What Is Pip Coverage

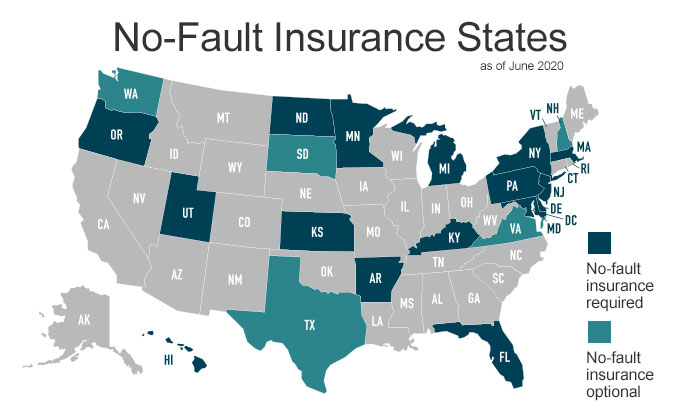

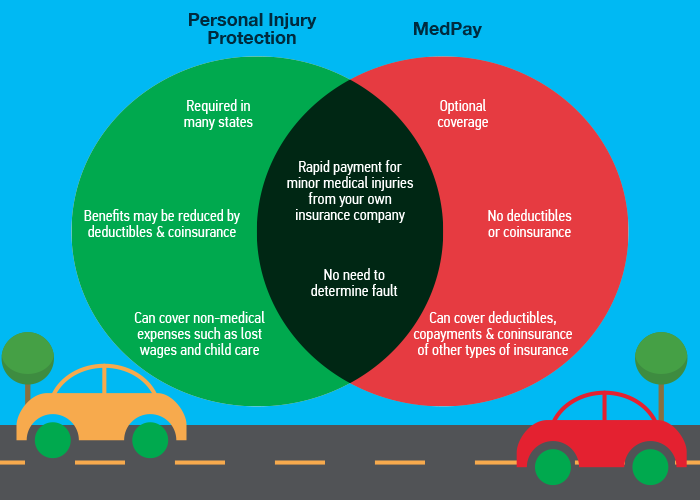

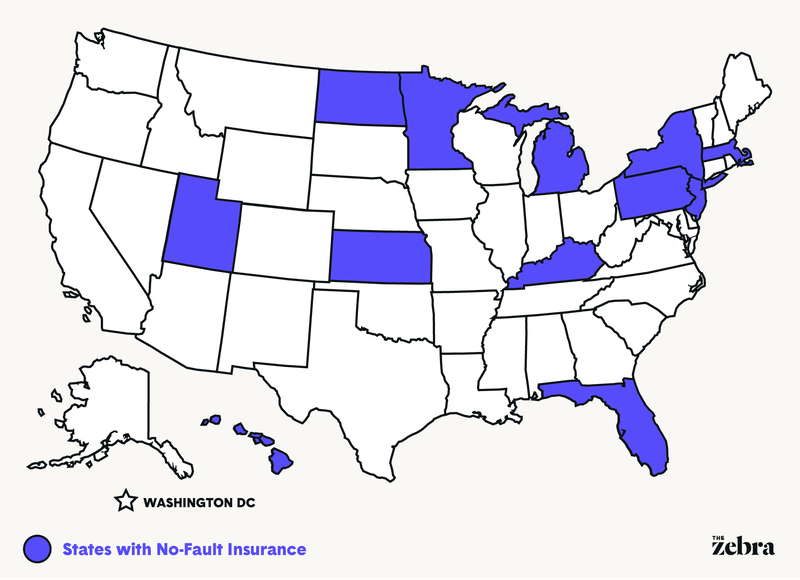

States that covers medical expenses and in some cases lost wages and other damages pip is sometimes referred to as no fault coverage because the statutes enacting it are generally known as no fault laws and pip is designed to be paid without regard to fault or more properly legal liability.

What is pip coverage. No fault means that regardless of which driver was at fault some of the medical expenses for the policyholder and others in the policyholder s car may be covered by insurance. With personal injury. Personal injury protection or pip is a subset of auto insurance coverage. Personal injury protection is a no fault coverage and is required in some states.

Up to 250 000 in. Pip coverage also includes some funeral expense benefits and survivor s benefits which are paid to your dependents if injuries from an auto accident result in your death. Pip medical coverage options. The minimum pip coverage in oregon is 15 000 and pays for medical hospital dental surgical ambulance and prosthetic expenses that you have within two years after the date of the injury.

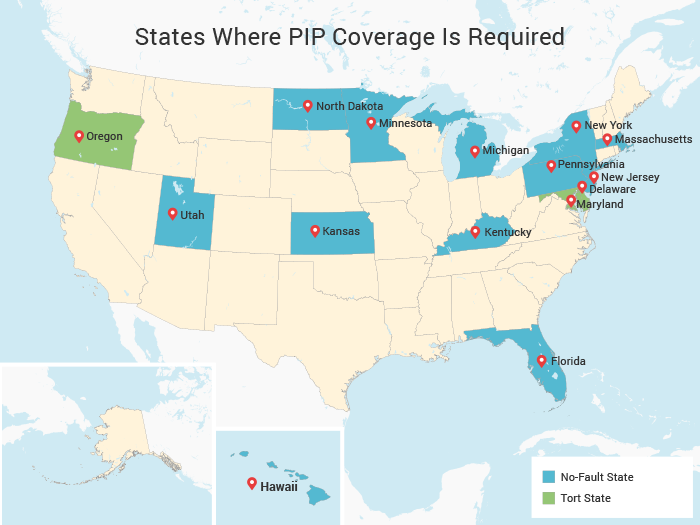

Under these limits this amount is the most a driver s auto insurance company will pay per person per accident for an injured person s expenses under pip medical coverage. However 16 states require you to carry a minimum amount of pip coverage. Up to 500 000 in coverage. A feature of automobile insurance that covers the health care expenses associated with treating injuries sustained in a car accident.

Personal injury protection pip. Depending on the state where you live pip may be an available insurance coverage or a required policy add on. Personal injury protection also known as pip coverage or no fault insurance covers medical expenses regardless of who s at fault. There are six pip medical coverage levels available to michigan drivers.

Pip is optional in most states. It is often called no fault coverage because its inherent comprehensiveness pays out claims agnostic of who is at fault in the accident. Personal injury protection pip pays allowable expenses for your care recovery rehabilitation wage loss and replacement services. Personal injury protection pip insurance covers your medical bills and lost wages when you or your passengers are injured in a car accident.

It can often include lost wages too.