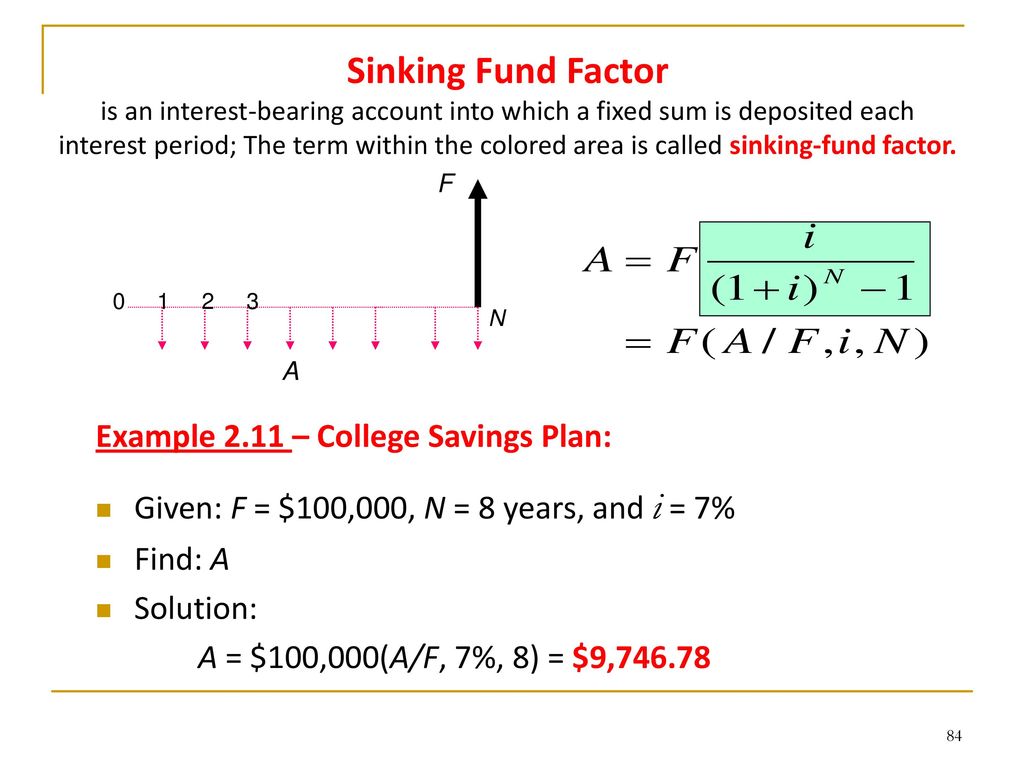

Sinking Fund Factor

The fund gives bond investors an added element of security.

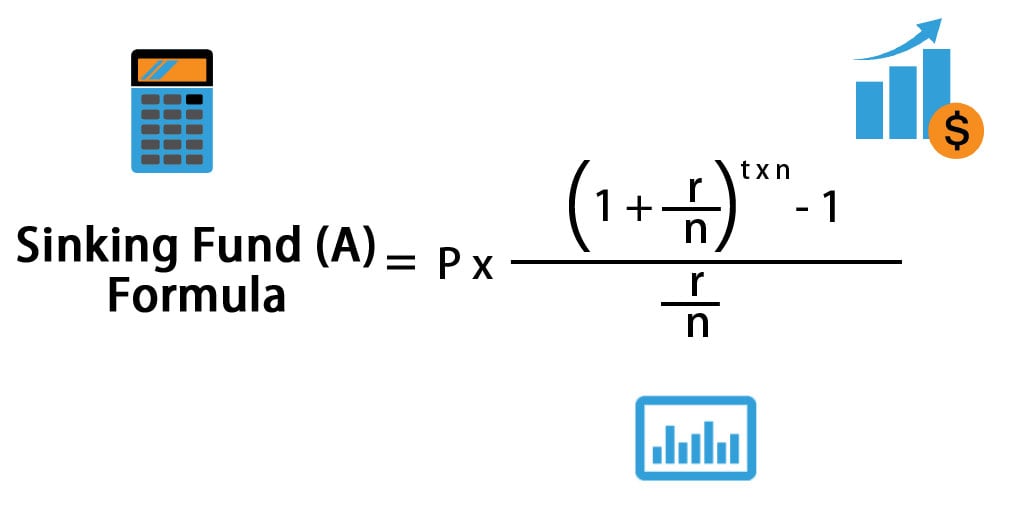

Sinking fund factor. There are various ways in which sinking funds benefit the investors. Relevance and uses of sinking fund formula. Sinking fund refers to a fund that is set up by the particular bond issuer in order to repurchase a definite portion of the bond issue or for the replenishment of a major asset or any other similar capital expenditure as such the bond issuer is required to contribute a certain amount of money to the sinking fund each period and the formula to calculate the. A sinking fund is an account that is set up with the objective of saving a target amount of money as a means of ensuring future financial obligations can be serviced or debt can be repaid.

