Reasons For Cash Out Refinance

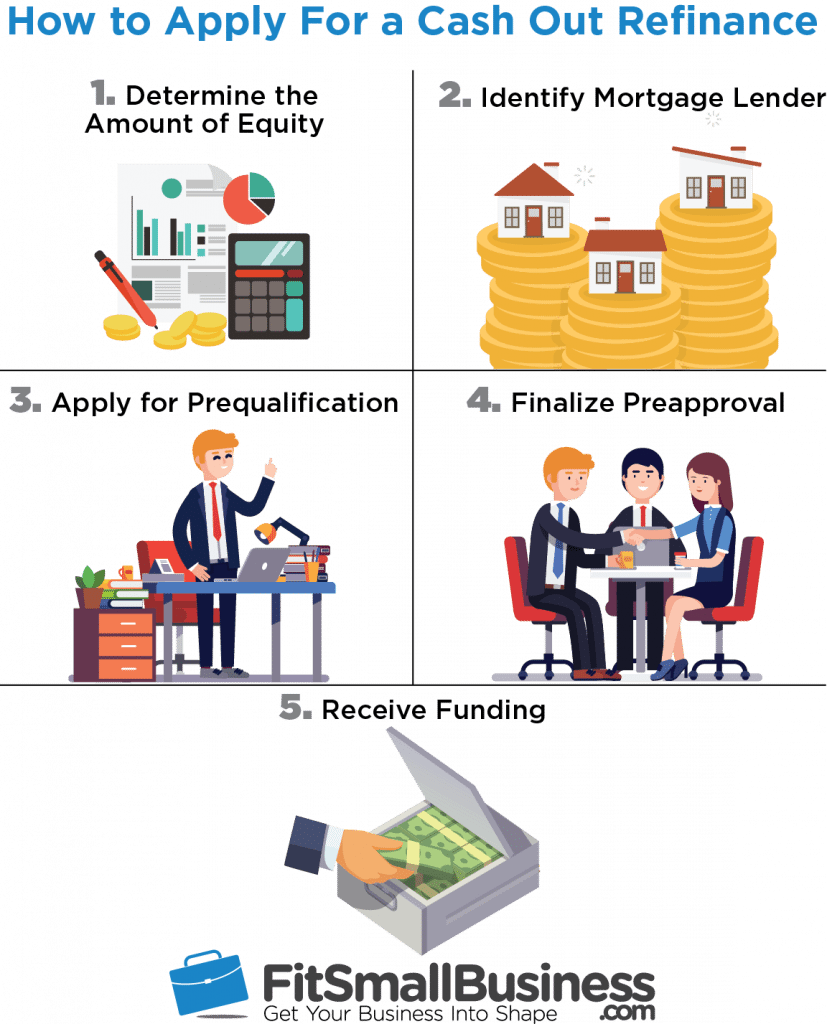

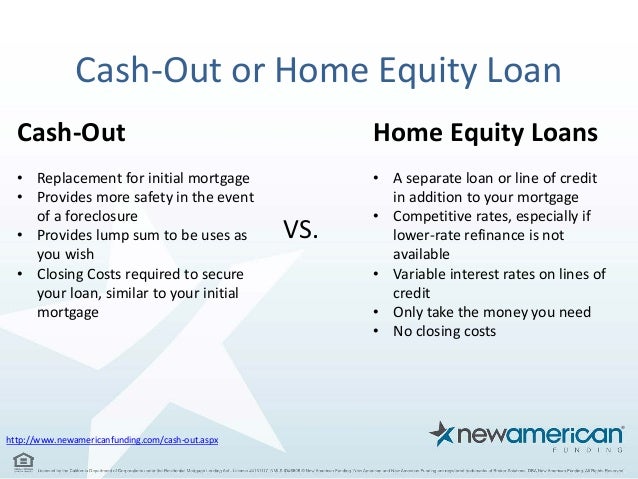

Cash out refinances require you to apply for a new loan provide a new set of income and financial documents and pay a new set of closing costs.

