What You Need To Get Prequalified For A Home Loan

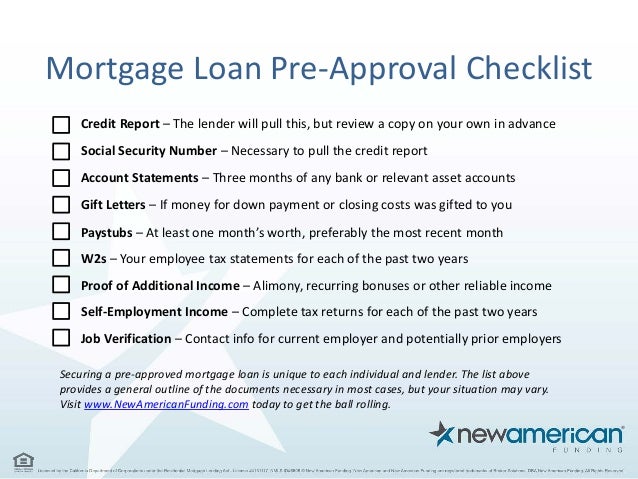

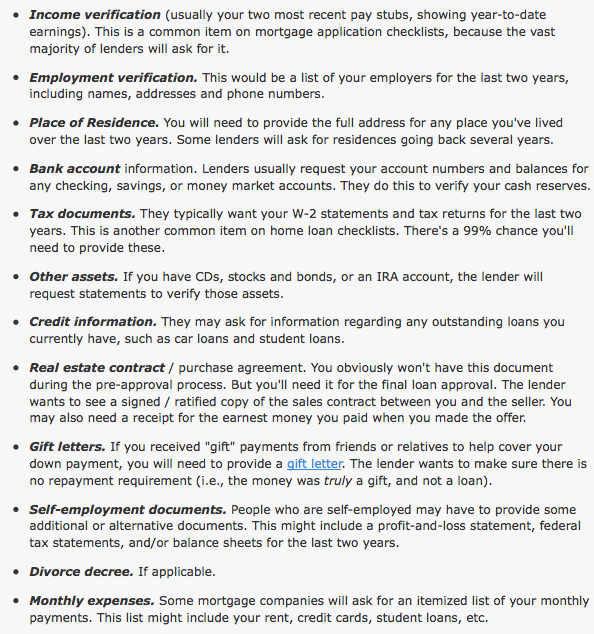

To get pre approved you will likely need to provide the following documentation.

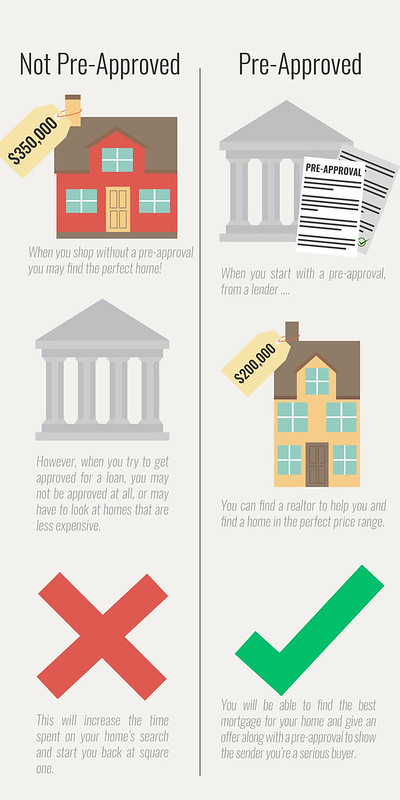

What you need to get prequalified for a home loan. Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals. After you ve been prequalified you ll usually receive a prequalification letter you can show to an agent or seller as proof you re working with a lender. This assessment is based on things like credit score income debts and employment history. Without your credit report your lender can only give you estimates which means the approval amount loan program and interest rate might change slightly as the lender gets more information.

These are important questions to answer if you want to pre qualify for a home loan and our loan prequalification calculator is a great tool to help you get started. Getting preapproved for a mortgage shows that you aren t playing. After evaluating this information a lender can give you an idea of the mortgage amount for which you qualify. With a prequalification you won t have to provide as much information about your finances and your lender won t pull your credit.

While my advice may be simple getting pre qualified does require sacrifice discipline and patience. You supply a bank or lender with your overall financial picture including your debt income and assets. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require. Being prequalified for a mortgage is a good starting point if you are on the fence and you re trying to decide if you want to rent or buy a home.

Your w 2 from the past two years your pay stubs for the past three months your tax returns from the past two years. When you prequalify for a home loan you re getting an estimate of what you might be able to borrow based on information you provide about your finances as well as a credit check. Getting pre qualified is the initial step in the mortgage process and it s generally fairly simple. Pre qualification by a lender will help you determine the amount of mortgage you can afford.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)