What Is The Difference Between Checking And Savings

Understanding the difference between savings and checking account is essential as this will help anyone who is interested in maintaining.

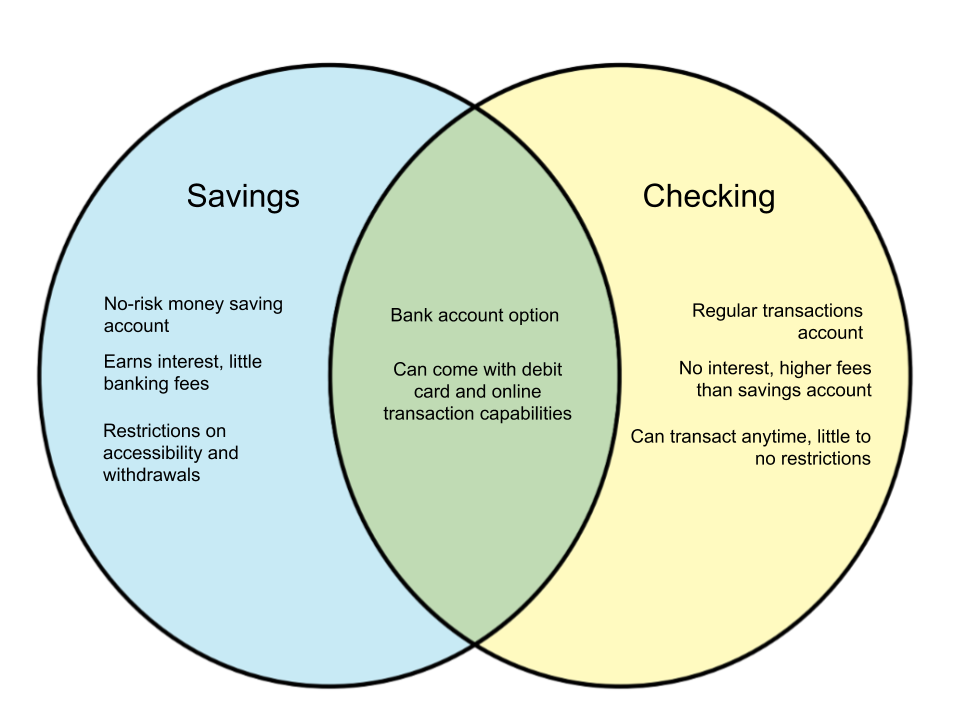

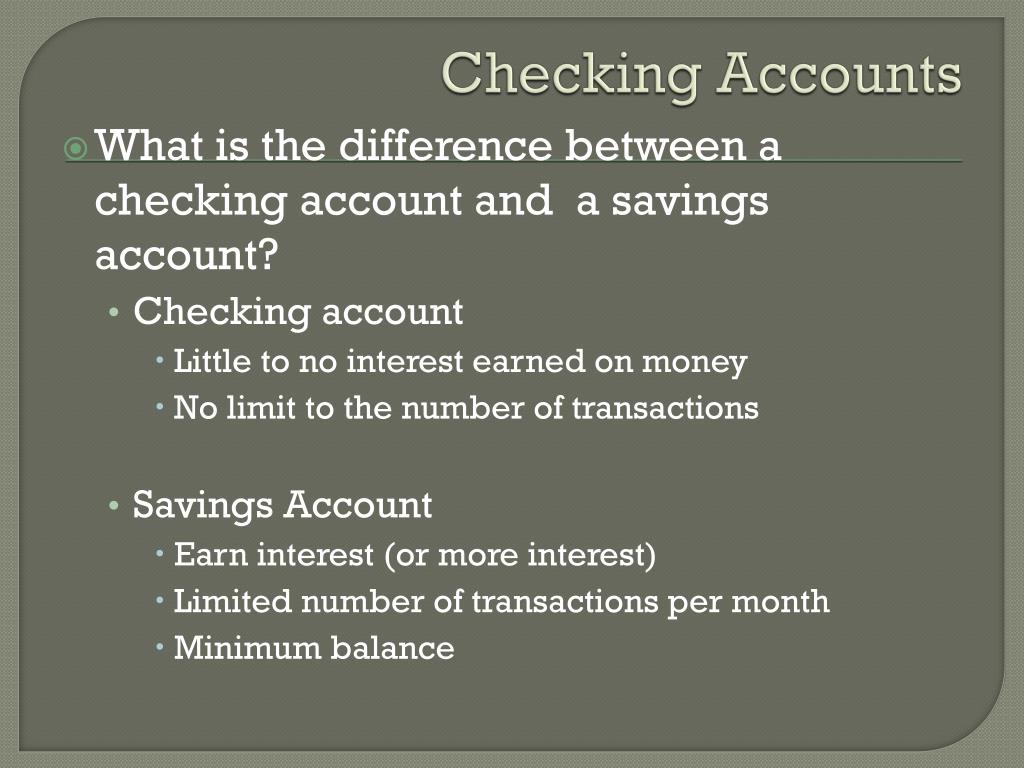

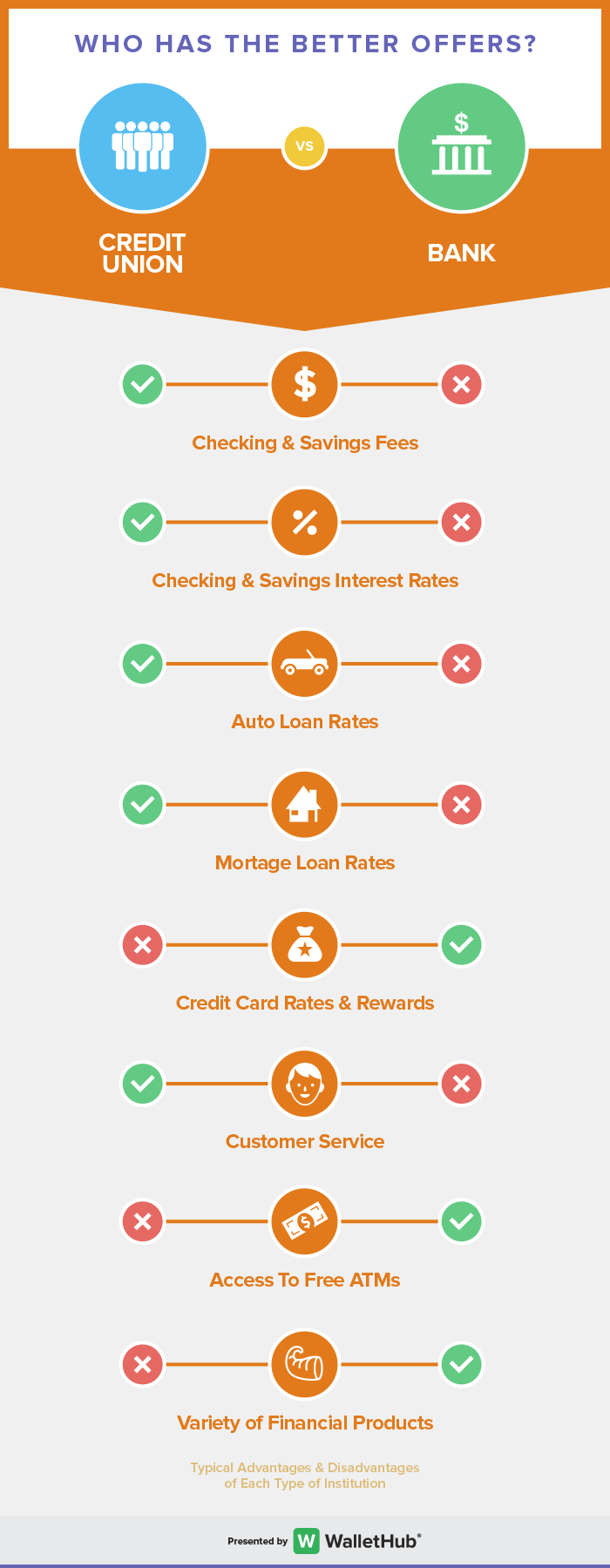

What is the difference between checking and savings. Savings accounts have higher interest rates than checking accounts meaning it is better to let large. Today the line between checking and savings accounts is rather blurry but there are still differences worth mentioning. Checking and savings accounts are the bank accounts you use most often. What is the difference between a checking and savings account.

