What Is A Brokerage Account

/what-is-a-brokerage-account-356076_FINAL-5e0c3872c0684007b1d5595593c0c9d0.png)

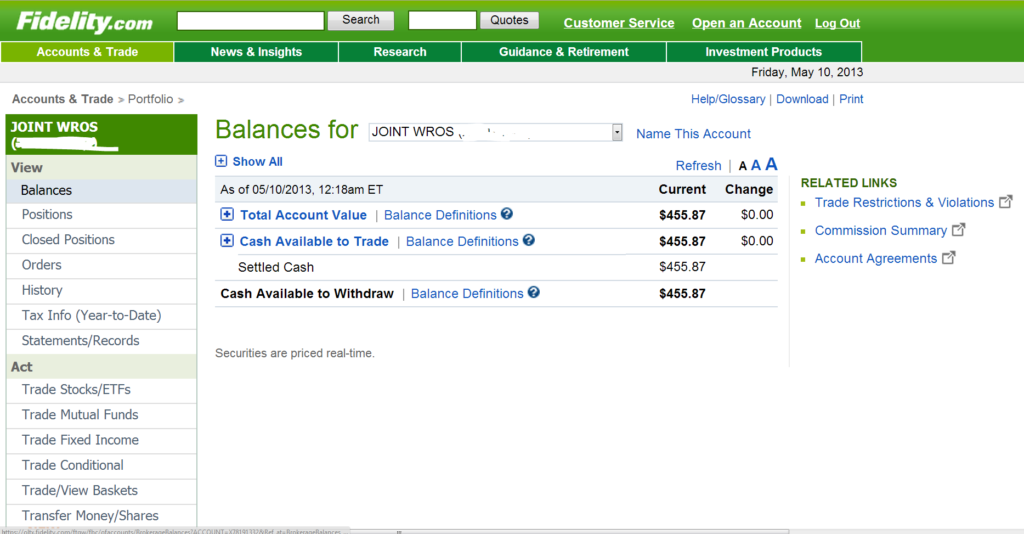

A brokerage account allows an individual investor who has deposited money with a licensed brokerage firm to make orders to buy and sell assets with the firm serving as their representative for.

What is a brokerage account. A brokerage account is an account that is used by investors to buy sell and hold investment securities such as stocks and bonds. A brokerage account is a type of taxable investment account that you open with a brokerage firm. A broker also known as a brokerage is a company that connects buyers and sellers of investment vehicles like stocks and bonds. A brokerage account is often where an investor keeps assets.

You deposit money into this account by writing a check wiring money or transferring money from your checking or savings account. Brokerage account to invest you need to open a brokerage account also known as trading account or simply a broker with a brokerage firm. Brokerage accounts can be opened through a conventional full service brokerage firm or through an online discount broker. In singapore the online stock brokerage account space is already a highly competitive space.

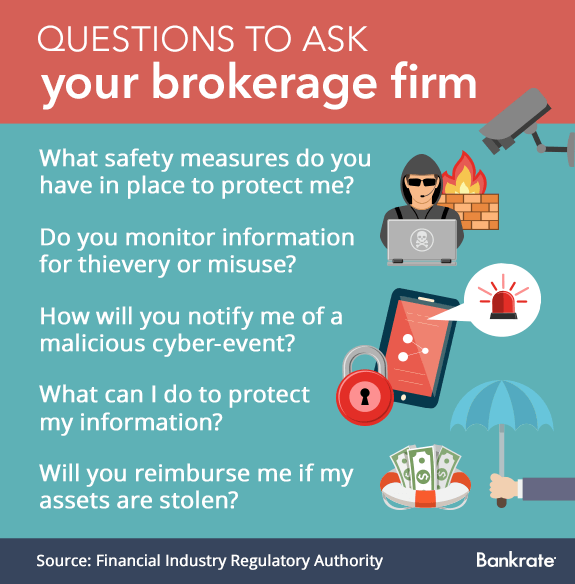

Brokerage firms act as intermediaries between investors and the stock exchange. A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. The brokerage is the intermediary between you and markets buying and. A brokerage account is a great option if you want to start investing in the stock market and it comes with many advantages.

Most brokerage houses charge commission fees that range in a narrow band of 0 08 to 0 28 of your contract value. A brokerage account is a platform that allows investors to buy and sell investment products such as stocks reits and etfs that are listed on a stock exchange. A brokerage account is a taxable investment account used to buy stocks bonds mutual funds and other investments. Get an overview of what a brokerage account entails and how it compares to other account types.