What You Need For A Mortgage Approval

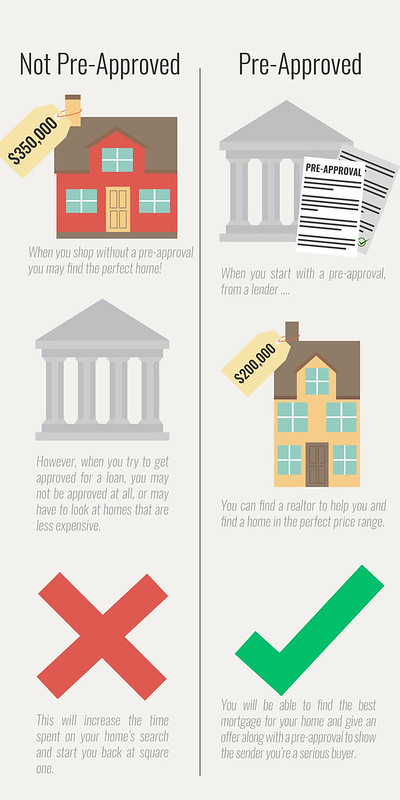

You don t want to go shopping for the most important purchase of your life without knowing how much you can spend do you.

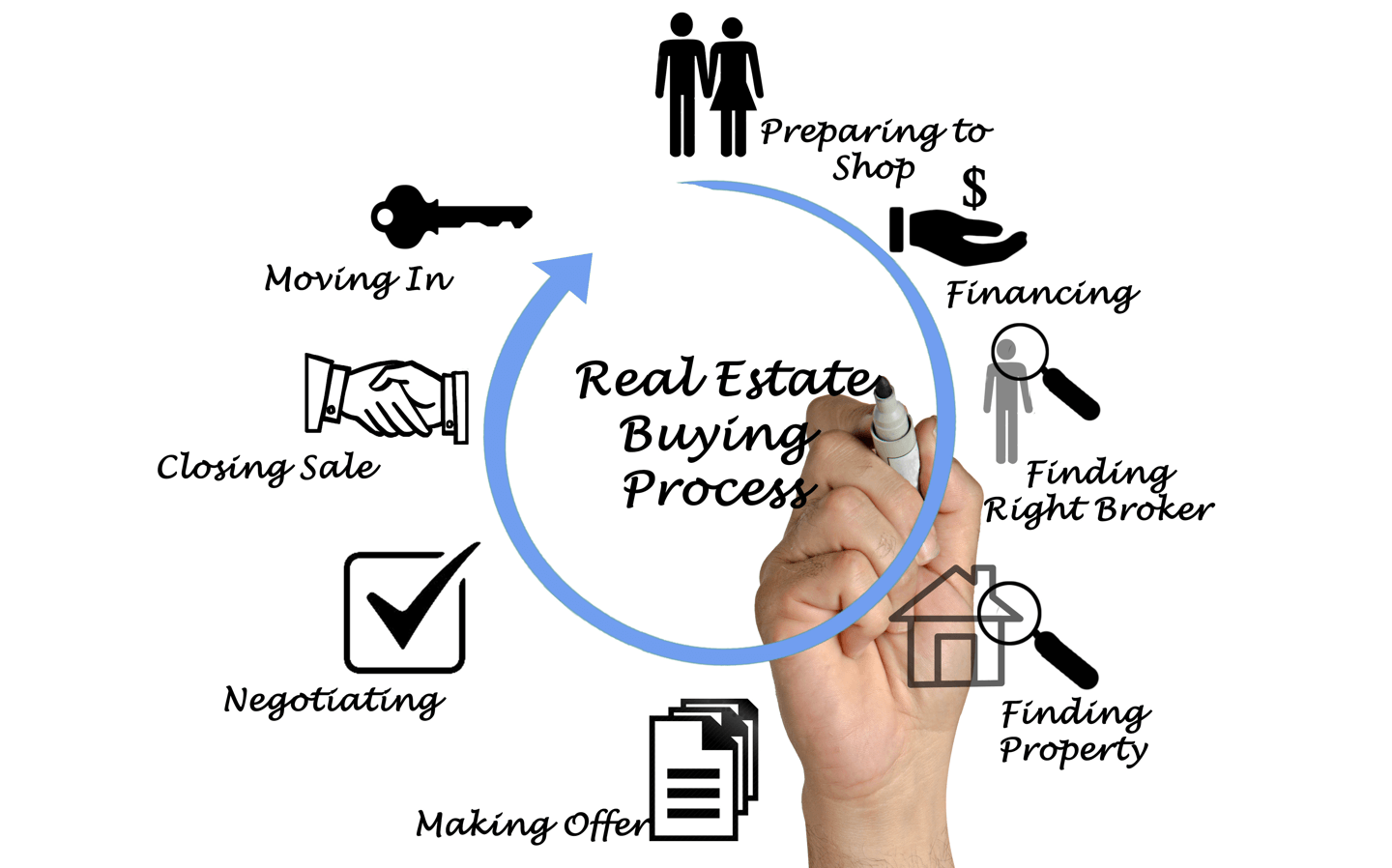

What you need for a mortgage approval. For example say you apply for a mortgage at a bank and that you have a down payment of 5 of the value of the home. What you ll need to get a pre approval. You ve been working hard love your city and you are ready to buy a house. This information can be verified through a social security card tax documents or anything else that shows the ssn.

