When Can Refinance Mortgage

Reduce the monthly payment.

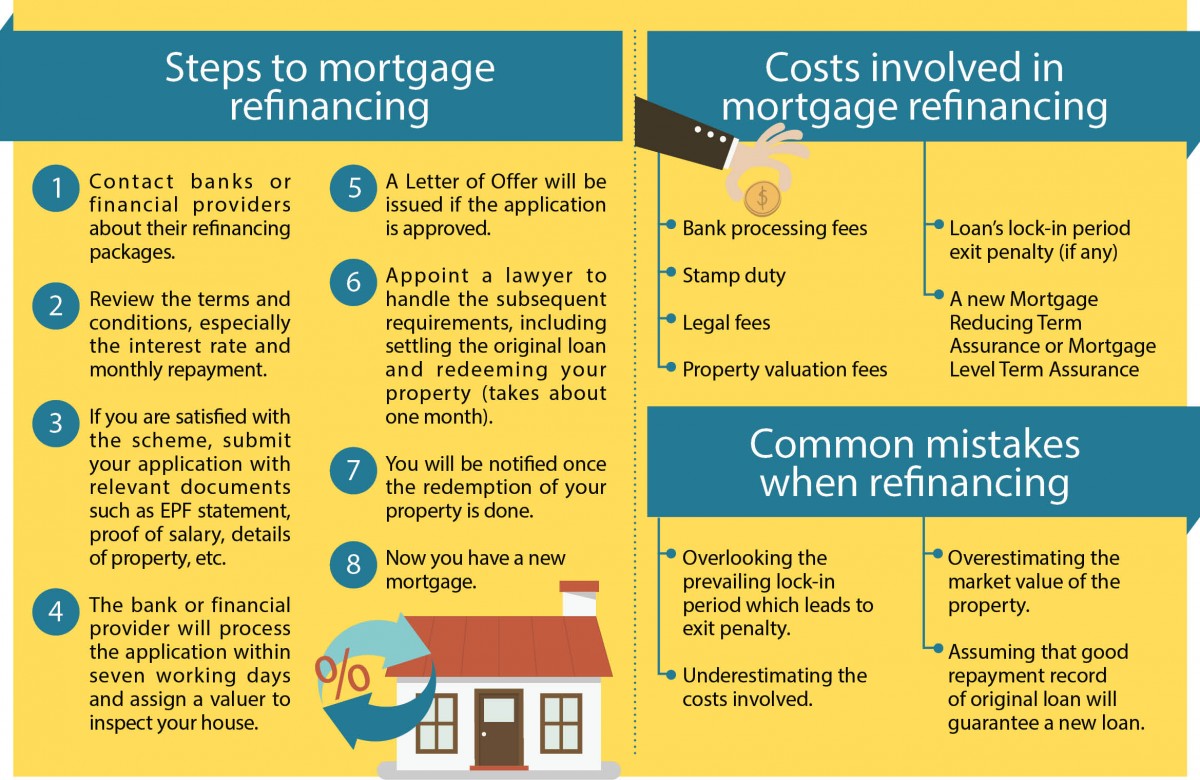

When can refinance mortgage. Consider some of the reasons that people refinance a mortgage. If rates are lower than when you got your original loan refinancing can reduce your monthly mortgage payments. Getting a lower interest rate is by far the most popular reason to refinance a mortgage. Lower interest rates are a.

