What Does General Liability Business Insurance Cover

General liability covers a lot of common issues that you might run into particularly if you work on client properties or interact with customers on a day to day basis.

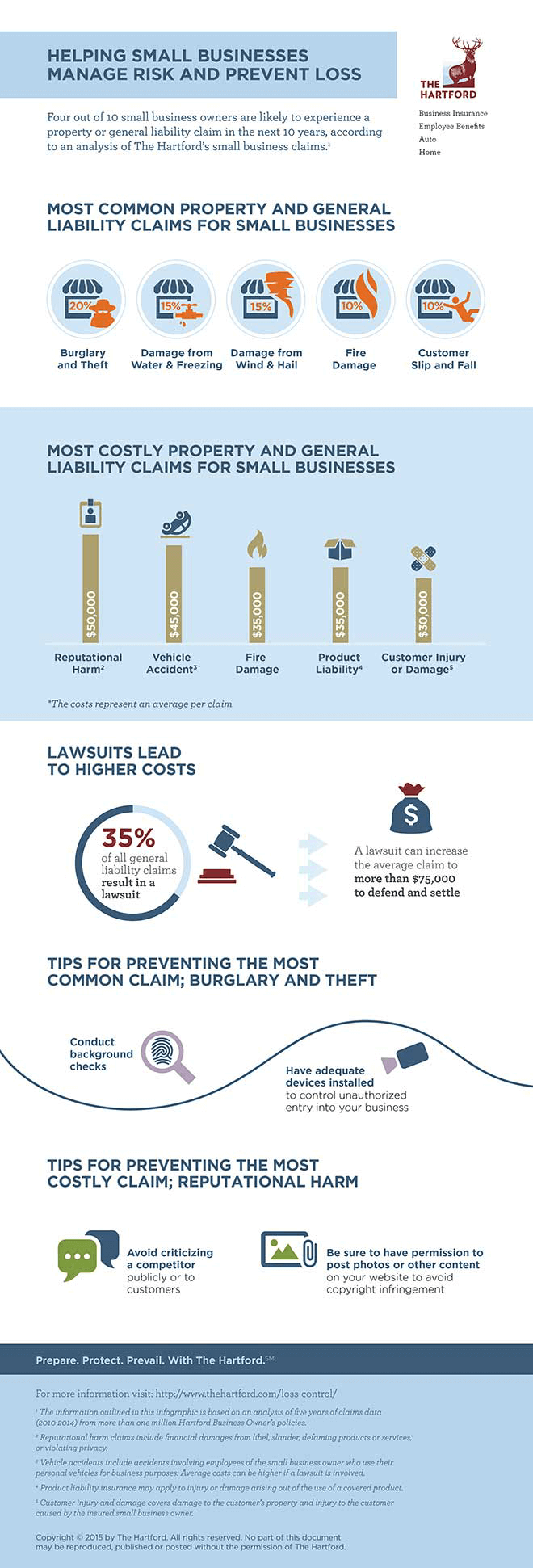

What does general liability business insurance cover. Business liability insurance protects the financial interests of companies and business owners. Find out how general liability insurance can help protect your small business from a broad range of accidents. What does general liability insurance cover. Regardless of if a small business is at fault it can be accused of negligence and sued for many different things making general liability a very important insurance coverage for operating a small business.

