Working Capital Loans

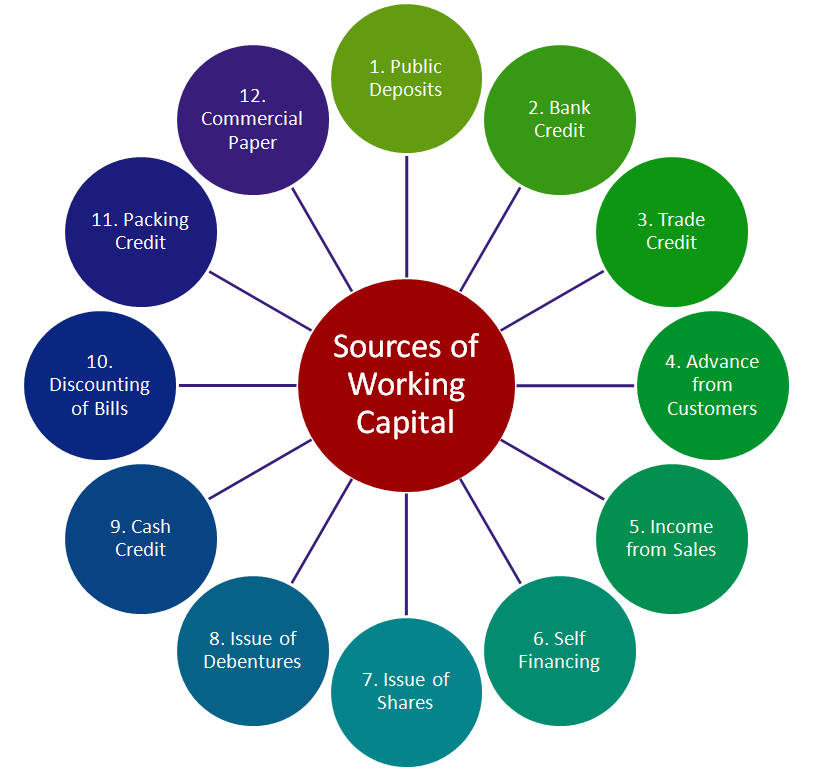

The sme working capital loan is a government assisted financing loan under the enterprise financing scheme efs wcl.

Working capital loans. S 50 vouchers with min. Working capital loans on the other hand are loans that fund everyday business operations. The enhanced scheme in the solidarity budget 2020 helps smes access financing till march 2021. Enhanced sme working capital loan.

