What Is Reverse Merge

Sometimes conversely the public company is bought by the private company through an asset swap and share issue.

What is reverse merge. A reverse merger is a merger in which a private company becomes a public company by acquiring it. It also normally involves renaming the publicly traded company. In some cases the public company is a shell company owned by the investors in the private firm. In order for a reverse merger.

Diginex is a hong kong based cryptocurrency firm that became a public company by closing a reverse merger deal. What is a reverse merger. It exchanges shares with 8i enterprises acquisitions corp a publicly listed company. A reverse takeover rto reverse merger or reverse ipo is the acquisition of a private company by an existing public company often a spac so that the private company can bypass the lengthy and complex process of going public.

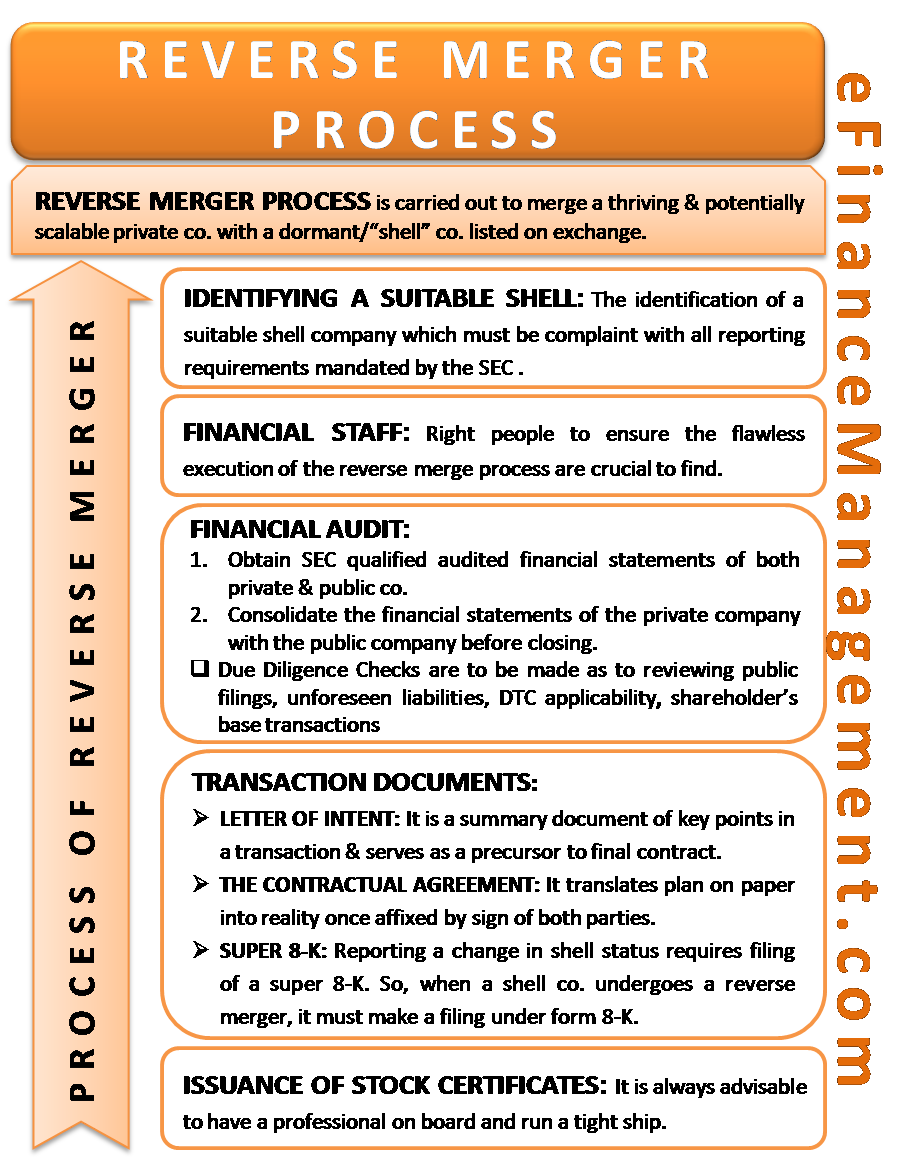