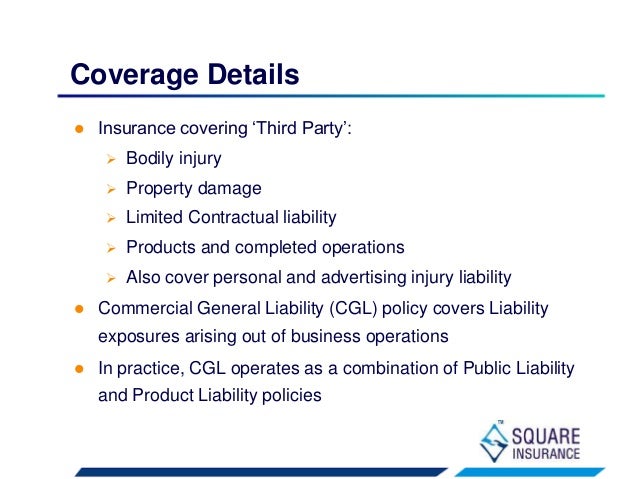

If your business unintentionally causes bodily injury property damage personal injury or advertising injury to a third party cgl will pay for the legal fees settlements judgements and even. In the uk this cover is more widely known as business liability insurance or separately as public liability insurance and product liability insurance. General liability will apply to a nonprofit or individual similarly to cover lawsuits accusing them of negligence. Depending on policy limits general liability coverage can pay for some or all expenses associated with replacing the damaged fence.

