Wrap Around Mortgage Definition

:max_bytes(150000):strip_icc()/14037125672_68ca580a76_k-c6247edc6c784ac2acfbb02b6077d0f9.jpg)

Wrap around mortgage agreements allow buyers to obtain financing without having to apply through a traditional lender.

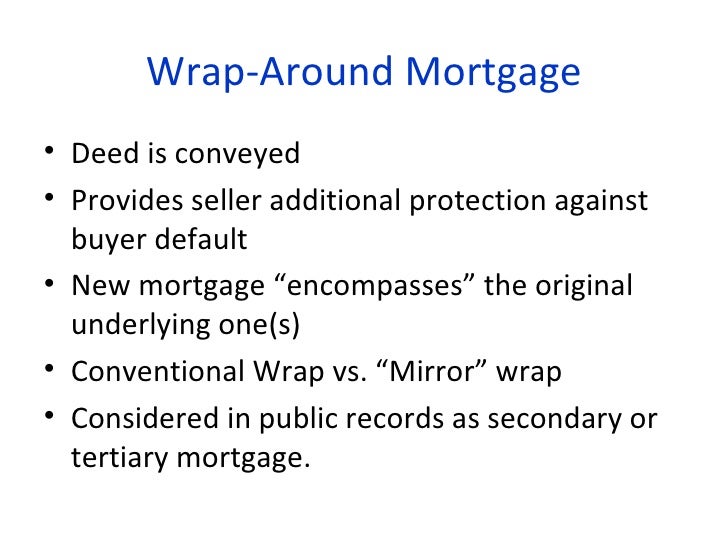

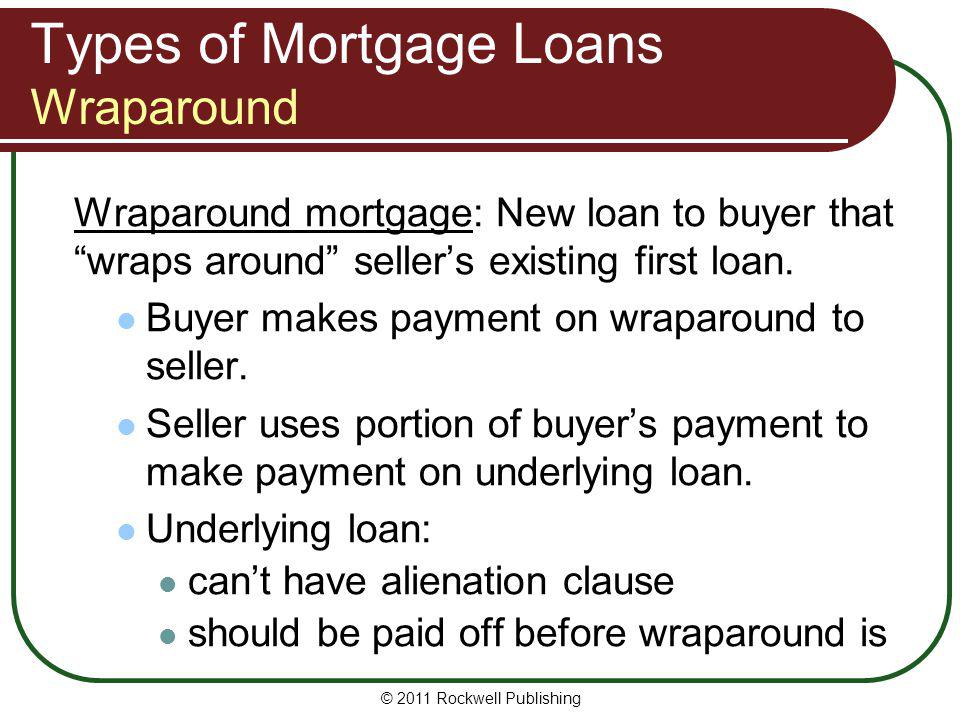

Wrap around mortgage definition. Wraparound mortgage a second mortgage that a borrower takes out to guarantee payment on the original mortgage. In this situation the borrower makes payments on both mortgages to the wraparound lender which then makes payments on the original mortgage to the original lender. Wrap around mortgage a mortgage loan transaction in which the lender assumes. Seller a wants to sell his or her home to buyer b.

