What Is A Stock Insurance Company

Standard lines excess lines captives direct sellers domestic alien mutual companies stock companies lloyds of london and more.

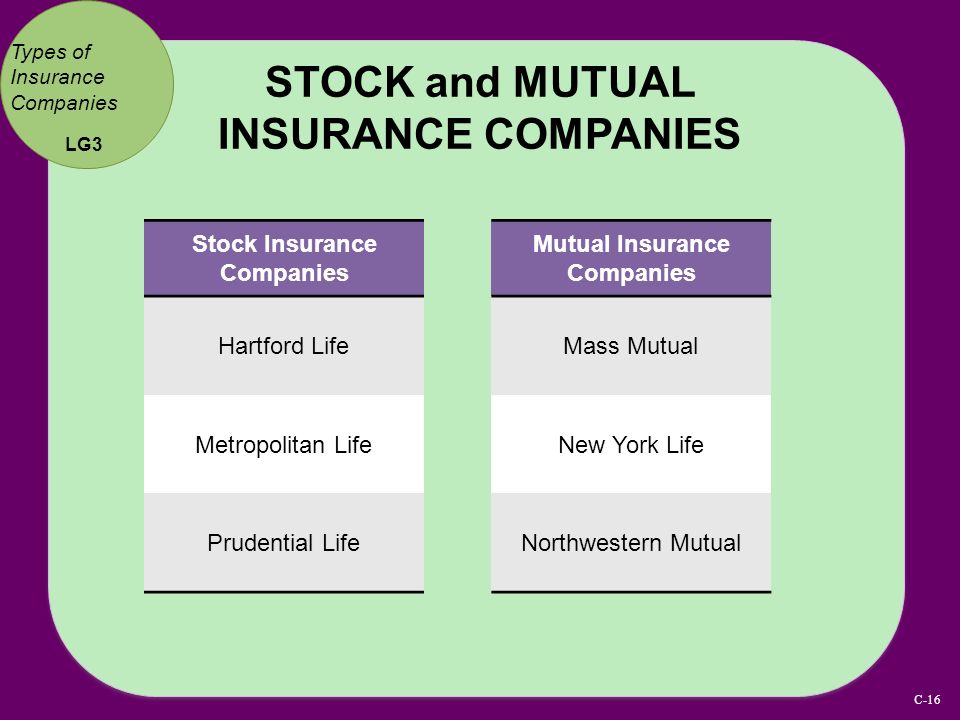

What is a stock insurance company. A stock insurance company is owned by its shareholders. A capital stock insurance company is a company that gets its capital from contributions from its stockholders in addition to its surplus accounts and reserve. This enables the stock insurance company to utilize the additional capital to enlarge the firm in a manner superior to a mutual insurance company. It may be privately held or publicly traded.

Here is a brief explanation of each of these different types of insurance companies and the specific specialty risks insured and other unique attributes. The company issues shares which can be purchased by the public to help raise capital for the company. Because stock insurance companies allow for direct investment via stock purchases in the company stock. Some of the different types of insurance companies include.

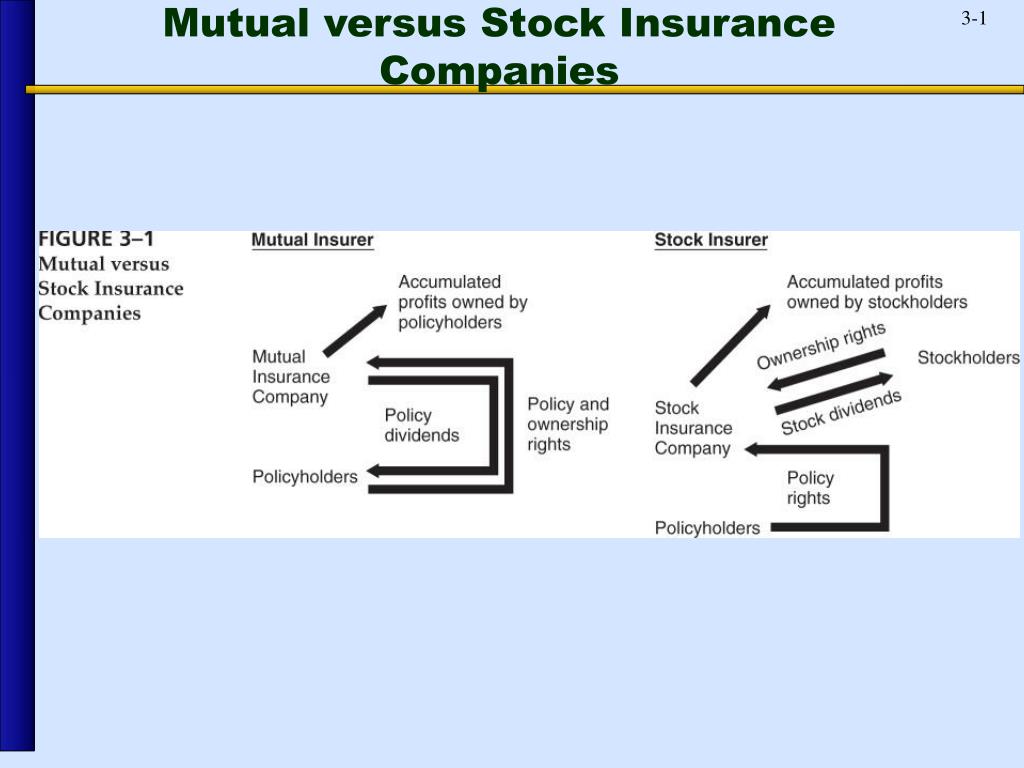

In a mutual company policyholders are co owners of the firm and enjoy dividend income based on. Insurance companies are most often organized as either a stock company or a mutual company. One of the most important things to understand before buying any stock is how the company makes its money. The biggest advantage with this type of company is the access to capital.

How insurance companies make money. However they may also sustain losses if the stock value goes down. A stock insurance company is an insurance company that has stockholders as owners instead of policyholders. A stock insurer distributes profits to shareholders in the form of dividends.

A stock insurer is an insurance company that operates on the money from the shares held by its stockholders. Capital stock insurance companies. Its financial aim is to turn out profits for those stockholders through the distribution of dividends. Stock insurance company definition is an insurance company with capital contributed by stockholders who control its operations and reap any profits or sustain any losses which may result therefrom and with policies that are ordinarily nonparticipating and always nonassessable.

This sounds simple but it s frequently. A stock insurance company may be a private insurance company or a publicly traded company that uses stockholder investments to raise the capital for the company.