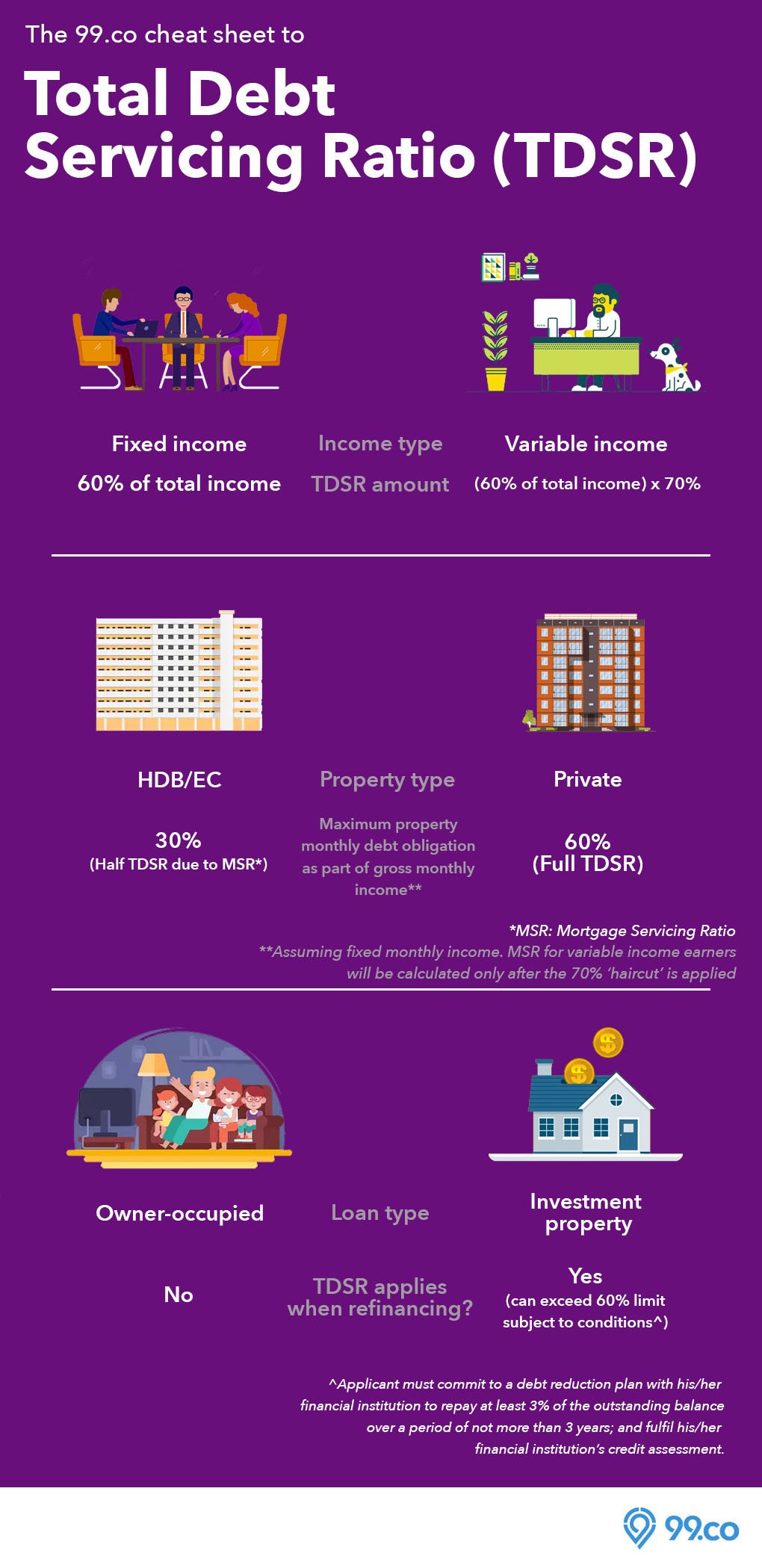

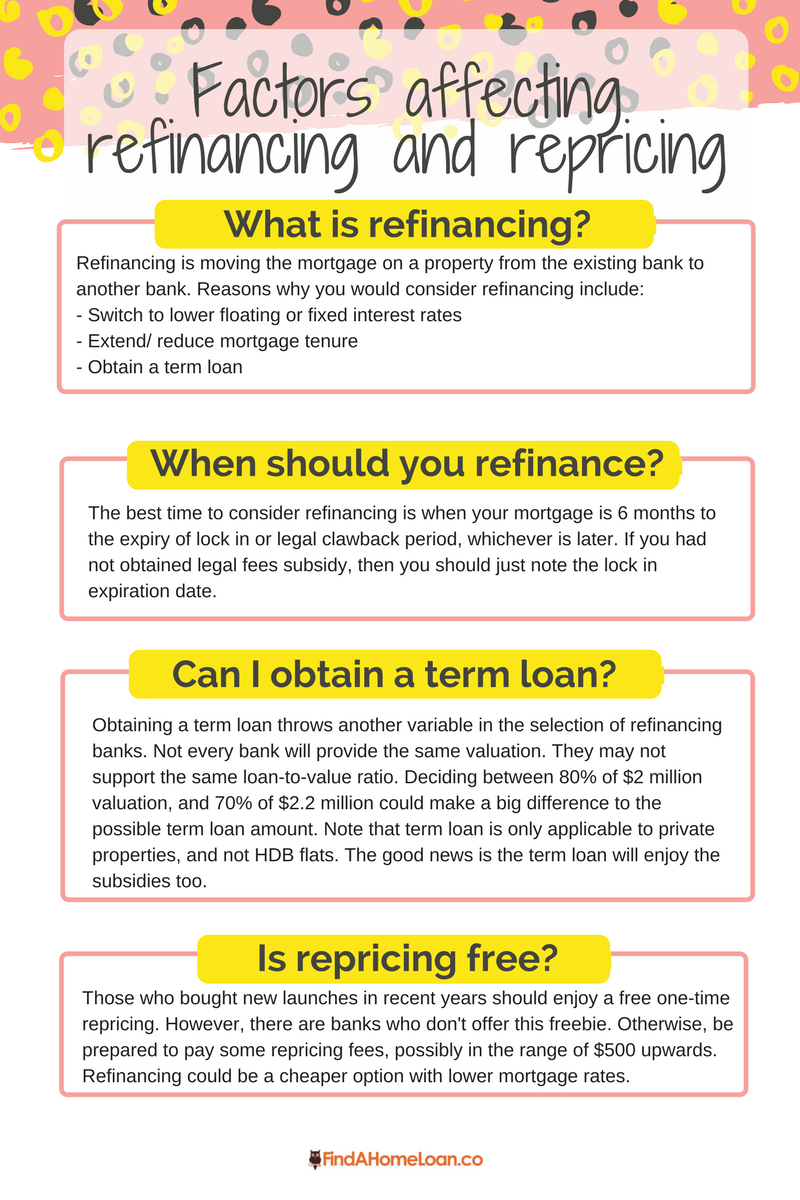

Therefore it is in the best interest of the borrower to check with the specific lender for all restrictions and details. Switch your mortgage type. Depending on the situation it s possible to refinance a mortgage loan immediately. If you want to do a cash out refinance and gain access to some of the equity you have in the home the waiting period can be at least six months after your current mortgage loan closed.

When your goal is to pay less every month you can refinance into a loan with a lower interest. In some circumstances however you may need to wait. Mortgage refinancing is not always the best idea even when mortgage rates are low and friends and colleagues are talking about who snagged the lowest interest rate. While most people refinance to take advantage of a lower interest rate on a new loan other.

It can also help you save thousands of dollars in interest over the life of your loan. Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance. Now you can refinance your current mortgage or purchase a new home once you ve made three consecutive mortgage payments either after your forbearance plan ends or under a repayment plan or loan modification. Refinancing is the process of paying off your existing mortgage with the funds from a new mortgage.

If after nine years you refinance into a new mortgage with a principal amount of 270 000 at a fixed rate of 3 952 for 30 years assuming 6 000 in closing costs refinancing would save you. When can i refinance my home. For a 30 year fixed rate mortgage on a 100 000 home refinancing from 9 to 5 5 can cut the term in half to 15 years with only a slight change in the monthly payment from 805 to 817. Mortgage refinancing makes sense when you can use it to save on interest access home equity or both.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/GettyImages-1171659710-149c5671e12b4e4d855730507df022ef.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/155421401-56a2eea15f9b58b7d0cfc939.jpg)