What Do You Need To Set Up A Checking Account

After you have set up the account keep the checking account documentation with the original trust agreement.

What do you need to set up a checking account. By opening an account with a bank you can avoid these costs and even set up direct deposit through your employer to avoid the physical process all together saving you both time and money. There are several ways to fund your account. Here are some helpful tools and links to get your account up and running. 360 checking unlocks a world of banking built around you.

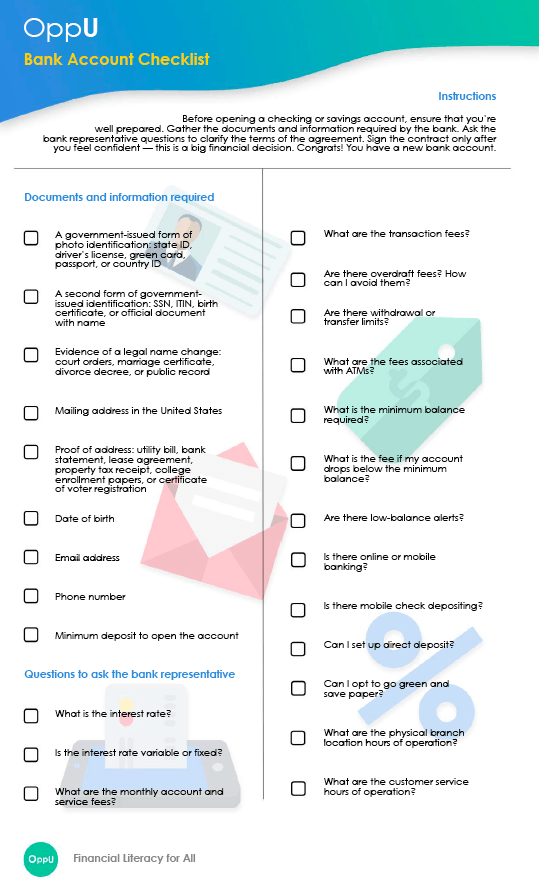

Sometimes this is required as part of the opening process and other times you can do it after the account is up and running. If you need to deposit checks frequently or even 1 2 per month these fees can quickly add up. Convenient and free bill pay. Bank branch to open a checking account.

The grantor or trustee should also add the account information including the bank name and account number to the trust s asset list. You can also call a u s. In fact opening a separate account for your business should be one of the first things you do even before. Fund your account.

Online banking allows you to monitor your account balances set up billpay and make automatic payments toward your monthly bills any time no matter where you are. You do not need to be making any money yet in order to open a business checking account. If you re opening a checking or savings account you ll often need to make an initial deposit into the account. You don t have to think about the extra.

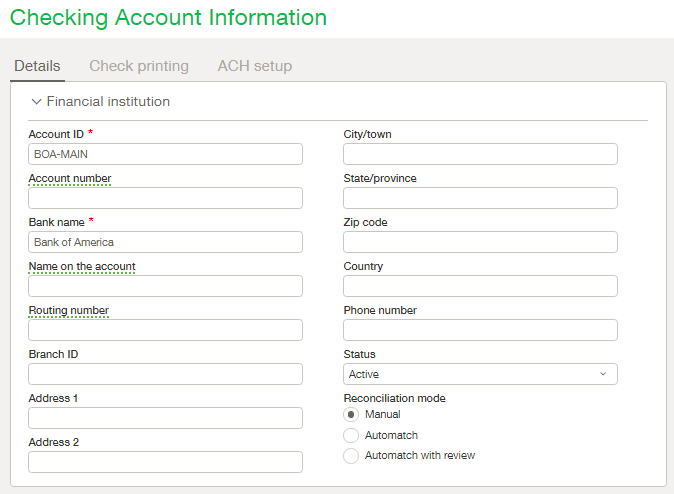

You can apply for a tax identification number with the irs online. You can visit any u s. Bank representative at 800 398 0371 to ensure you have everything you need to open a checking account or other bank account. Once your representative has set up the account they can transfer money from your other bank accounts and deposit incoming funds like stock dividends remaining paychecks or other income.

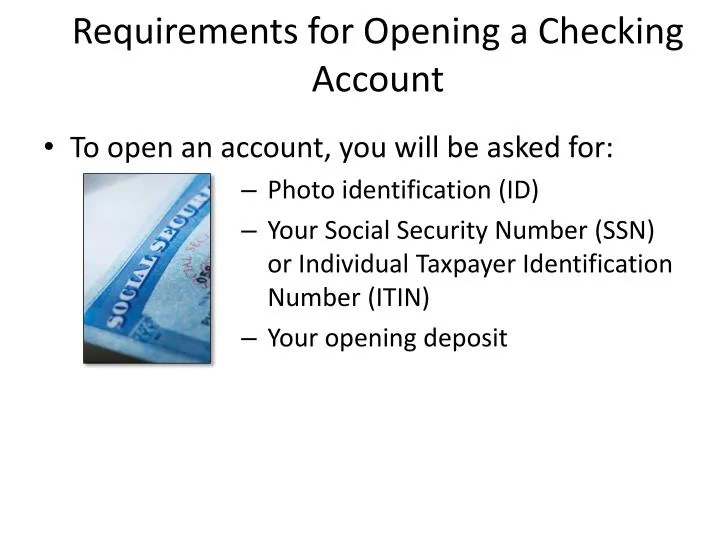

You ll still need identification and personal details such as your social security number and a valid government issued id. Once you find a credit union for which you re eligible you can open an account. And when you have a savings or money market account balance transfers to your checking account let you put money into your account quickly and securely 1. Then you can send the remaining 200 to your savings account.

You can often do it all online or you can visit a branch in person.

/how-can-i-easily-open-bank-accounts-315723-FINAL-051b5ab589064905b1de8181e2175172.png)

:max_bytes(150000):strip_icc()/bank-accounts-for-people-under-18-315365-v6-5b576cfb4cedfd00374a0eb8.png)

/check-your-bank-balance-online-315469-FInal-65f751f553e34e7cb1852e957d917745.png)