A reverse merger process is carried out to merge a thriving and potentially scalable private company with a dormant or shell company listed on the exchange. Reverse merger an act where a private company purchases a publicly traded company and shifts its management into the latter. This allows private companies to become publicly traded while avoiding the regulatory and financial requirements associated with an ipo. It is a less time consuming and less costly alternative to the conventional.

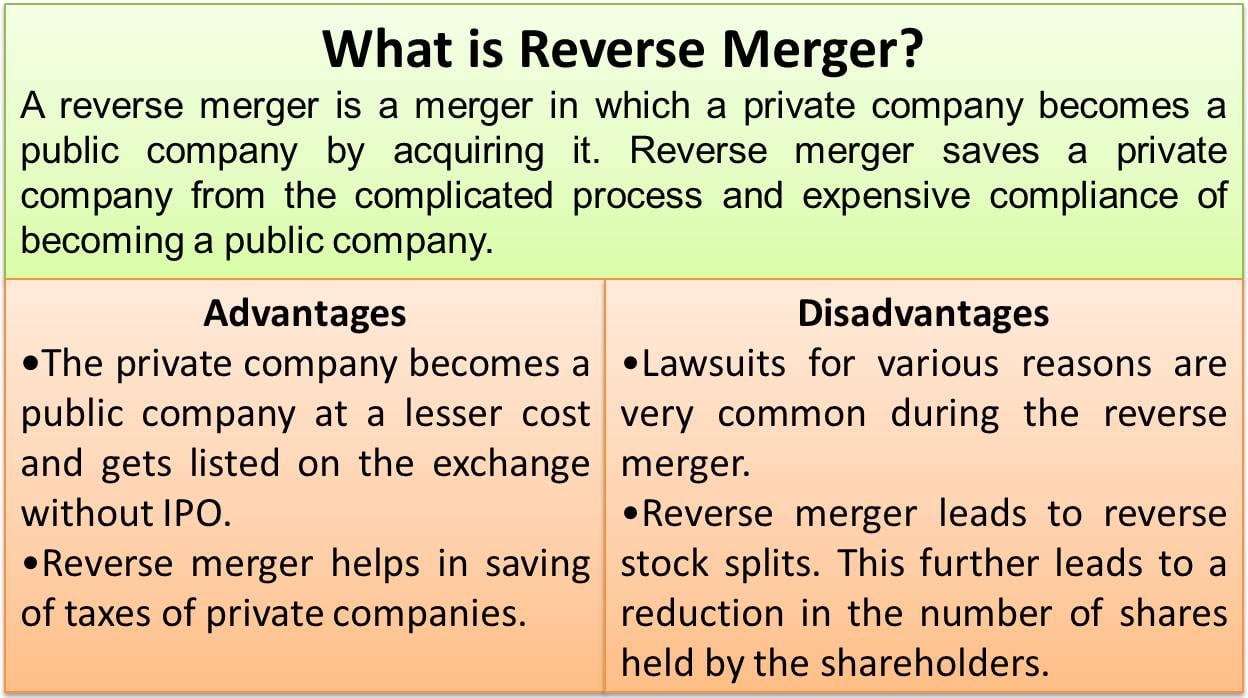

It saves a private company from the complicated process and expensive compliance of becoming a public company. Example 2 ted turner rice broadcasting a prominent example of a reverse merger is of ted turner merging his company with rice broadcasting. A merger takes place when two companies combine to form a single business entity. A reverse merger is an attractive strategic option for managers of private companies to gain public company status.

