What Is A Self Directed Brokerage Account

You can place market orders to buy or sell at the current market price orders which most modern brokerages typically are able to execute very soon after the order is placed.

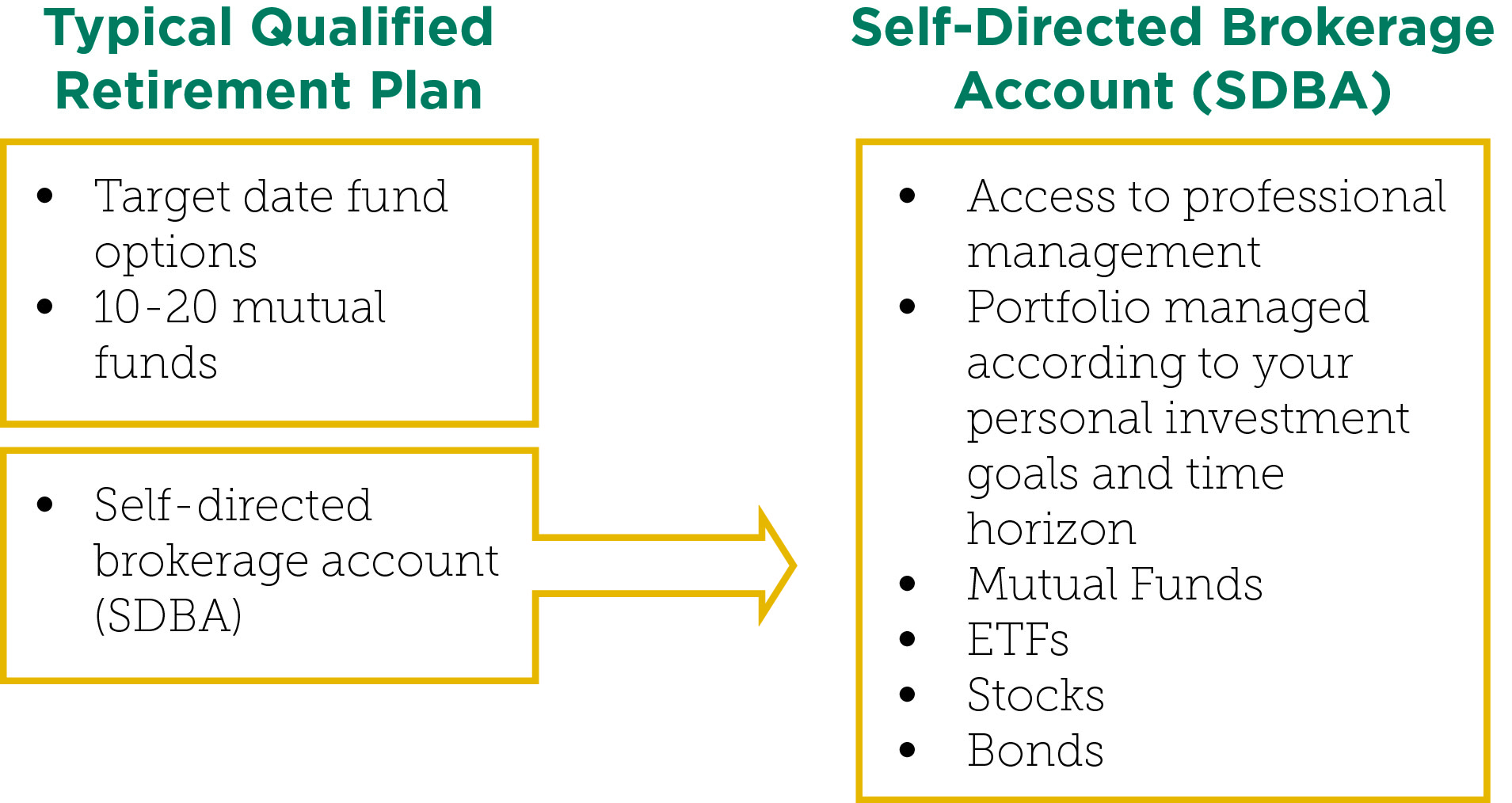

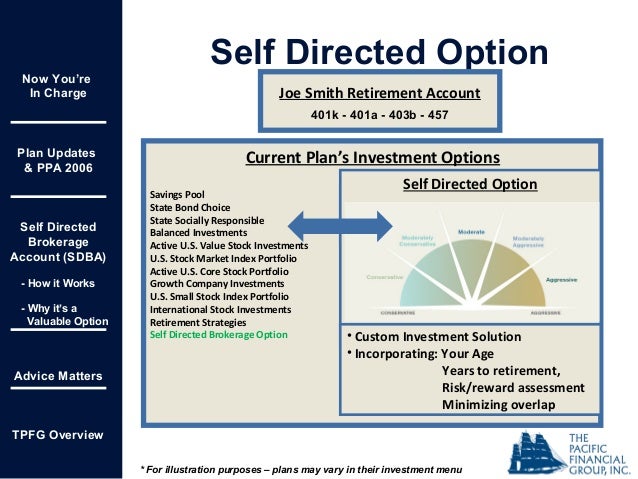

What is a self directed brokerage account. It gives participants more flexibility to select the individual investments in their plan. So rather than investing in a limited number of options offered within the plan a self directed brokerage account often includes many more investments like stocks bonds mutual funds and etfs. The term self directed brokerage account usually refers to a specific option in 401k and defined contribution pension plans. The self directed brokerage account or sdba allows you to invest outside of the normal 401k investment options available to you.

Participants can invest in individual stocks bonds etfs exchange traded funds and mutual funds that are not available outside the sdba. A self directed brokerage account gives you the benefit of exercising far more control over the timing and pricing of trades. Individual retirement accounts iras an ira is the most classic type of self directed brokerage account because it is completely separate of any employer and can be opened at any discount. A sdba is a sub account of the qualified retirement plan and money not investments can be moved between the sdba and the qualified plan fund choices.

A self directed brokerage account is an option that opens up access to a network of mutual funds. Published quarterly the schwab self directed brokerage account indicators report contains data associated with approximately 137 000 sdbas. A self directed brokerage account expands your retirement offering beyond a preselected investment lineup. When you place your retirement savings in an account like this your investments are allocated to investments apart from those available in the core plan.

Find out the benefits of human self directed and robo advisors. Some sdbas may let you invest in stocks bonds and exchange traded funds as well. Which type of brokerage to choose is a matter of the investor s needs and preferences. A 401 k self directed brokerage account allows participants to make investments outside of their regular plan window.

The trends and statistics presented in the report may help give you a better feel for whether a self directed brokerage account is where you want to place a portion of your retirement plan dollars.

/401K-cash-2441f4926cef43c29c12c2453016245c.jpg)