What Is A Roth Ira Savings Account

Coverdell education savings account cesa.

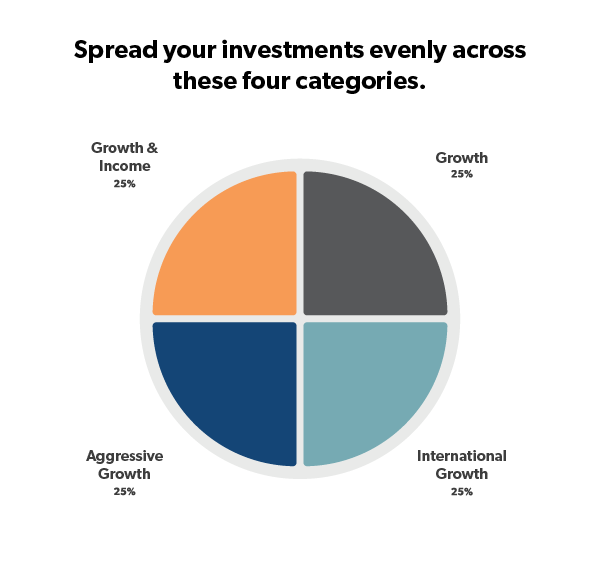

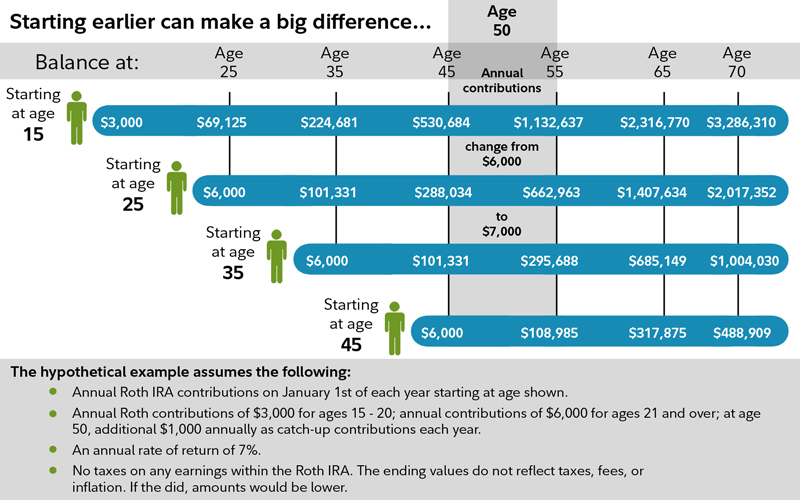

What is a roth ira savings account. Once you have built up your retirement savings with this account you may want to roll the ira funds into a higher yield savings account such as an ira certificate of deposit cd which would have better interest rates. Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. Savings accounts are interest bearing accounts used to hold money whereas a roth ira is a retirement account for after tax earnings. An individual retirement account ira is a tax advantaged way for just about anyone with earned income to save for retirement.

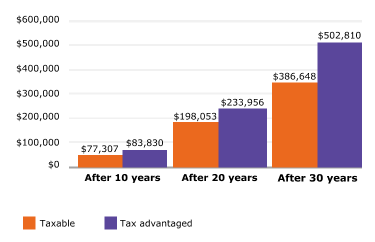

The ultimate savings account. Contributions are nondeductible but all withdrawals including earnings are tax free if the account has been open for five years and the account holder is 59 or older. An ira is a tax advantaged way for just about anyone with earned income to save for retirement. Within those ira options banks and credit unions sometimes offer various features when it comes to the interest rate attached to the account such as variable fixed and step up rate features.

The worst case scenario is that you contribute today have a major unexpected expense tomorrow and you no longer have the money in your checking and savings accounts to pay for it. Here s how they work whether you qualify and other faqs. The roth ira is probably most similar to a standard savings account after 5 years as you are able to deposit and withdraw in a similar fashion usually 6 withdrawals a month. When you open a capital one 360 ira savings account you ll have the option of selecting between a traditional ira or a roth ira.

When you open a capital one 360 ira savings account you ll have the option of selecting between a traditional ira or a roth ira. For example the beneficiary must be 18 years or younger when the account is set up or be a special needs beneficiary and you can make a maximum contribution of 2 000 per year. A roth ira is a retirement savings account that allows you to withdraw your money tax free. Additionally unlike standard savings accounts ira savings accounts have the option of being set up as tax deferred accounts until you withdraw the funds in retirement.

A roth ira is a special savings plan authorized by the federal government to help you accumulate funds for your retirement.

/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)