What Is Ho3 Insurance Coverage

Ho3 and ho5 policies are pretty similar in their overall structure but as previously mentioned ho5 policies are a bit more comprehensive when it comes to covering your stuff.

What is ho3 insurance coverage. If you take out a mortgage at the bank for your home you ll be required to show proof of insurance. If you don t take out a mortgage you re not required by law to have insurance for your townhome. An ho 3 insurance policy known as an ho 3 special form homeowners insurance policy is the most common type of home insurance on the market. And while the ho3 policy is a mixture of a named peril and open peril policy ho6 policies tend to be fully named peril policies.

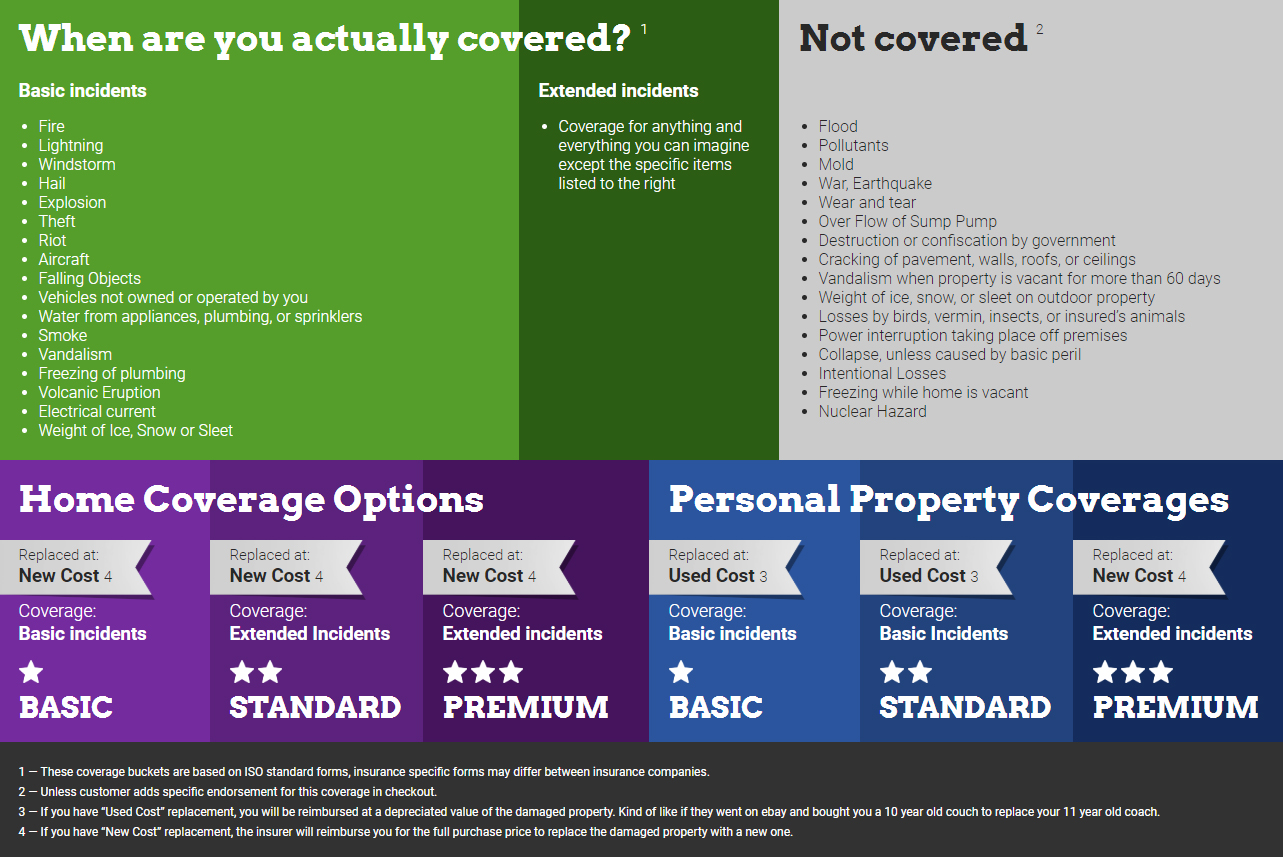

An ho3 policy is an open perils policy which means it covers everything that it does not specifically exclude from coverage. Below is a list of named perils that limit your personal property coverage on an ho3 policy. An ho3 policy is insurance lingo for a basic homeowners insurance policy. Also known as the special form homeowners policy it provides excellent coverage for your house as well as your personal property.