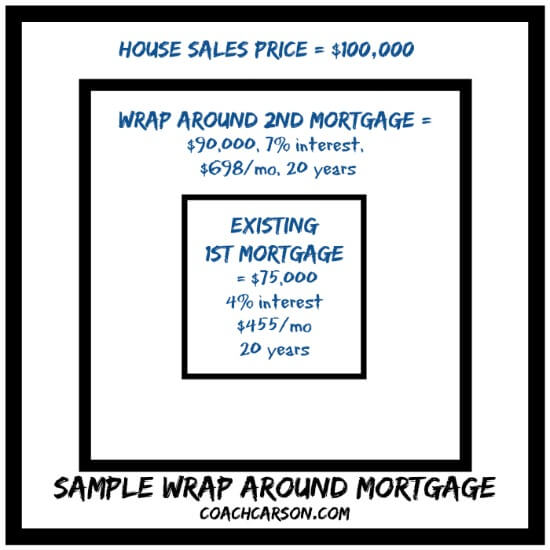

A wrap around loan structure is used in an owner financed deal when a seller has a remaining balance to pay. A wrap around loan is a type of mortgage loan that can be used in owner financing deals. Seller a has an existing mortgage of 70 000 and buyer b is willing to pay 100 000 with 10 000 down. A wraparound mortgage more commonly known as a wrap is a form of secondary financing for the purchase of real property the seller extends to the buyer a junior mortgage which wraps around and exists in addition to any superior mortgages already secured by the property.

Definition of wraparound mortgage in the financial dictionary by free online english dictionary meaning of wraparound mortgage as a finance term. Definition of wrap around mortgage yadira bello real estate agent agent trust realty. A wrap around can be attractive to home sellers because they may be able to sell their home for a higher price. A wrap around loan structure is used in an owner financed deal when a seller has a remaining balance to pay.

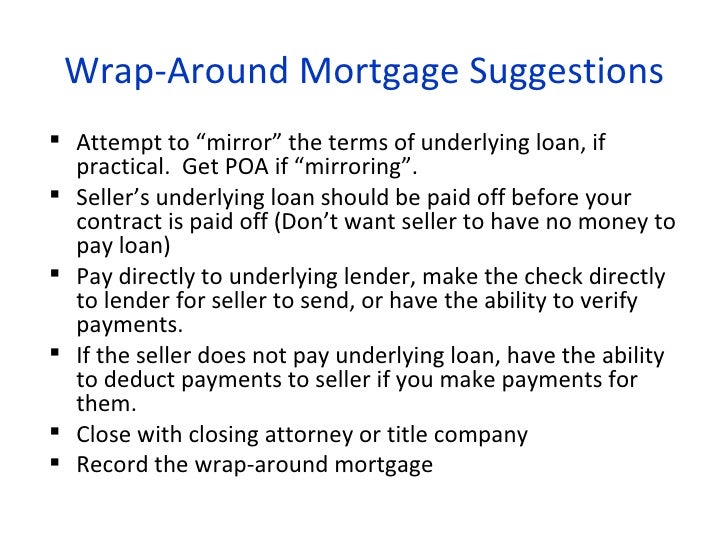

The specific wraparound mortgage definition and terms are specified in the form of a secured promissory note. Under a wrap a seller accepts a secured promissory note from the buyer for the amount due on the underlying mortgage plus. Because it can be tricky to wrap one s head around the idea of what is a wraparound loan the following is an example. A mortgage loan transaction in which the lender assumes responsibility for an existing mortgage.

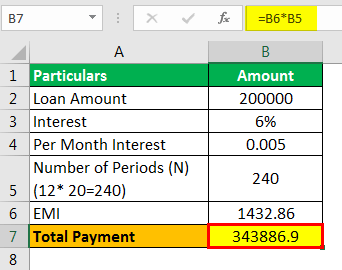

B pays 5 000 down and borrows 95 000 on a new mortgage. A wrap around mortgage is a loan transaction in which the lender assumes responsibility for an existing mortgage. A wrap around loan is a type of mortgage loan that can be used in owner financing deals. For example s who has a 70 000 mortgage on his home sells his home to b for 100 000.

However a wrap around mortgage contract can represent tremendous risk for both the buyer and seller if they re not carefully drafted.