What Is Standard Car Insurance Coverage

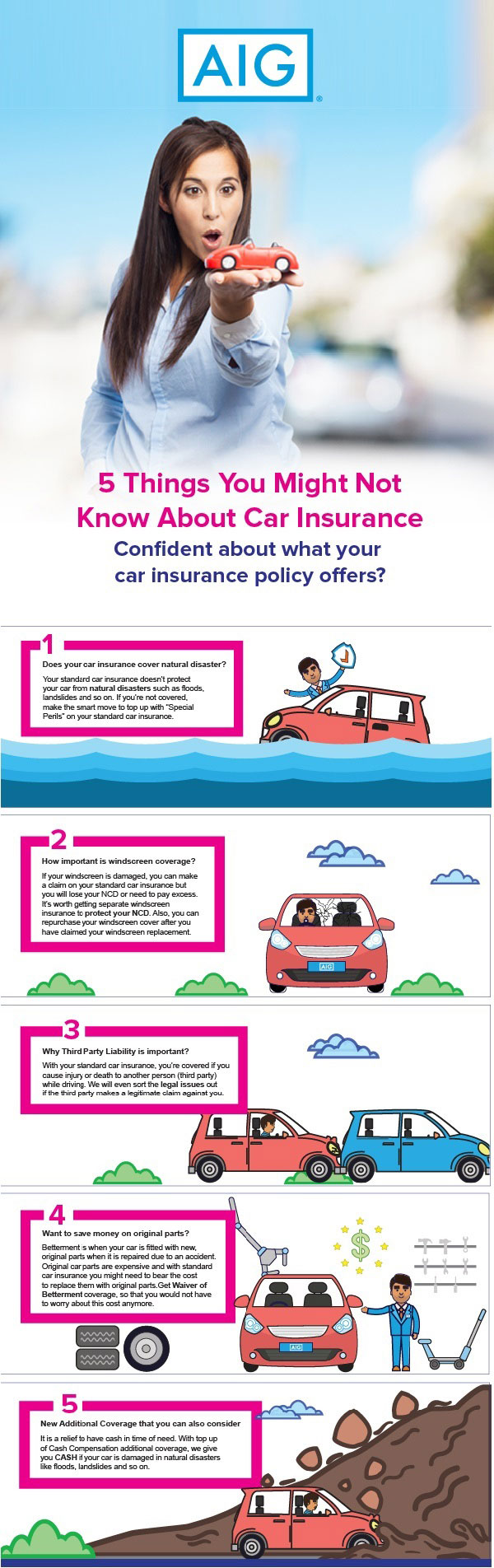

Your auto insurance is a collection of different policies that cover you in different ways.

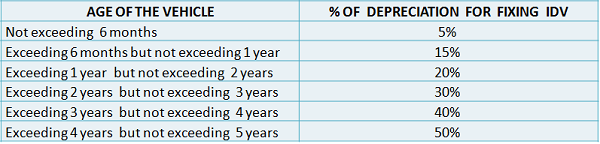

What is standard car insurance coverage. The coverage is the difference between your family protection limit as per the terms of your policy and the liability insurance limits of the other at fault driver. Members of auto clubs with such privileges don t need this coverage. This level of insurance is applicable to drivers who have an average risk profile and do not want to pay a considerable monthly premium for extensive insurance coverage. The six common types of car insurance that make up a standard policy are liability coverage collision insurance comprehensive insurance medical payments coverage personal injury protection.

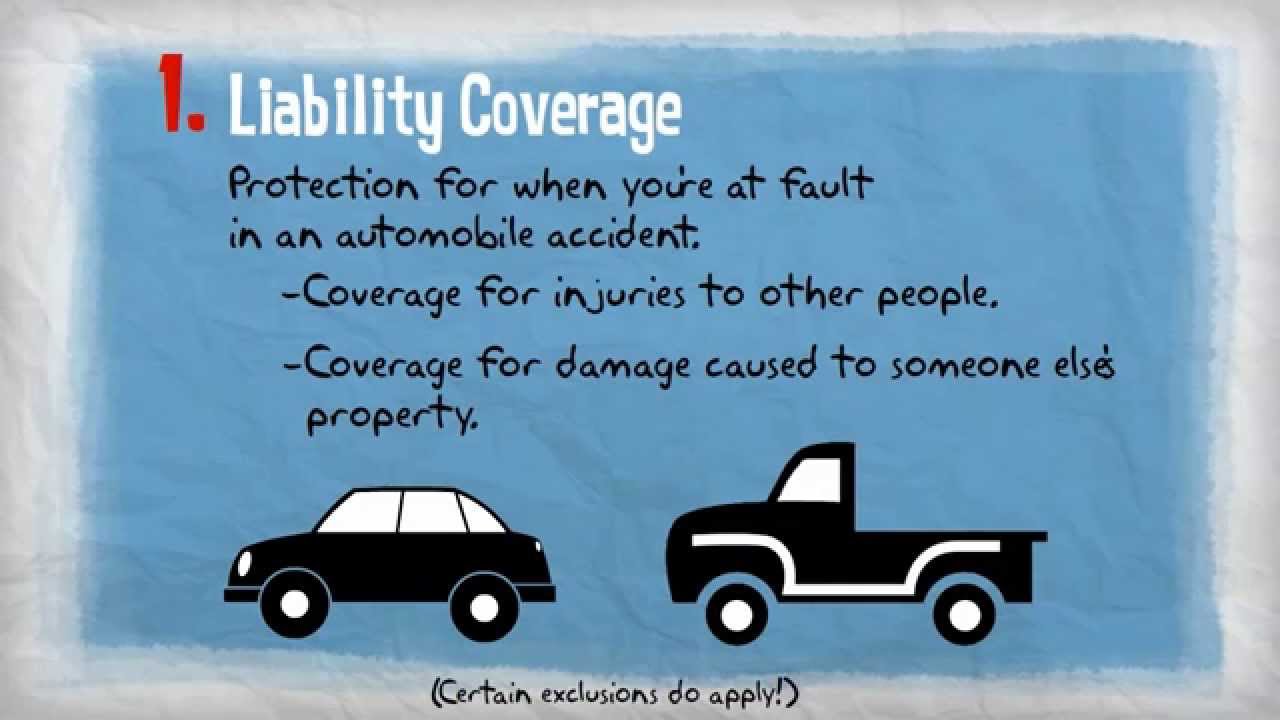

Non standard auto insurance typically describes the rates not the coverage that you may receive from an insurance company. Here s how they break down. Liability coverage these policies help cover liability and expenses when you re at fault in and accident. Rental insurance it costs only a few dollars per year certainly a worthwhile expense if you travel and rent cars frequently.

Liability coverage collision coverage comprehensive coverage uninsured motorist and medical payments coverage. Standard auto insurance coverage is the basic insurance required to legally operate an automobile. Automobile insurance standard coverage is the basic amount of insurance coverage that is required by law in order for an individual to legally operate a motorized vehicle. The money will go to the people you hit but it won t cover the people in your car.

Auto insurance offered to drivers considered to fall into an average risk profile. Standard insurance usually refers to the insurance coverage that is required by law in order to make a car legal. Standard auto insurance is not always what the majority of the population purchases but it does give a driver peace of mind and the legal right to drive. Robert was involved in an automobile accident that caused 800 000 in damages.

Read more to learn about who gets placed into the non standard tier of drivers. Extraordinarily risky drivers will be placed into the non standard tier of drivers who will receive the most expensive rates to purchase coverage. There are five basic types of auto insurance. You can simply it even further with the blanket statement as being the mandatory amount of auto insurance coverage a driver must possess.