lenders see. It depends what kind of company is accessing your report and why. If one or more of your accounts is late or in default it can signal to a lender that you may be experiencing financial hardship and won t be able to make timely payments on a new line of credit.

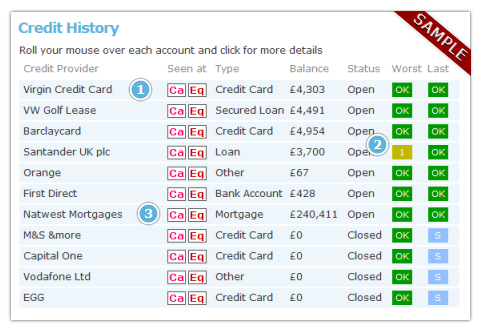

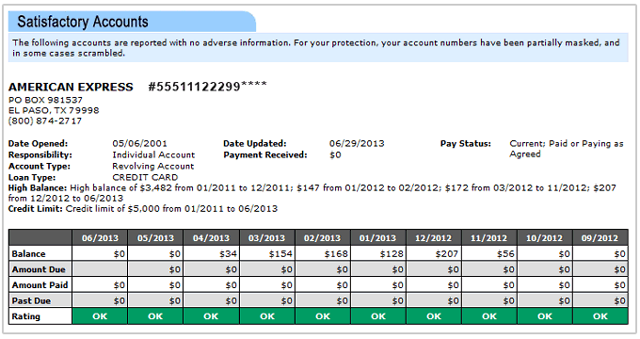

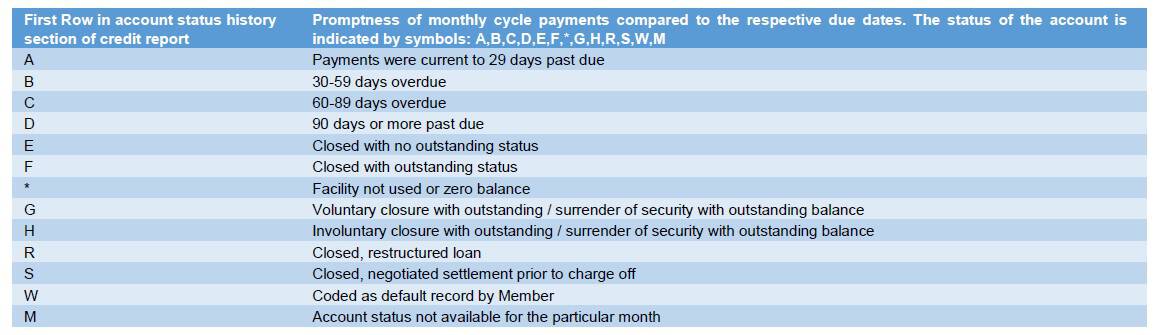

Your credit report lists the status of each of your open accounts. For example if a company does a soft search of your report they ll see less information than if they did a hard search. Your credit report gives lenders an insight into your repayment habits. How much credit you re using using a credit card regularly and paying it off on time is looked upon favourably by lenders because it shows that you know how to manage your money well.

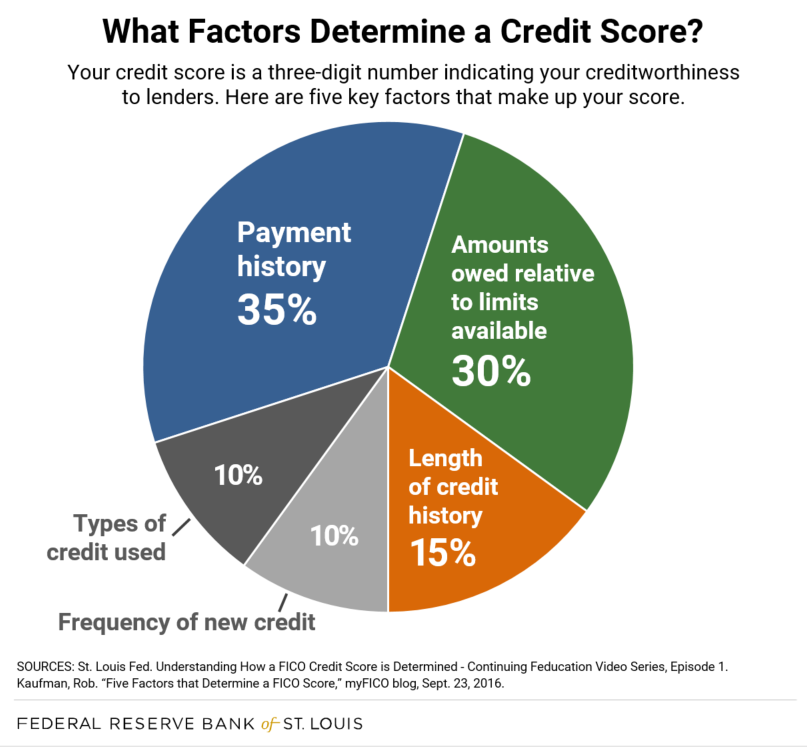

Lenders want to see that their clients have experience using multiple sources of credit from credit cards to car. The reason i would like to know is if i am trying to explain a blemish on my report i would like to know what the prospective lender is seeing s. Lenders use this to check if you can manage your finances and if your current debts are too big to allow further borrowing. Is it a summary or a full length credit report like we get when we pull our own report.

What do lenders see when they pull a consumers credit report. Note that companies don t always need your consent to do a search on you but they must. Here s what lenders like and don t like to see on your credit report and some tips on putting your best foot forward. This includes credit cards store cards overdrafts mortgages and personal loans.

Learning how lenders see your credit in advance can help you take steps to improve your credit score or clean up mistakes on your credit report.

:max_bytes(150000):strip_icc()/CreditReport_SpiffyJ_E--56a1deaa5f9b58b7d0c4000c.jpg)

:max_bytes(150000):strip_icc()/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png)