What States Do Not Require Auto Insurance

To compensate anyone you injure as a result of your driving you are financially responsible for property damage.

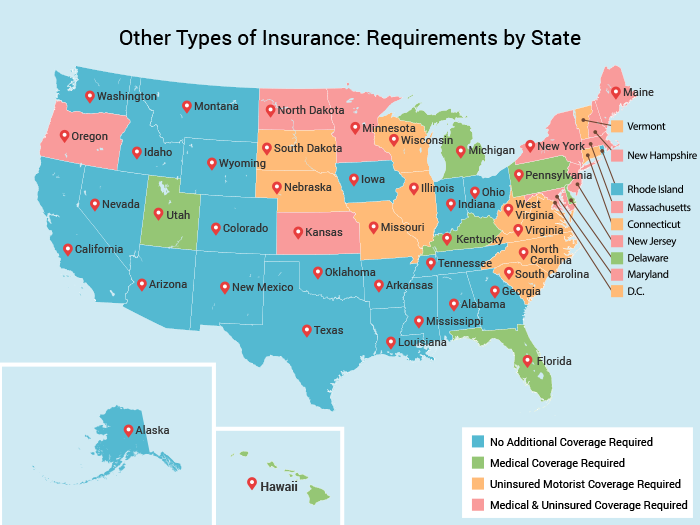

What states do not require auto insurance. However it is the only state where if you cause an accident don t have the cash to cover the damages and have chosen not to buy insurance your wages are allowed to be garnished to pay for the damages you caused. New hampshire is the only state without a financial responsibility law. New hampshire and virginia are currently the only states that do not require motor vehicle insurance with the cost of car insurance rising in many areas some people may wonder if there is a way around it. Most nh drivers achieve this by purchasing liability insurance anyway.

See drive uninsured legally for 500. Here s a look at states that don t require car insurance and the other options. Skip to content 888 449 5477. Drivers are under the jurisdiction of their individual states when it comes to car insurance and the auto insurance laws vary by state.

New hampshire and wisconsin are the only two states that do not require its residents have auto insurance though certain states like virginia allow you to post a bond. Which states do not require car insurance. New hampshire is the only state that does not require liability insurance to operate a car. New hampshire is the only state that doesn t have set car insurance requirements in place.

If you live in new hampshire although the state does not require you to purchase car insurance in order to legally drive the law requires you to be financially responsible. Going rogue new hampshire is the only state that doesn t require residents to have insurance or even prove they could cover their liability in an accident according to. 4 being financially responsible means. There are just two states that don t require car insurance.

New hampshire and alaska. And even in new hampshire you have to buy car insurance if you cause an accident. Alternatives to car insurance by state. New hampshire and virginia.

Up to 50 000 for liability and 25 000 for property damage.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/hands-up-while-driving-a-convertible-164952484-588e3a1d3df78caebc194118.jpg)

/GettyImages-941132094-04368c13d238481d9212f34d1658f271.jpg)