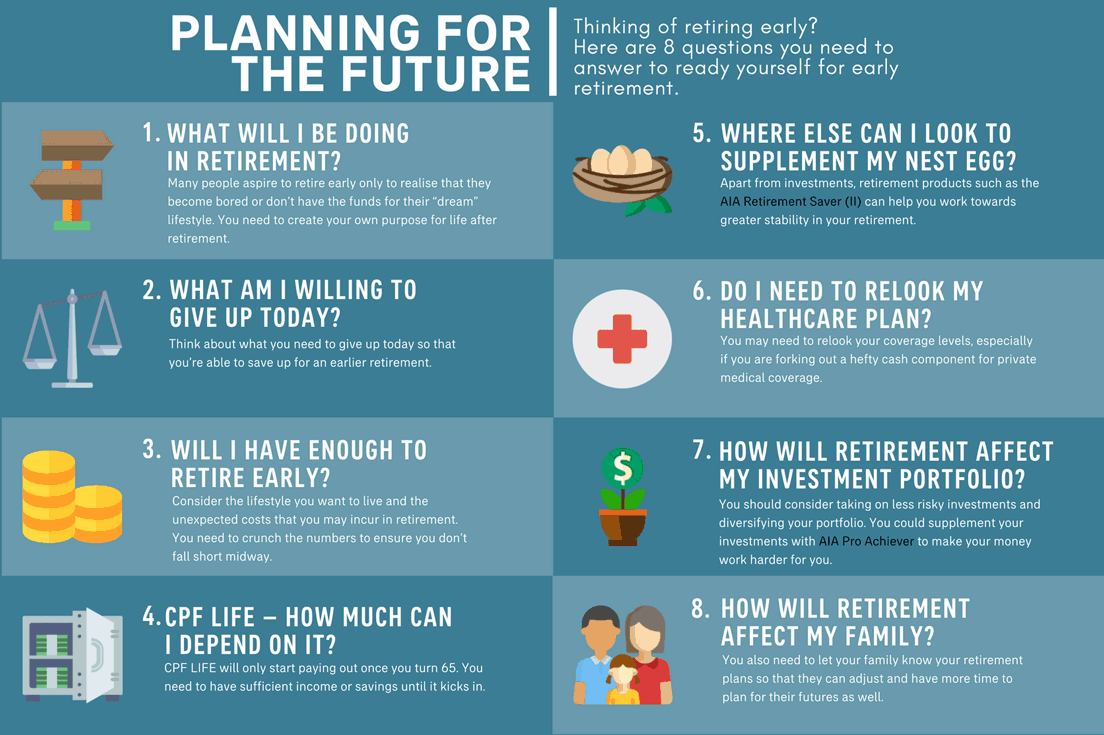

Your Retirement Plans

Enjoy your financial freedom while ensuring your funds last.

Your retirement plans. Even if you tell your manager and your human resources staff verbally about your retirement plans months or even years in advance your employer will still want an official written notification. The coronavirus pandemic has affected millions of americans from both a health and financial perspective and there s a chance you may need to adjust your retirement plans because of it. Use this sample retirement letter to notify your employer of your expected date of retirement. This is just your estimated life expectancy minus your expected retirement age.

401 k a 401 k is the most common type of employer sponsored retirement plan. Tools to help envision your retirement and draw up a plan. With so many companies providing support to their employees through 401 k plans and matching we should be doing better. How to assemble it all to fit your retirement goals.

Nearly half of americans have less than 10 000 saved for retirement. Your employer preselects a few investment options for you to choose from and then you defer a portion of each. Estimate your retirement expenses. Keeping your money at work.

Fill in the gaps so you don t worry about being caught off guard. Db plans require the employer to make good on an expensive promise to fund a hefty sum for your retirement. The lingering fear of the pandemic and the financial uncertainty that comes with it are ruining retirement plans. To ensure you can rebuild your retirement savings move to ever reliable income.

Start by estimating the length of your retirement.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)