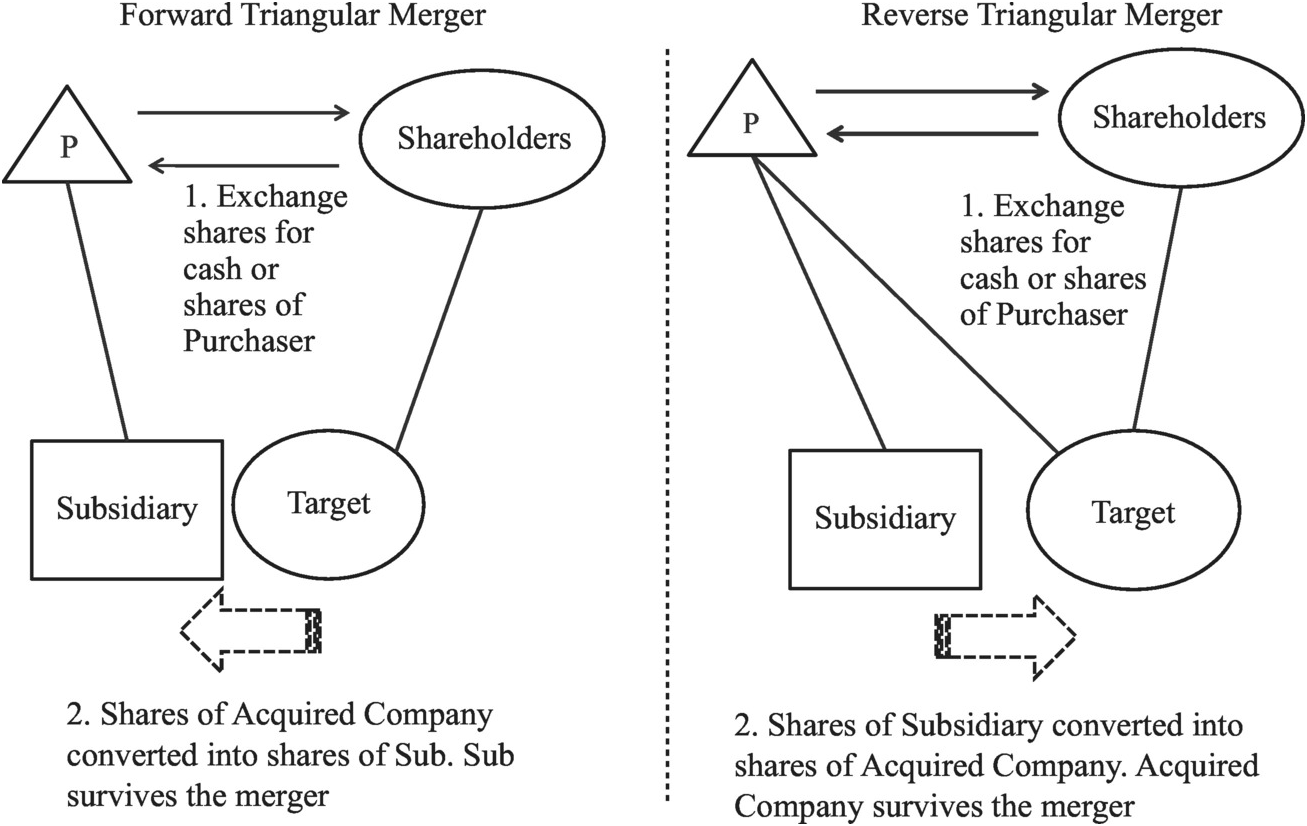

Most mergers happen when one public company takes over the shares of another company either public or private and just gets bigger. The foremost objective of a reverse merger process is to bypass the extensive procedures and regulations imposed by the government on a company seeking to issue an ipo. Instead it acquires a public company as an investment and converts itself into a public company. The practice is contrary to the norm because the smaller company is taking over the larger company thus the merger is in reverse order.

In a reverse merger a private company buys out a public one then has shares of the new business.

/GettyImages-166076219-9b322f8c656e44bea66507f7195f06f2.jpg)