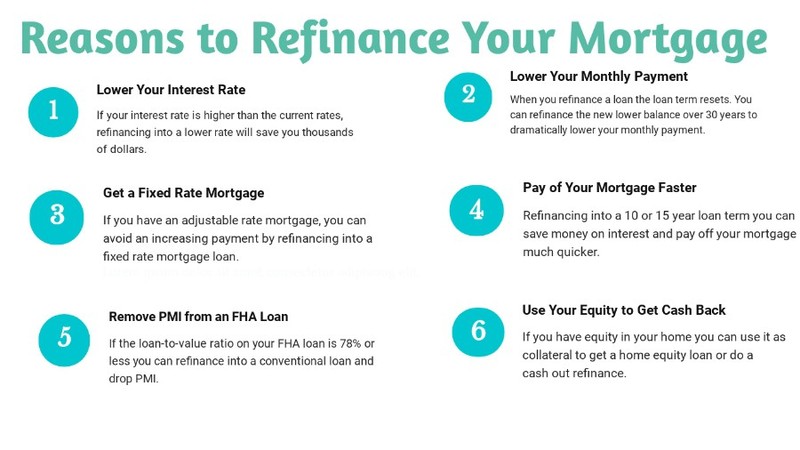

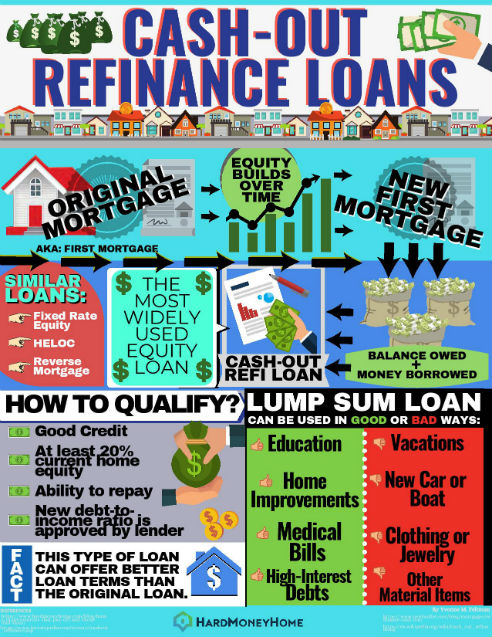

Reasons for cash out refinance. In most cases the cash comes in the form of a check or wire transfer to your bank account. Reasons to use a cash out refinance there are many advantages to using a cash out refinance over other types of loan products if you need a large sum of money. A cash out refi replaces your current mortgage with one that includes the original loan balance plus an amount of cash you d like to withdraw. Refinancing for the wrong reasons 1.

