What Documents Are Needed For A Mortgage Pre Approval

Paperwork is the lifeblood of the mortgage industry.

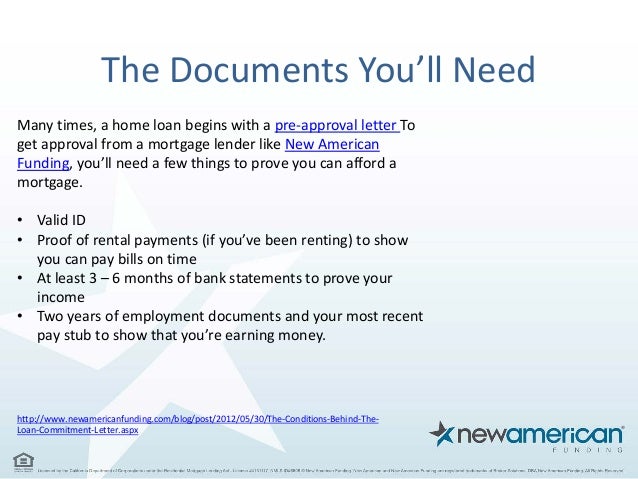

What documents are needed for a mortgage pre approval. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. Requirements for pre approval. This mortgage documents required checklist will help you ensure that you have all the documentation required for the mortgage approval process with cibc. Documents needed for a mortgage pre approval.

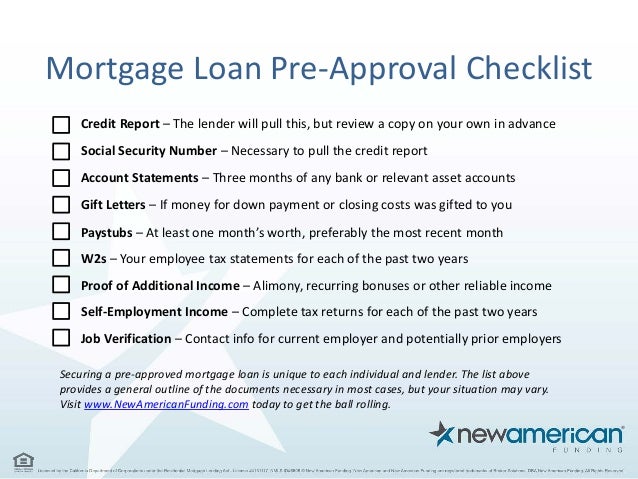

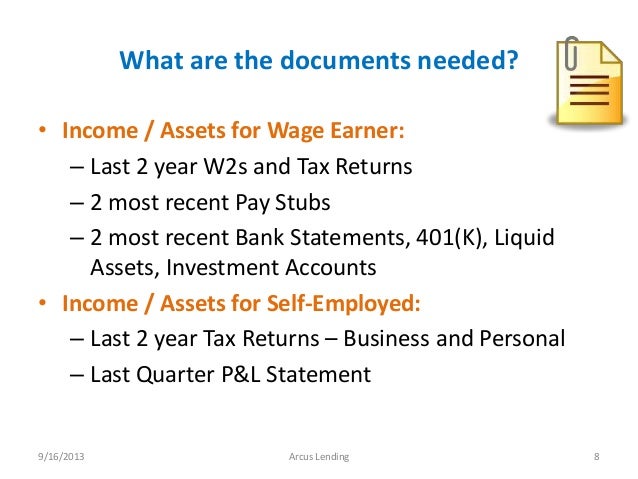

A checklist for each type of loan whether you re self employed or applying for an fha or usda loan here s the pre approval paperwork you need. To determine how much you can afford and get the home buying process started you ll need to provide them with the below information and documents needed for mortgage pre approval canada. Documents needed for mortgage pre approval and underwriting. If the answer comes back yes your lender can issue a pre approval letter.

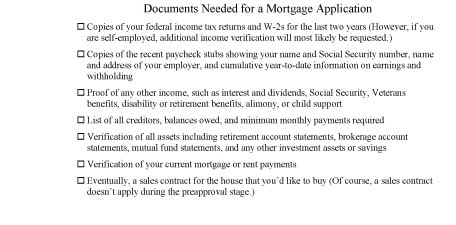

When getting pre approved there are some documents that you might be asked for. Documents needed for a mortgage preapproval letter income and employment documents such as tax returns w 2s and 1099s. Know the maximum amount of a mortgage you could qualify for. Estimate your mortgage payments.

Documents you need for mortgage pre approval. A mortgage lender might want to see a list of employers for the past two years maybe longer in addition to the name of your employer a lender will want to see a mailing address and phone number. Required mortgage documents checklist purchasing a home is an exciting process but gathering all the required mortgage documents can be a daunting task particularly for first time home buyers. To get pre approved for a mortgage you ll need to meet with a mortgage broker or a lender.

With a pre approval you can. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation. Documents needed for a mortgage pre approval. After assembling and reviewing the application credit report and documents needed for mortgage pre approval the mortgage underwriter will render either a yes or no decision.

Asset statements on bank retirement and brokerage accounts.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)