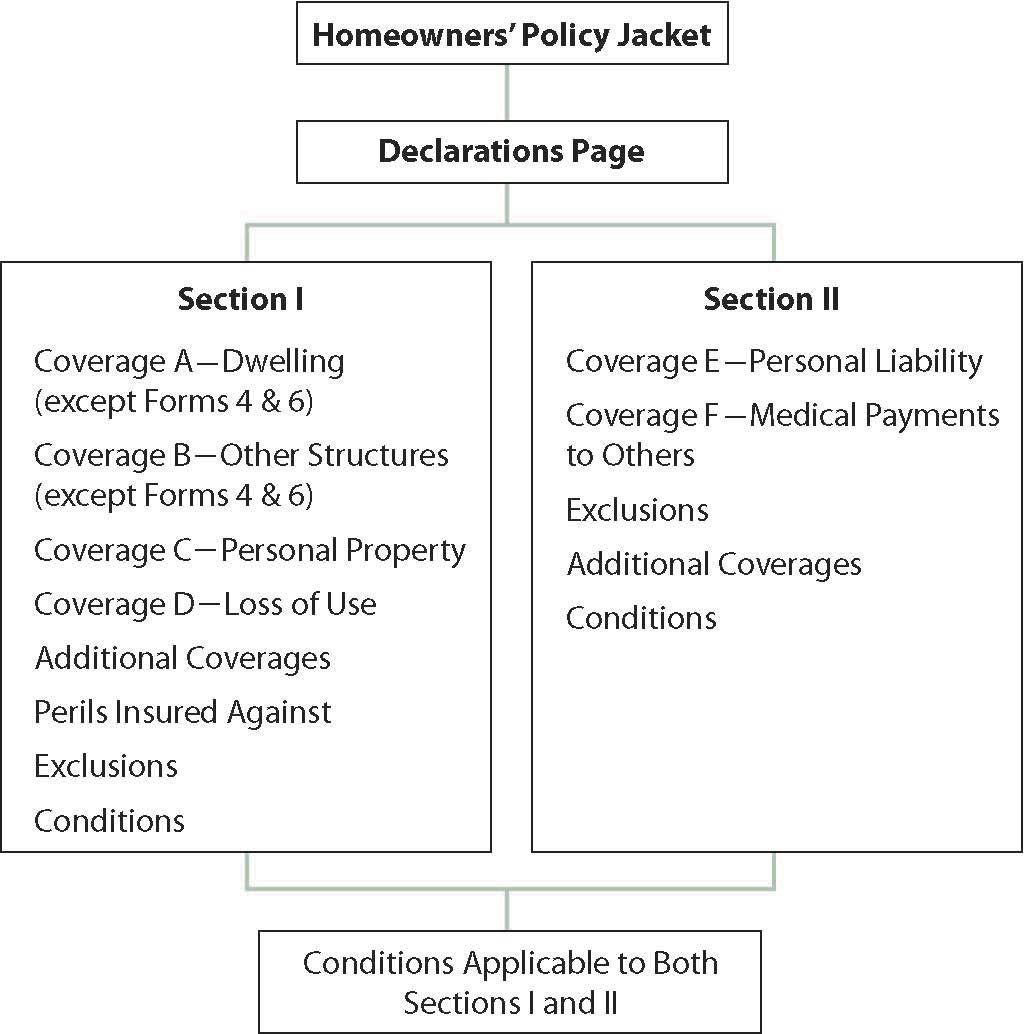

This means if your homeowner s insurance policy lists snow as a type of covered peril but not hail then hail damage would not be covered in a named peril policy. It s essentially just a contract between you and your insurer. If you have homeowners insurance you most likely have what is called an ho 3 policy the most common type of home insurance policy in the industry also referred to as the homeowners policy special form 3 an ho 3 is the form or template behind most standard homeowners insurance policies your ho 3 policy form is essentially the insurance manual that breaks down how each of the six coverages. What is an ho3 policy.

The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. Ho3 is the most common and most popular form of homeowners insurance according to the national storm damage center. As we said the ho 3 home insurance policy is the most commonly purchased home insurance policy because the policy encompasses all the coverage that most homeowners need. An ho3 policy is the one of the most common types of home insurance the coverage is written on an open perils basis for your home and other structures which means it can cover any risks except for those specifically excluded in the policy.

However it offers named perils coverage for your personal property meaning it only covers damage to belongings caused by the. An ho3 policy is insurance lingo for a basic homeowners insurance policy. You agree to pay a monthly fee called a premium and in return they can have your back when things don t go your way.