What Is A Good Auto Insurance Score

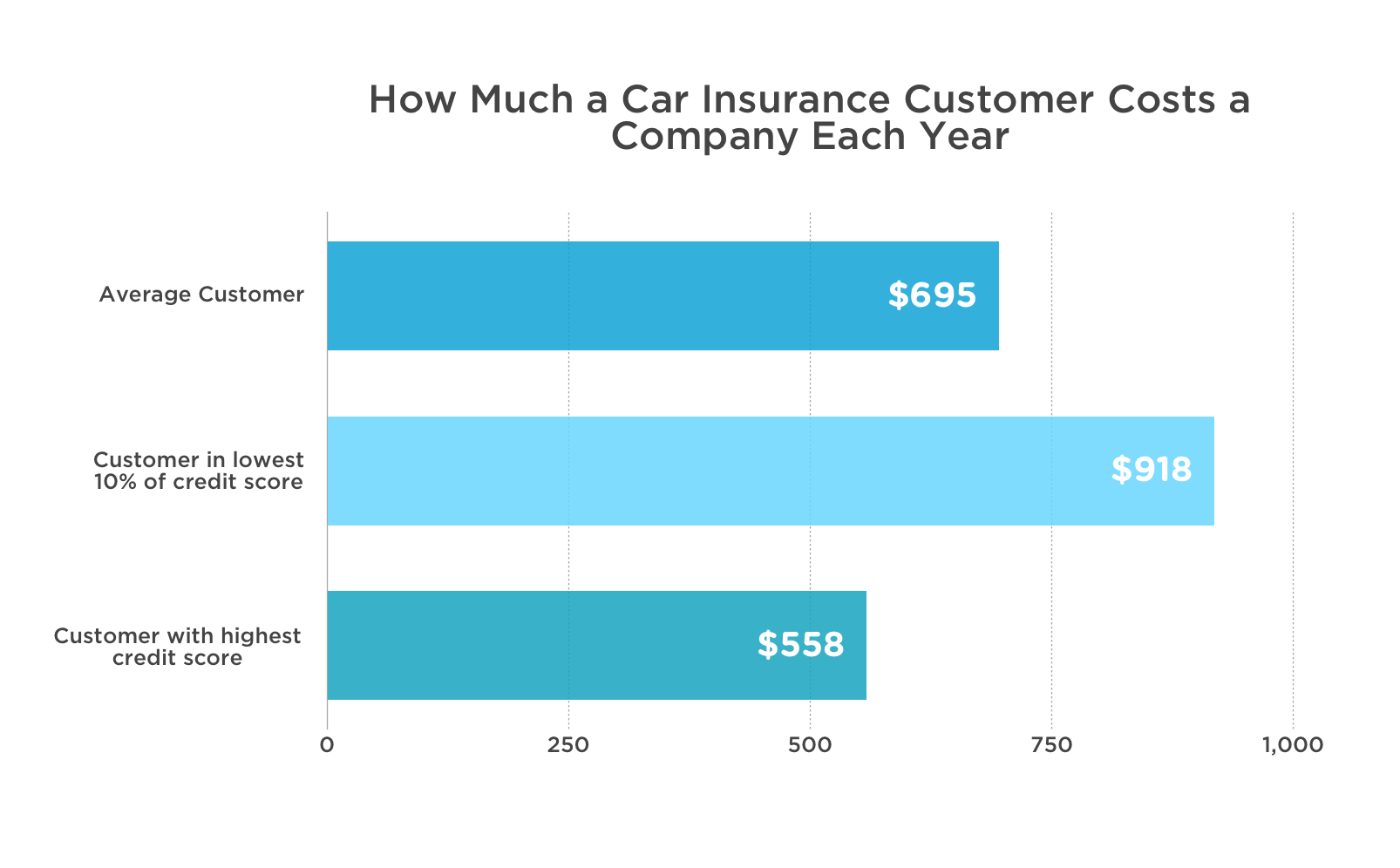

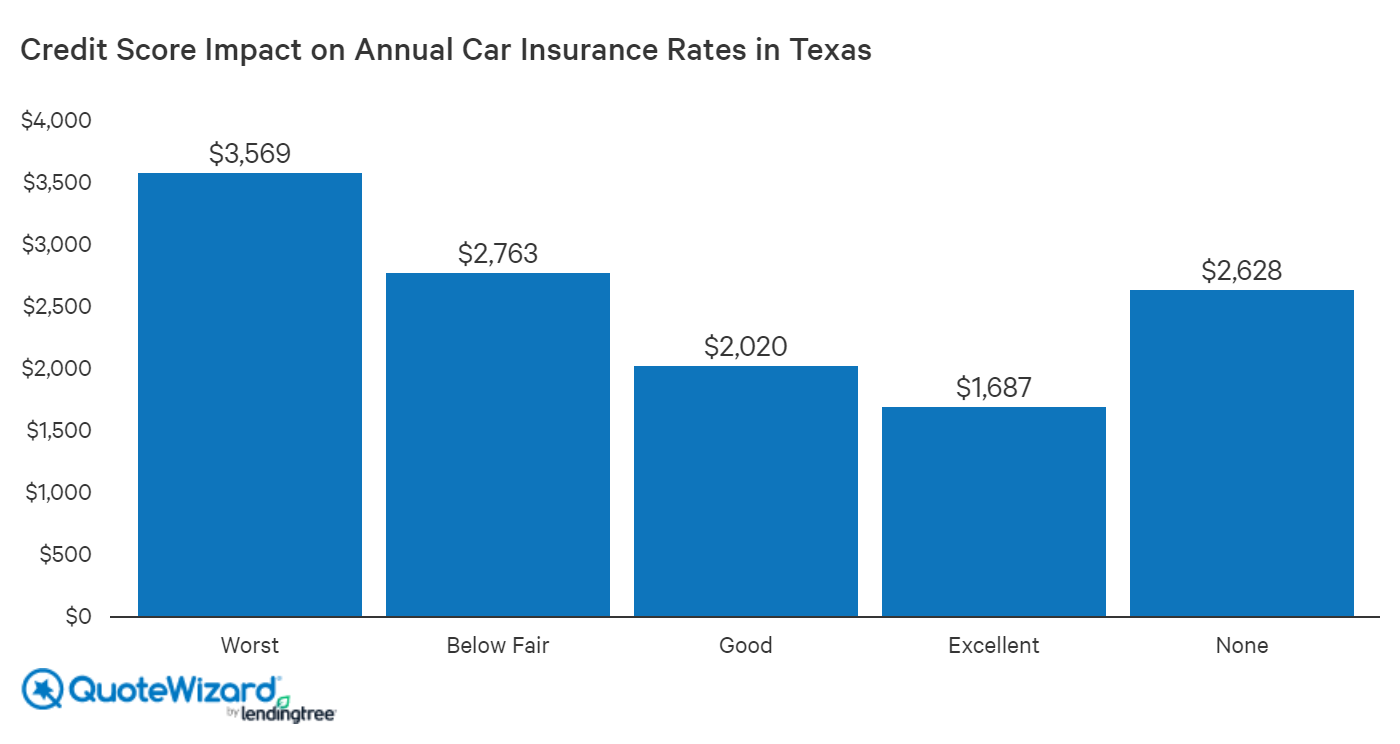

Even more than your driving record studies have shown that drivers with the worst insurance scores are twice as likely to have an insurance claim as those with the best scores.

