When To Refinance Mortgage Loan

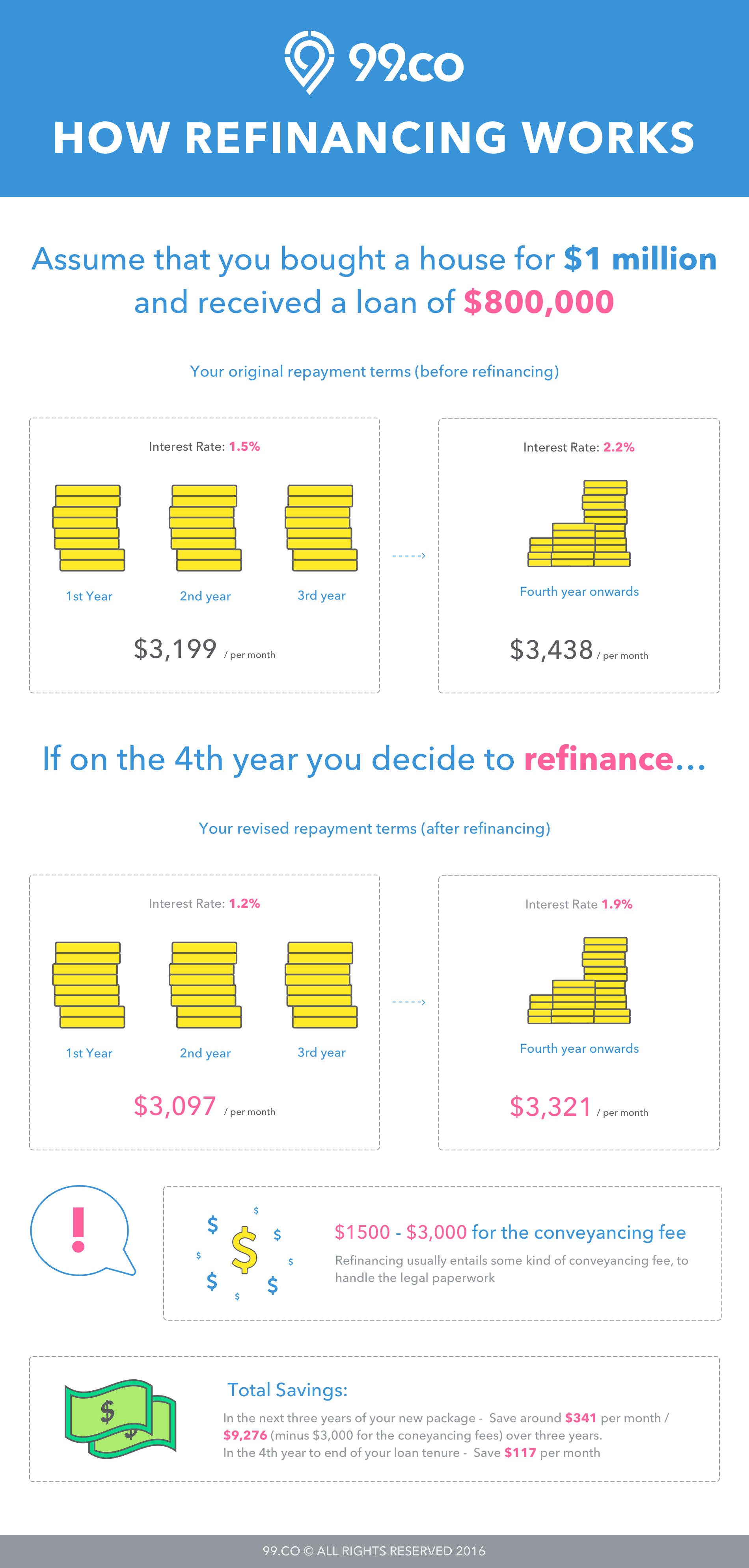

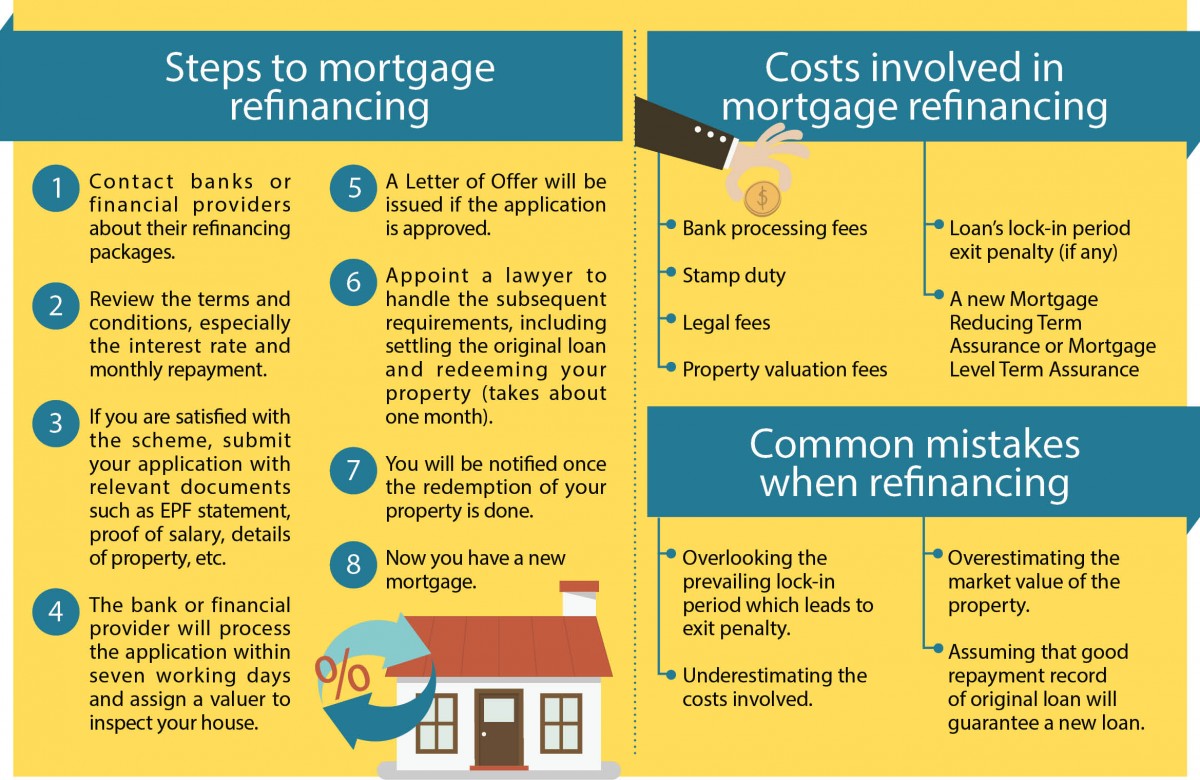

The new loan will pay off your existing debt completely and all at once when your refinance loan is approved.