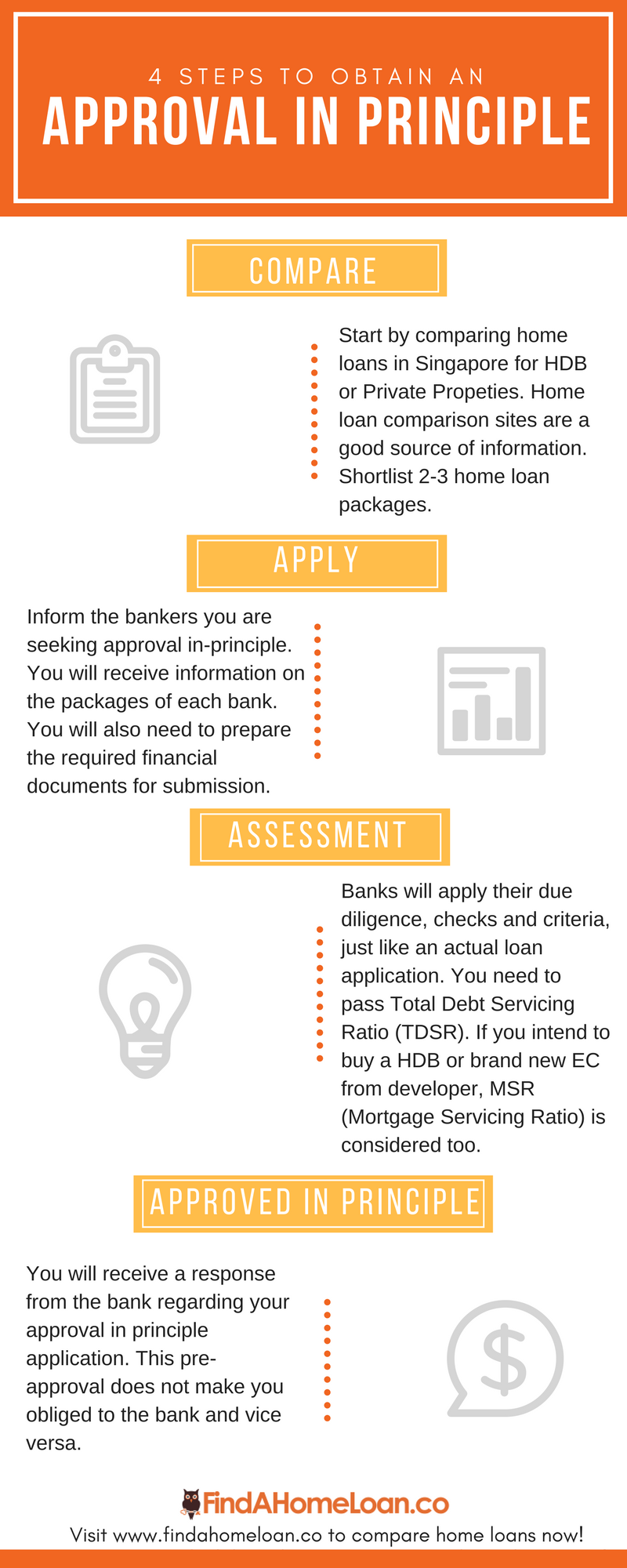

The federal reserve board. The bank of canada s conventional five year mortgage rate. If you are self employed the mortgage application process remains the same as for any other borrower and you can still obtain a pre approval. If you don t need mortgage loan insurance the bank must use the higher interest rate of either.

Getting a mortgage pre approval is an important first step in buying a house learn what you need to get pre approved for your home loan. Many lenders ask for the following. You can speak with a loan officer to discuss the amount of money you ll need for a mortgage pre approval. With a mortgage pre approval we ll review your credit history income debt situation and employment history to determine your creditworthiness as a potential borrower.

A mortgage pre approval is a written statement from a lender that signifies a home buyers qualification for a specific home loan. Here are the most common documents you need for a mortgage pre approval. Each lender will consider your application differently so it s important to make clear the nature of your income from the outset. The interest rate you negotiate with your lender plus 2.

Social security number for anyone who is on the mortgage loan. Before you can buy a house you need mortgage approval. The next step is to learn how to go about getting one of your own. A mortgage pre approval gives you a homebuying budget.

Mortgage approval if you re self employed. Getting yourself ready for mortgage approval can take a number of years as you work to save up money for your deposit get rid of those old personal loans and manage your finances in a fashion that will meet the scrutiny of a lending officer. By now you should have a good sense of what a pre approval letter is and how having one can benefit you in a real estate transaction. The lender needs this to verify your identity and also to pull your credit.

Requirements for pre approval. The mortgage application process.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)