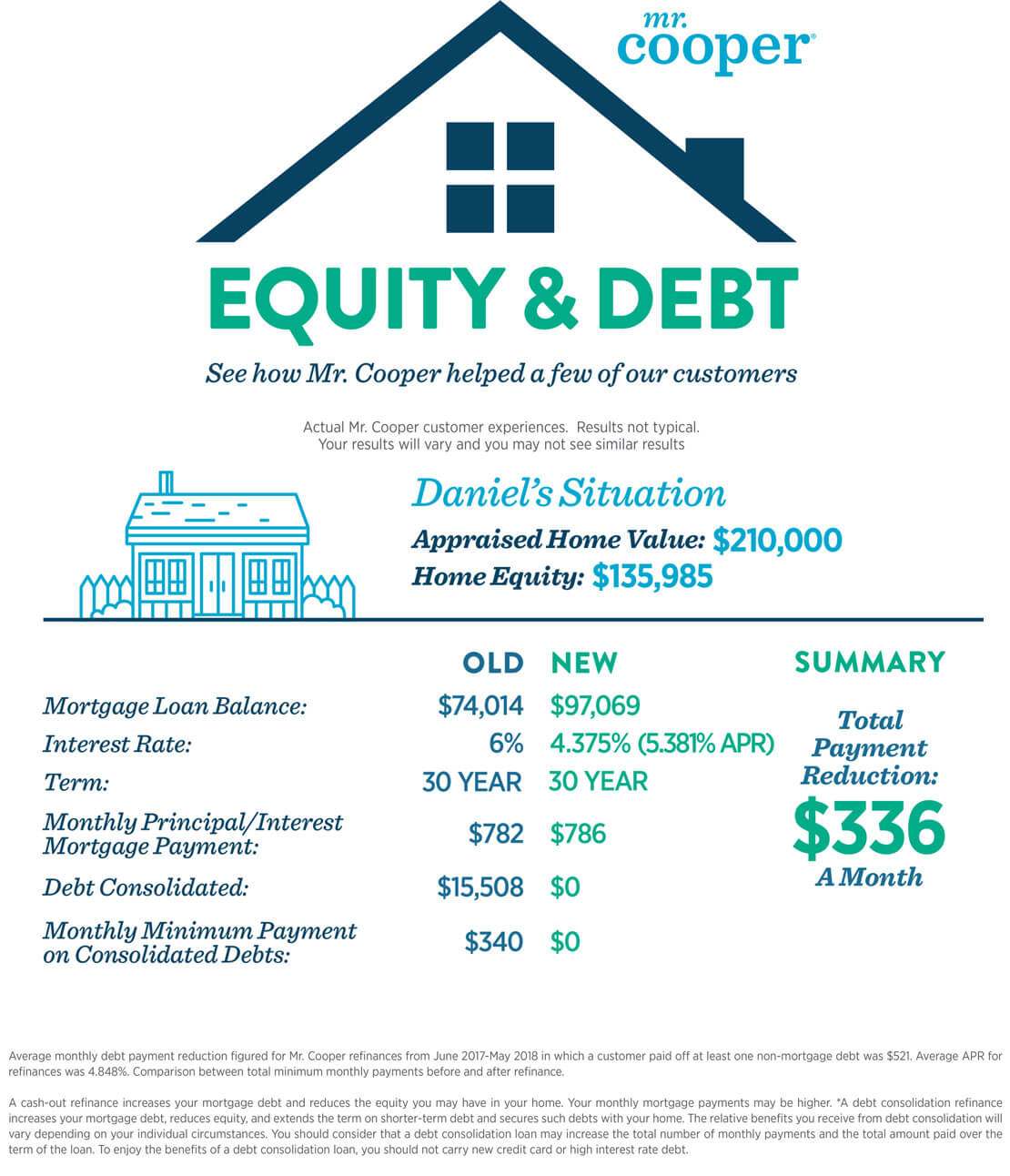

Purchasing a second home. While it seems at first glance that a home remodel is for personal gain it is also considered an investment. Cash out refinance for new purchases consider a couple that bought a home five years ago for 150 000 with a 112 500 30 year mortgage at 6. A cash out refinance is a mortgage refinancing option where the new mortgage is for a larger amount than the existing loan to convert home equity into cash.

The most common reason for a cash out refinance is to use the cash for a home remodel. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash. Cash out refinance this mortgage refinancing option the new mortgage is for a larger amount than the existing loan lets you convert home equity into cash. Cash out refinance cashing out refers to borrowing money against the equity that has built up in your home since you last negotiated your mortgage.

With cash out refinancing the owner pays off the existing mortgage and replaces it with a new mortgage that includes the amount of cash extracted against the equity. The most common reasons for a cash out refinance are. By borrowing more than you currently owe the lender provides cash that you can use for anything you want. Use it with care.

With a cash out refinance you replace your current mortgage with a new loan for an amount that is higher than your current balance and receive the difference in cash when the loan closes. Here are some common reasons to use. A cash out refinance will happen when you replace an existing home loan by refinancing with a new larger loan.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)