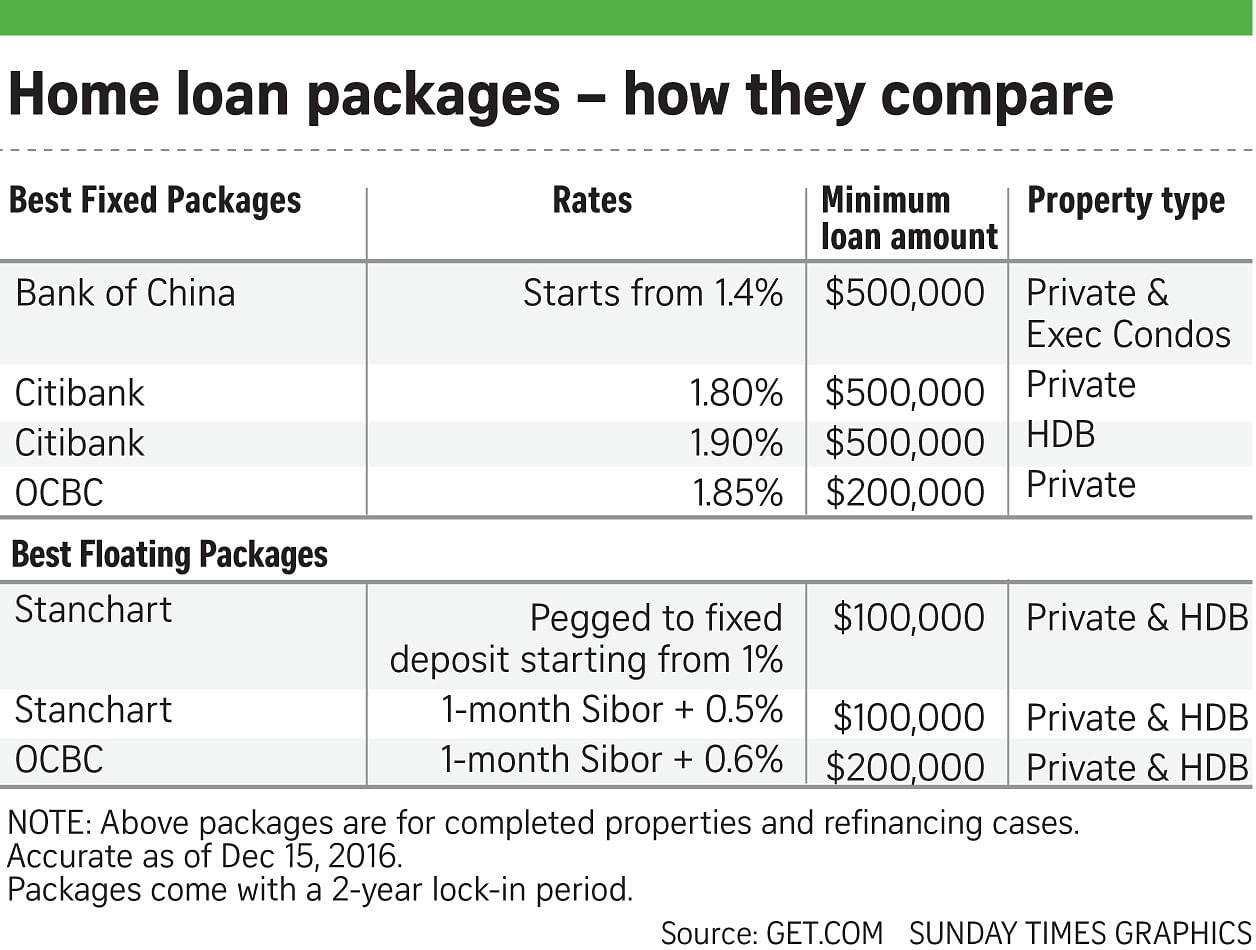

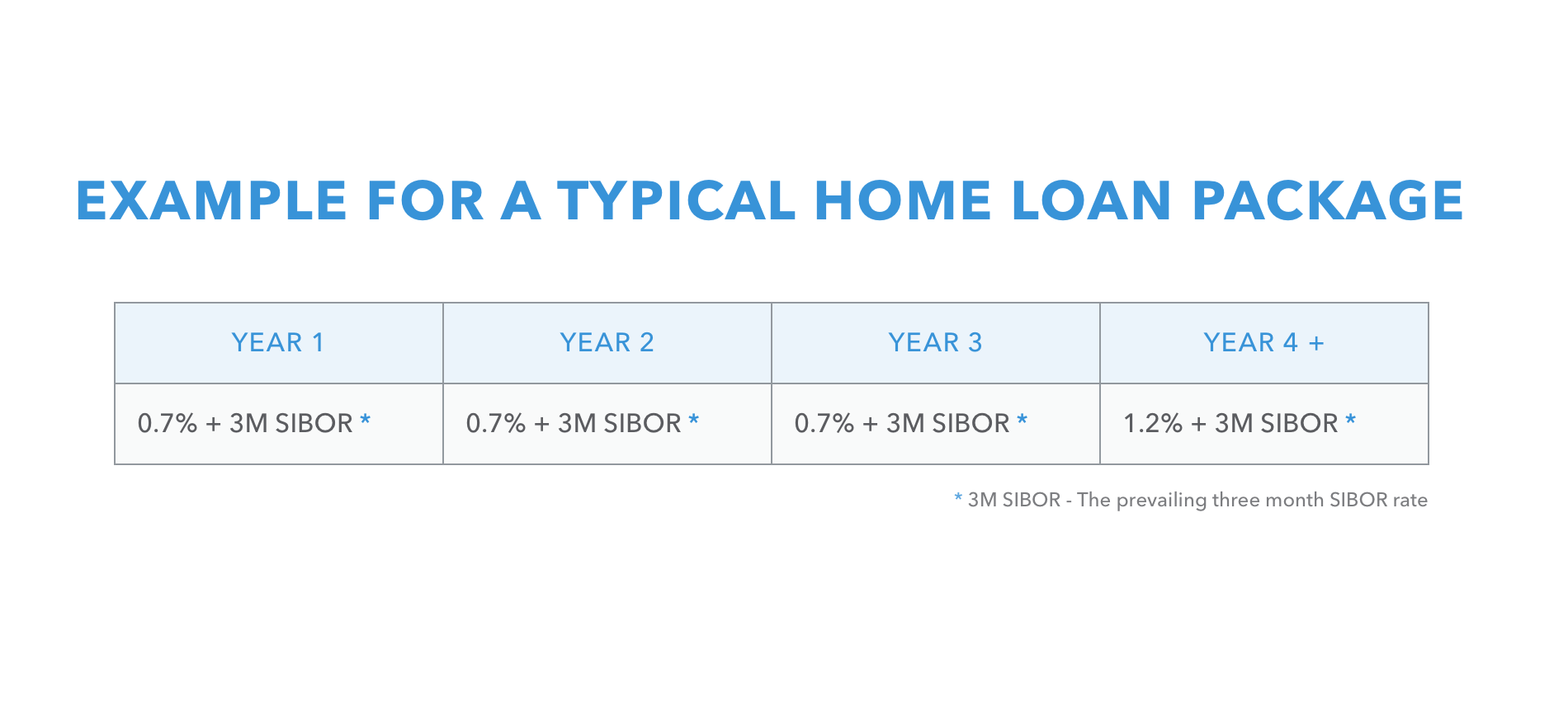

When to refinance mortgage loan. If a borrower is refinancing strictly to lower monthly mortgage payments and closing costs are 2 400 the borrower should expect to save at least this amount in interest payments for the. When you refinance in order to reset your interest rate or term or to switch say from an arm to a fixed rate mortgage that s called a no cash out refinance or a rate and term refinance. Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance. You would continue to make payments on the new loan until you pay it off or refinance this loan as well.

As a homeowner you need to make an important calculation to determine how much a refinance will cost and how much you will save each month. Although each lender and their terms are different. When you refinance you pay off the existing mortgage loan and replace it with a new one. Pros and cons of refinancing.

There are pros and cons to a. Just the interest rate and terms on the new loan. Today you are approved for a 3 rate. As a result you pay less interest over the life of the loan.

Mortgage refinance rates are historically low and many homeowners could save by refinancing to a lower mortgage rate. When you refinance from a 30 year mortgage into a 15 year loan you pay off the loan in half the time. At the same time mortgage lenders are less willing to take on risk because of market uncertainty prompted by the coronavirus. Therefore it is in the best interest of the borrower to check with the specific lender for all restrictions and details.

For a 30 year fixed rate mortgage on a 100 000 home refinancing from 9 to 5 5 can cut the term in half to 15 years with only a slight change in the monthly payment from 805 to 817. Let s say in 2011 you bought a home for 120k and after your 20k downpayment you were left with a 30 year 100k mortgage loan at a rate of 4 5.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)