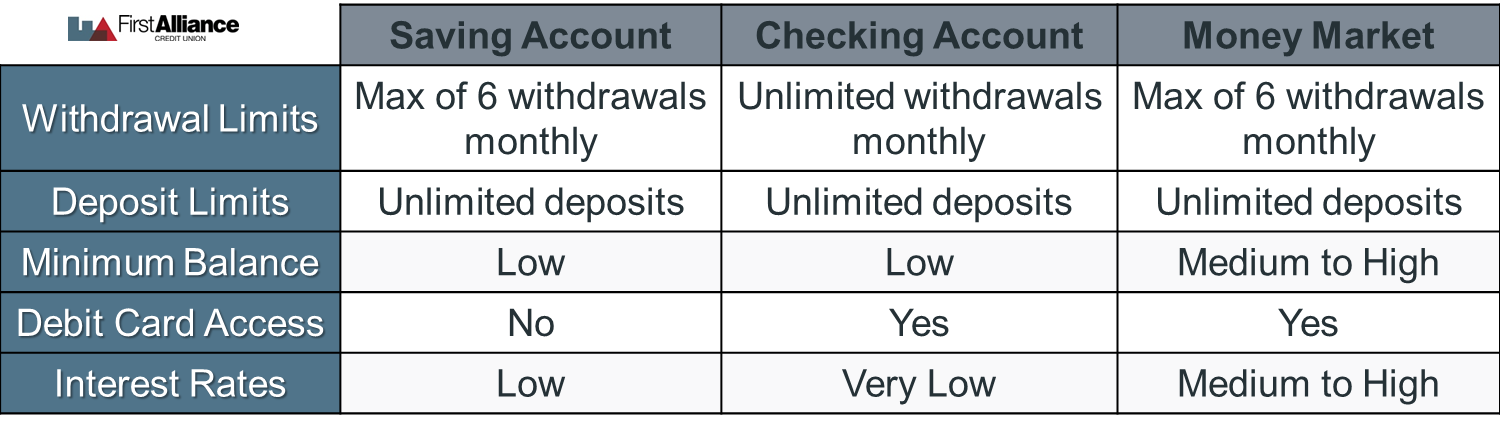

Checking accounts were meant as a place to deposit checks make withdrawals and manage bill payments. The main difference between a savings account and a money market account is the access you have to your funds. While both savings accounts and checking accounts help the individual or business to manage their funds in some way they are quite different to one another in terms of the purposes for which they are used their features fees charged interest earned etc. While both allow you to access your money you may consider it easier to do so with checking accounts.

A savings account is designed to sit and earn interest. They both hold money for safekeeping but have different features and it s essential to understand the differences between these accounts and when to use each one. With that in mind banks place more restrictions on savings accounts and the money is not as easily accessible as a checking account. The difference between a checking account and savings account is that money is spent from a checking account while money being saved is placed in a savings account.

Saving accounts were meant to put money away for rather long periods of time. This is noted in money market accounts inclusion of an atm card. Checking accounts are considered transactional meaning that they allow you to access your money when and where you need it. The accounts can be connected to each other if requested.

Customers move money in and out of checking accounts sometimes multiple times a day. The money in a savings account however is not intended for daily use but is instead meant to stay in the account be saved in the account so that it might earn interest over time. A checking account is a transactional account. The main difference between checking and savings accounts has to do with accessing your money.

A checking account is a type of bank deposit account that is designed for everyday money transactions. Here are the key differences between checking and savings. While you can often access a savings account at an atm through your checking account s debit card the savings account itself does not have its own card.