What S Needed To Get Pre Approved For A Home Loan

There s no need to choose a lender just yet.

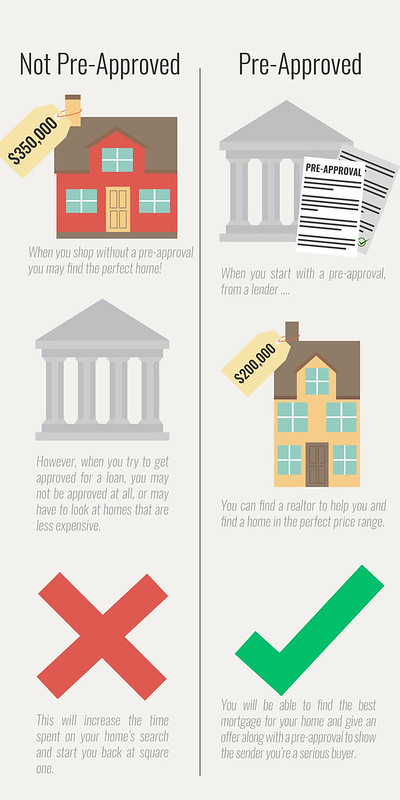

What s needed to get pre approved for a home loan. You ll need to submit paperwork about your income assets employment. Many sellers will require a pre approval or pre qualification letter if you re planning to get a mortgage. Citizen to be eligible for a mortgage but lenders may ask about your permanent residency and immigration status and may request copies of a green card employee authorization document or an approved visa. Know the maximum amount of a mortgage you could qualify for.

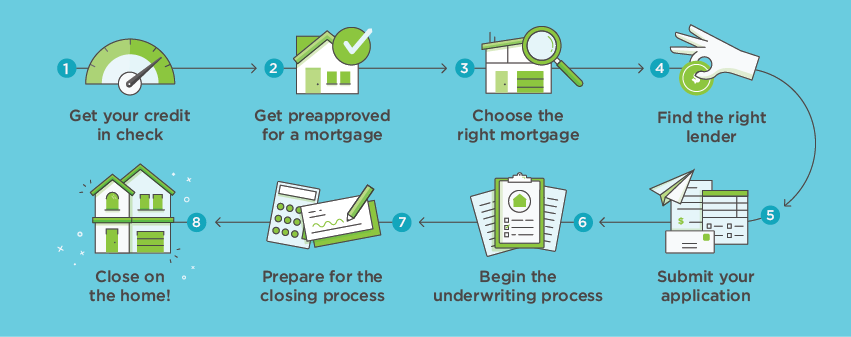

Estimate your mortgage payments. A pre approval letter or a pre qualification letter can help demonstrate that you have a good chance of being approved for a mortgage for the amount that you ve offered on the home. Getting a home loan preapproval can lower your credit score by a few points because the lender performs a hard pull on your credit reports during the process. Acquiring mortgage loan pre approval is the first step a borrower takes at the beginning of the home buying or refinance process.

You don t need to be a u s. After you re pre qualified your next step is to get pre approved. A letter to a bank from a parent company whose subsidiary is applying to borrow money from that bank. While not legally binding the letter indicates the parent company s.

A mortgage pre approval isn t a promise that you ll get a loan for the home you want to buy. Now folks don t be fooled. However if you re shopping around and multiple lenders check your credit over a 45 day window the credit bureaus generally count these inquiries as a single credit pull. A mortgage pre approval only means a loan officer has looked at your finances your income debt assets and credit history and determined how much money you can borrow how much you could pay per month and what your interest rate will be.

Letter of moral intent. With a pre approval you can. Getting preapproved is important because it helps you shop for a home. Like with any borrower the lender wants to verify you reasonably expect to receive income.

A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. This is an in depth process. Getting a preapproval doesn t commit you to using that lender for your loan.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)