What S The Difference Between Apr And Interest Rate

The interest rate represents the yearly cost you pay to borrow the money in your mortgage loan.

What s the difference between apr and interest rate. As a result the apr provides an all inclusive cost of borrowing enabling you to compare lenders who charge different fees and different interest rates. Apr also takes into account for any fees or additional costs associated with the loan. The interest rate is determined by prevailing rates and the borrower. In the context of borrowing apr describes the annualized interest rate you pay on credit cards loans and other debts.

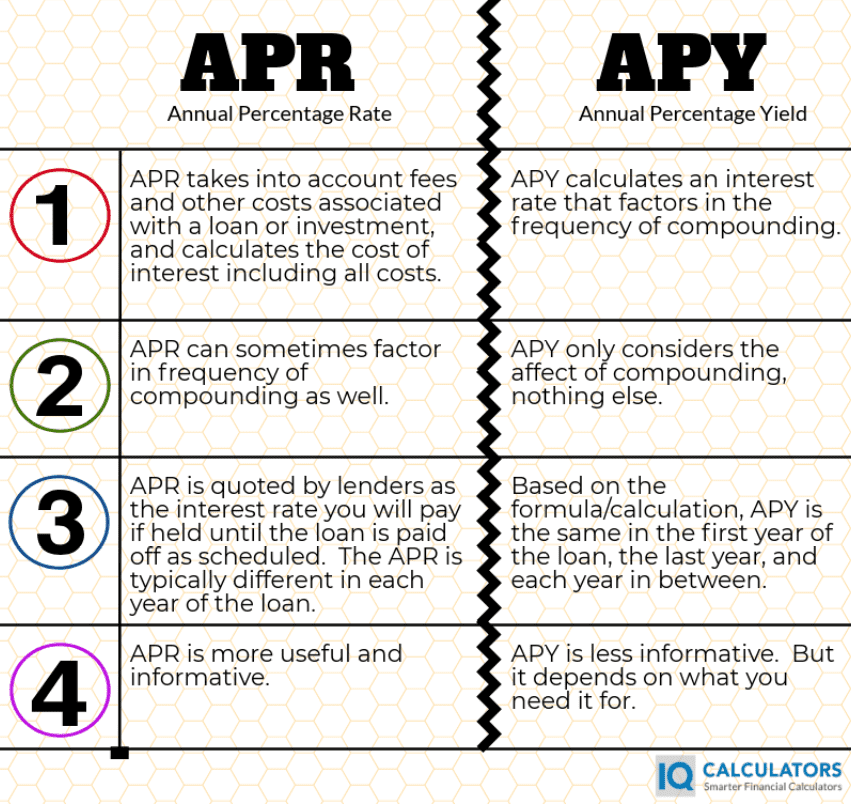

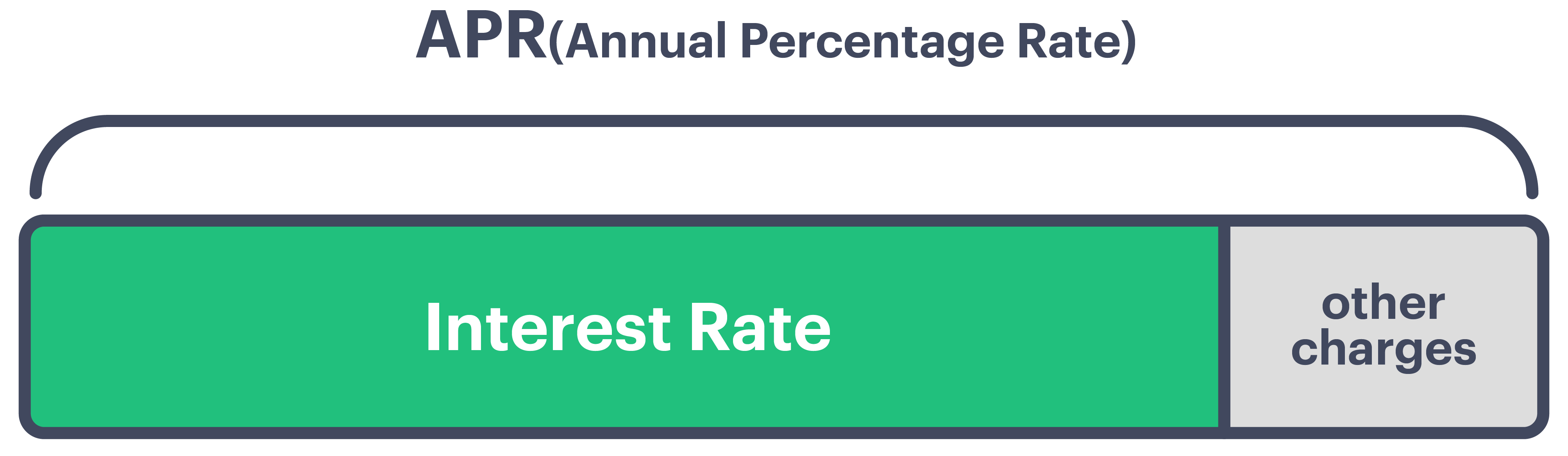

The difference between an apr and an interest rate is that the apr equals the interest rate plus other loan costs. The apr however is the more effective rate to consider when comparing loans the apr includes not only the interest expense on the loan but also all fees and other costs involved. In the context of savings accounts the apy reflects the annual interest rate that is paid on an investment. Apr is the amount of interest repaid in a year and can be expressed like other interest rates as either a nominal or effective rate.

Unlike a stripped down bare bones interest rate apr reveals the full price of the loan. A loan s annual percentage rate apr includes all those pesky fees you ll pay for borrowing money. For example short term high interest rate loans will often have a 30 interest rate for a two week term or 30 owed for every 100 borrowed which translates into a 782 14 apr. The apr includes the interest rate you pay on the debt as well as costs related to funding your loan.

The difference between the interest rate and apr is simple says bryan sherman a consumer lending executive with bank of america. Apr and apy can be defined in relatively simple terms. The difference between interest rate and apr are drawn clearly on the following grounds. As a numerical example of how interest rate and apr are different let s say that you re obtaining a 20 000 personal loan with a three year term with an interest rate of 6 99 and a 500.

The interest rate is described as the rate at which interest is charged by the lenders on the loan given to the borrowers. Apr or annual percentage rate is the most straightforward way to compare different loans credit cards and mortgages.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)