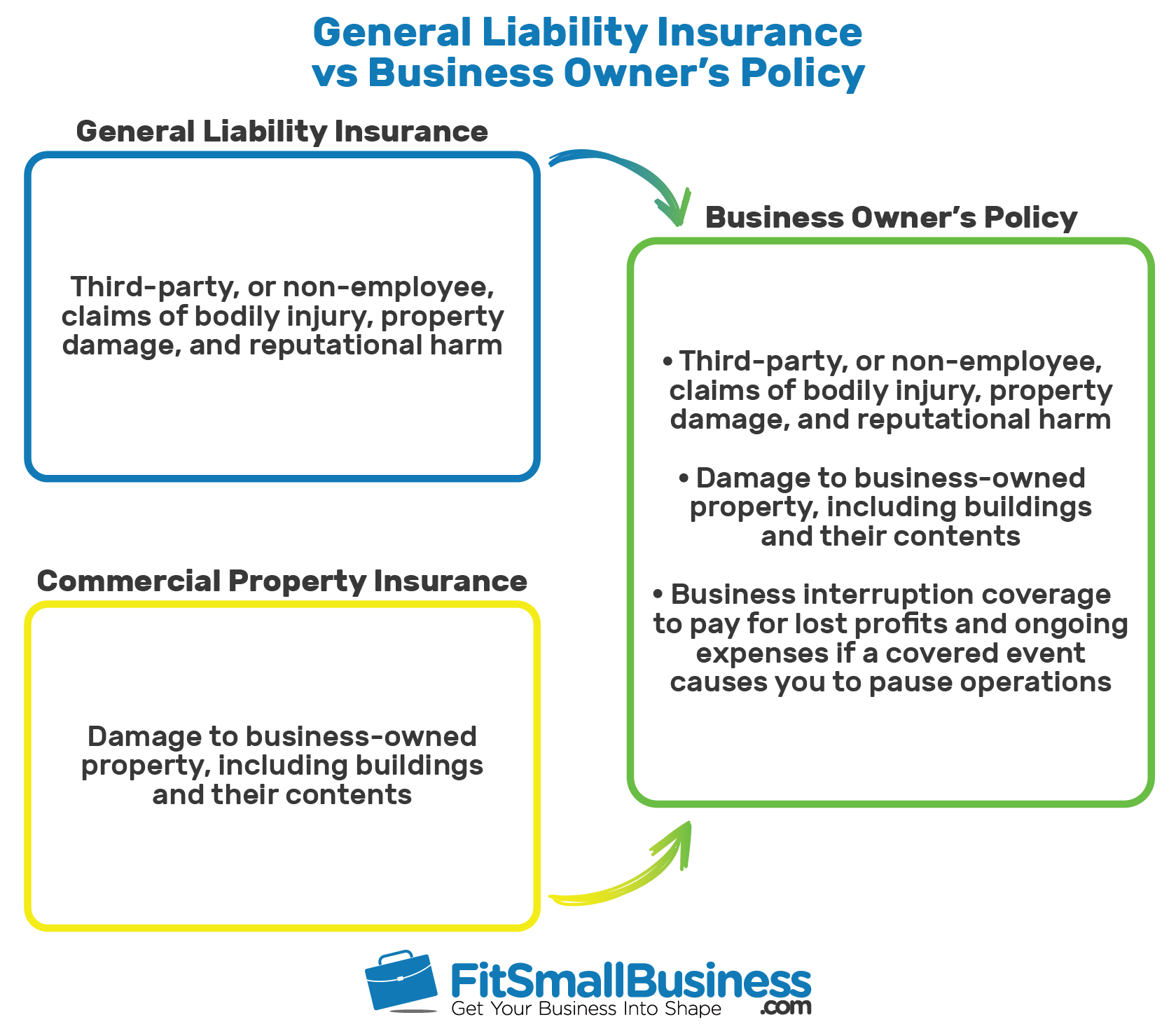

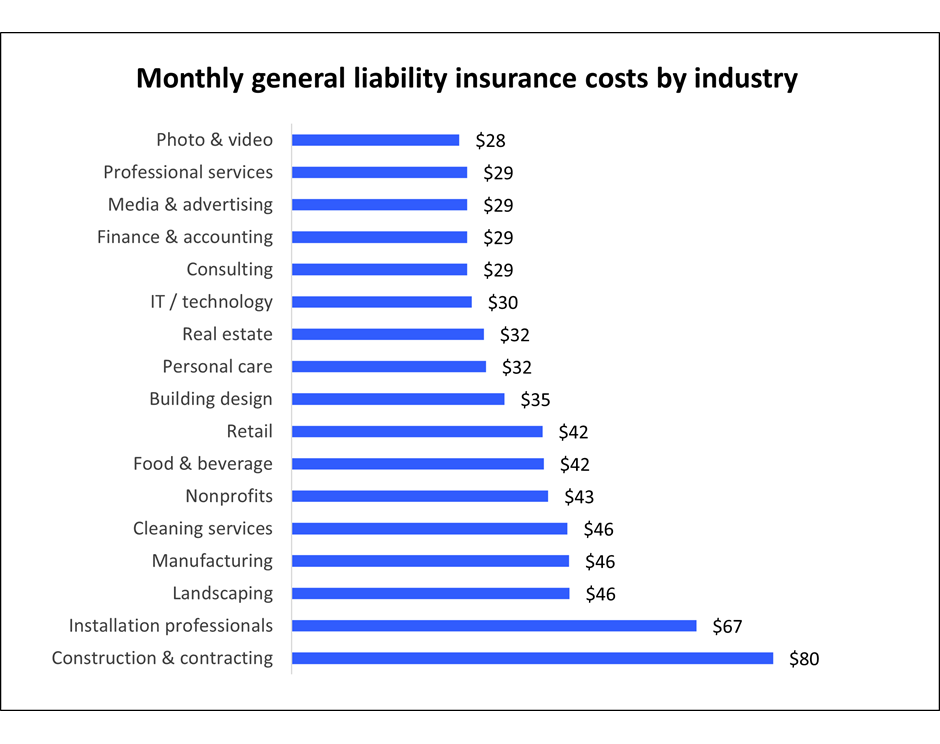

Get a quote today. Commercial general liability is a form of business insurance that covers claims of injury illness and property damage against your business. General liability insurance gli also known as commercial general liability cgl insurance can help protect your business if someone sues you for causing property damage or bodily injury you can get this insurance as a standalone policy or bundle it with other coverages in a business owner s policy bop. It is primarily a term used for policies in the united states.

What does general liability insurance cover. Also known as business liability insurance general liability insurance protects you and your business from general claims involving bodily injuries and property damage almost every business has a need for general liability insurance. General liability insurance can cover expenses to repair or replace customer property accidentally damaged by a business. Commercial general liability cgl is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business s operations or products or on its premises.

General liability insurance also known as commercial general liability cgl insurance protects your business financially from lawsuits and damages that arise in the course of doing business. Types of business liability insurance include general liability insurance professional liability. A general contractor backs his pickup truck into a client s fence.