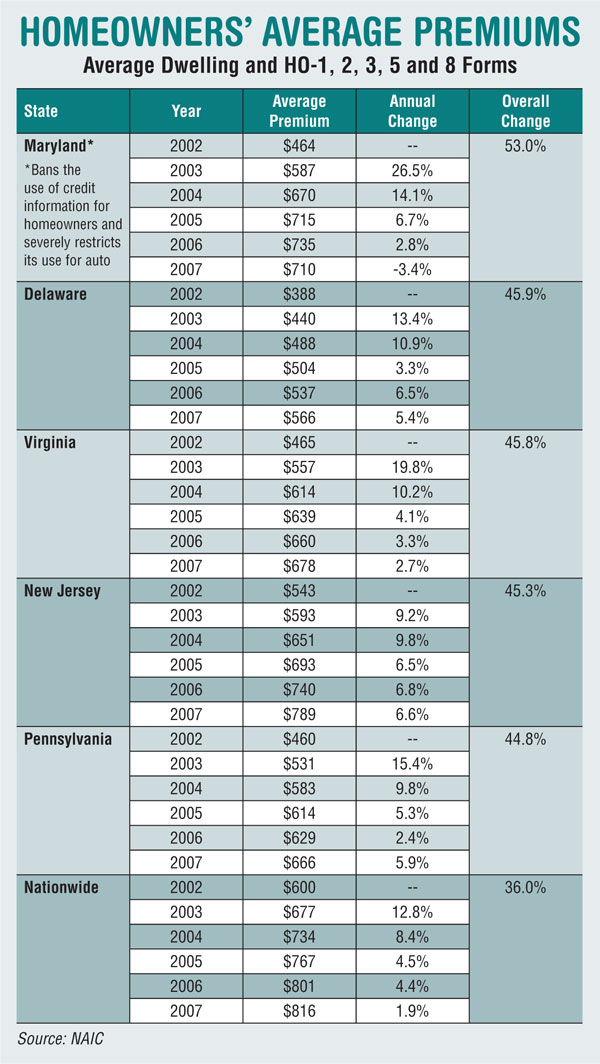

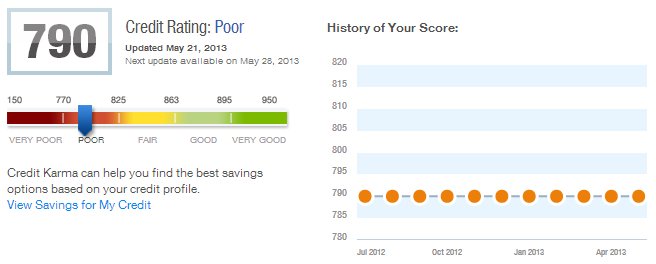

What is a good auto insurance score. A good score is usually around 770 or higher. It is good to know that nothing is uniform. An insurance score is a key component in determining the total premium that an individual pays for health homeowners auto and life insurance policies. Understanding insurance scores.

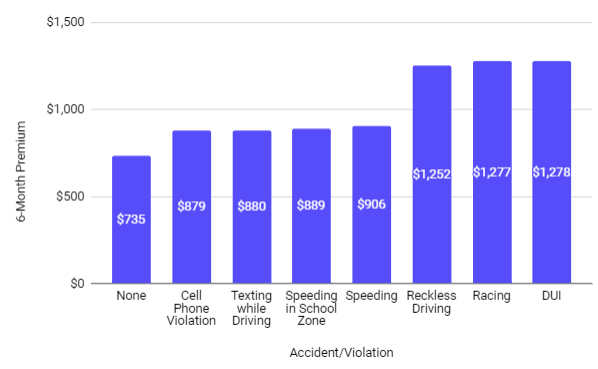

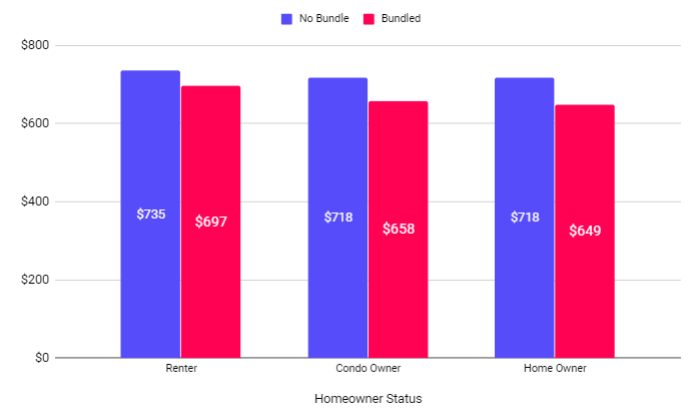

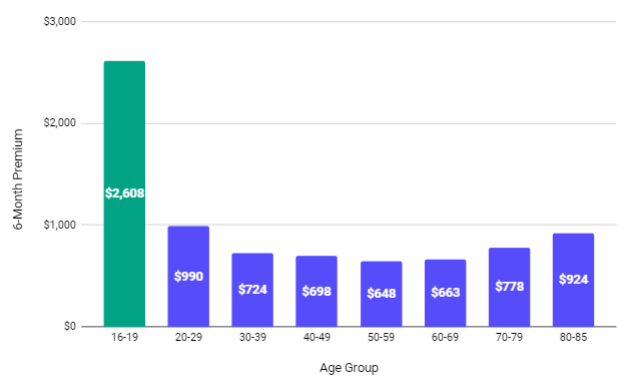

The final word on your auto insurance score. Just like your regular credit score your insurance score is a three digit number that falls somewhere across a large spectrum. However the information that would comprise an insurance score driving history vehicle type location credit score and other factors is used by insurance companies to determine rates. So the best thing to do is to shop around.

Why does my auto insurance score matter. It s mostly calculated from your claims history and your credit score so it s also referred to as a credit insurance score. Typical auto insurance scores range from 200 to 997. An auto insurance score is really just another term for insurance score that is used in the specific context of automobile insurance.

An insurance score is a score calculated from information on your credit report. The major things that affect your car insurance score are your credit score and your claims history. Your insurance score is a rating used by car insurance companies to figure out the probability that you will file a claim under your car insurance policy. What you should know what is an insurance score.

Like other insurance scoring auto insurance scoring takes into account all of the information that is found in your credit score plus your past auto insurance history. An auto insurance score or a credit based insurance score is similar to a credit score the main difference is that your auto insurance score predicts your likelihood of filing a claim as opposed to your odds of defaulting on a loan or line of credit. Every insurance company will have different guidelines for what is considered a good auto insurance score. A car insurance score is an arbitrary number not utilized by the insurance industryor individual insurance companies.

But what counts as a good score. A good insurance score means lower car insurance rates and a poor one means you ll pay more. An auto insurance score or home insurance score is a three digit number used to predict your odds of filing a claim.