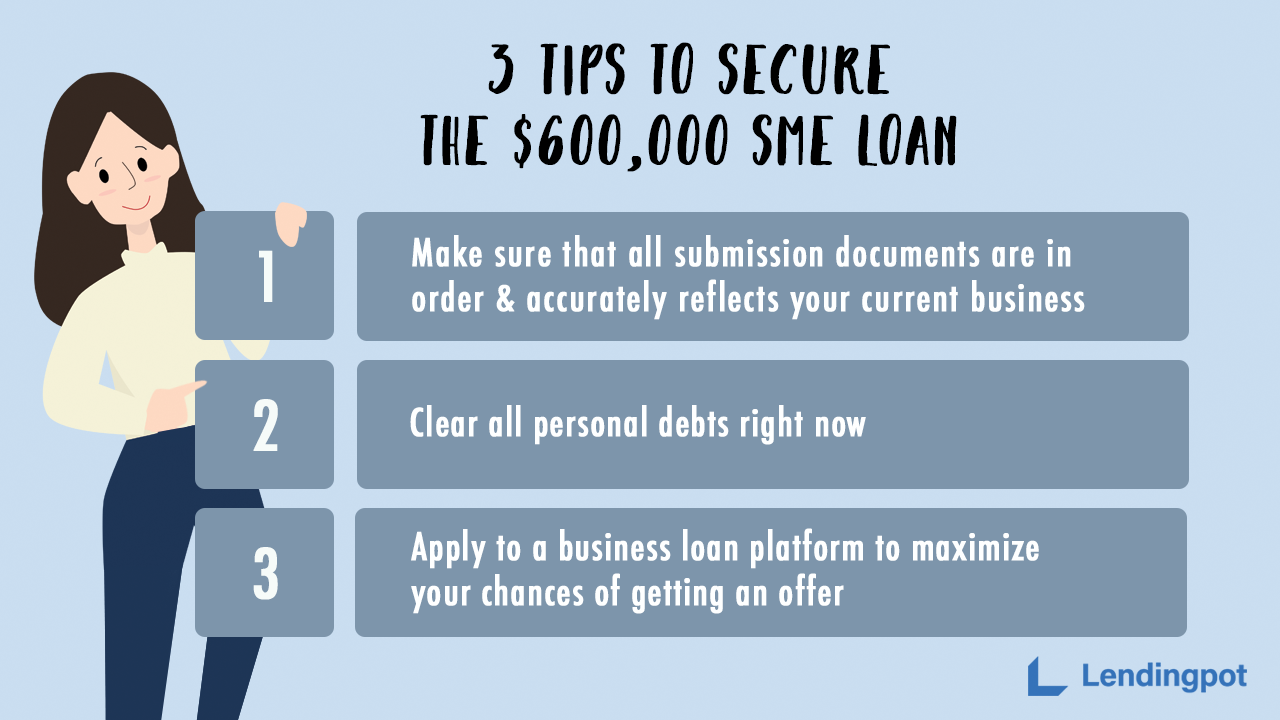

Remember working capital loans work best for short term needs as opposed to investments that may take years to produce results. A working capital loan is designed to cover short term business expenses such as payroll and inventory. As announced at solidarity budget 2020 the enterprise financing scheme sme working capital loan efs wcl is enhanced to help smes with their working capital needs the maximum loan quantum was raised from 300 000 to 1 million. Working capital loans are not used to buy long term assets or investments.

Grab the enhanced sme working capital loan facility of dbs. For this reason you can t use a working capital loan for expensive initiatives like developing a new product renovating your physical space adding a new division etc. Learn more and compare options up to 5 million. Complimentary 12 months insurance.

First ever business loan with loan repayment insurance. Working capital loans also offer lower borrowing amounts than business term loans and sba loans. Grow your business with collateral free working capital loan of up to s 1 000 000. Under the new enhanced sme working capital loan access up to 1 million to finance cash flow needs.

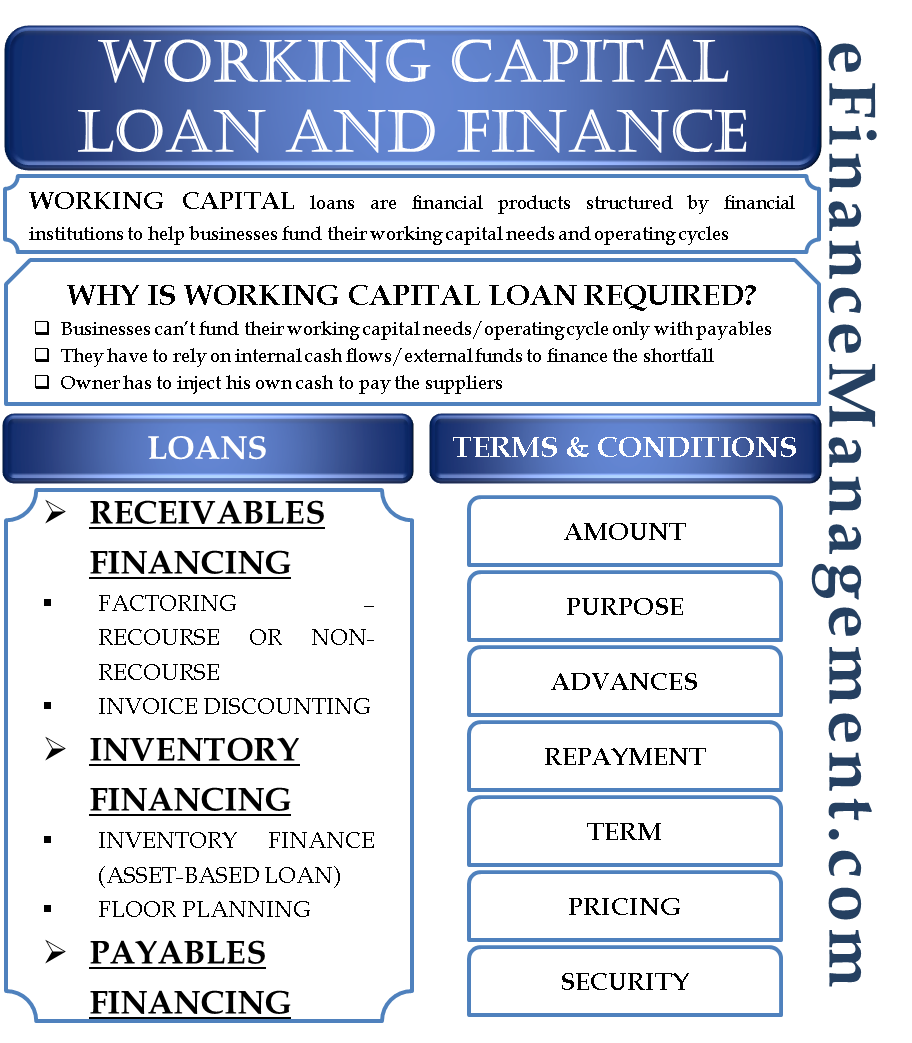

They are used to provide working. A working capital loan is a loan taken to finance a company s everyday operations. They are also often used by cyclical businesses during the off season the debt of which is paid down during the busy season.