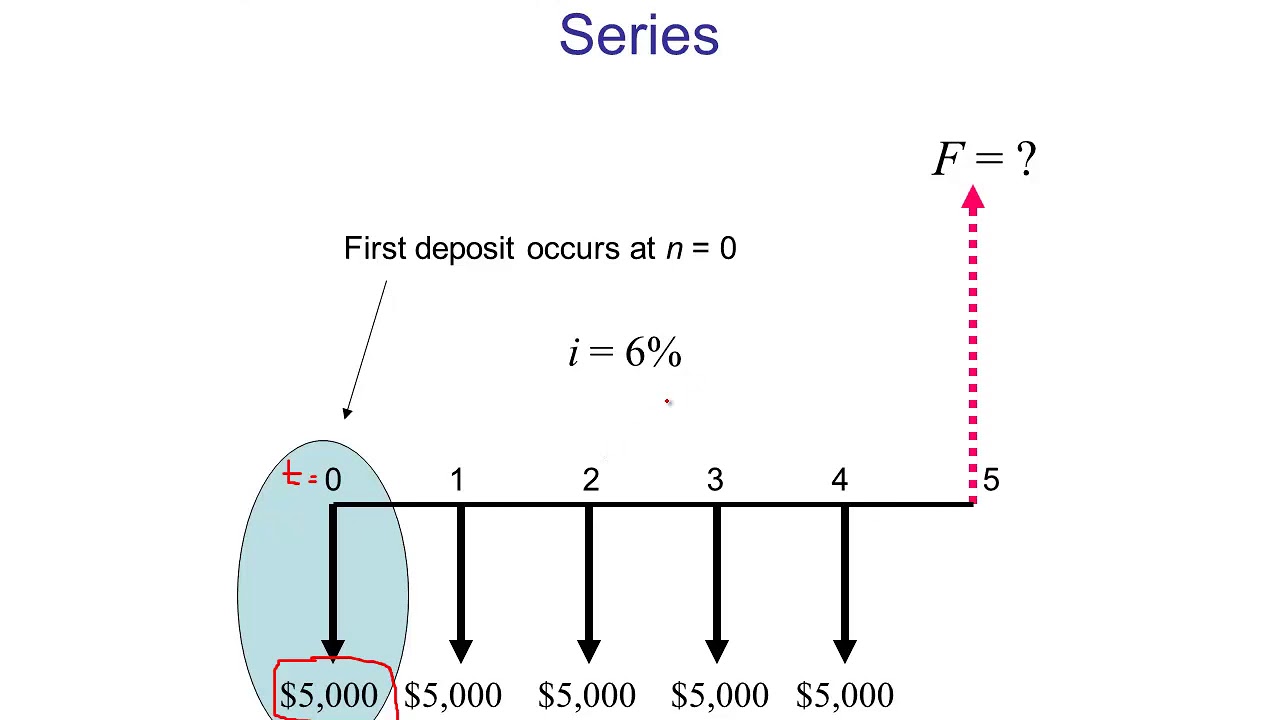

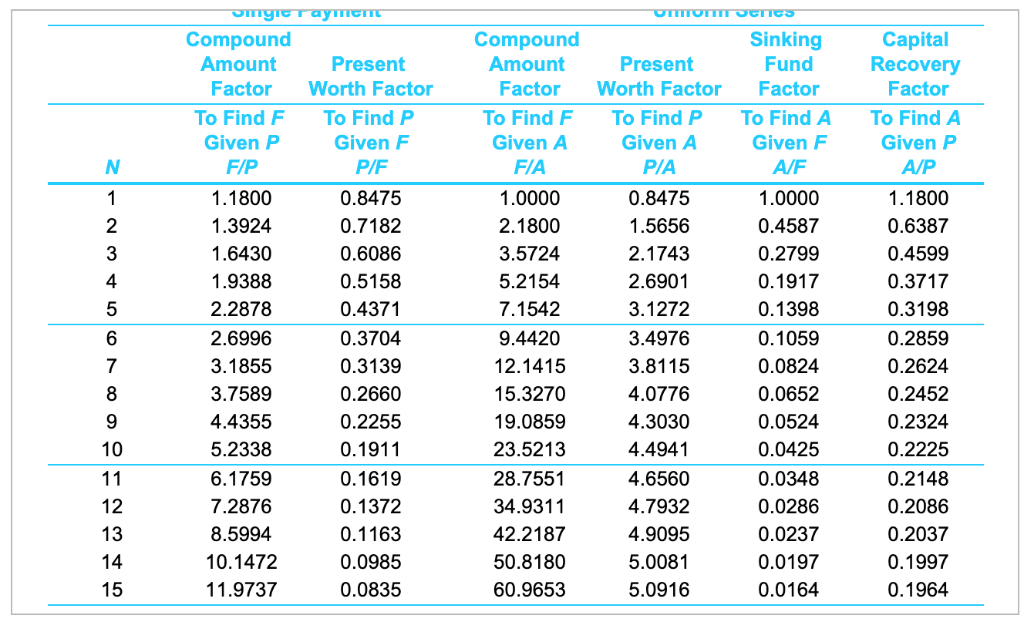

Money set aside in a special account to which regular contributions are made by way of additional money and or interest on the money with the plans that by a specified date the fund will be sufficient for a particular purpose prospective homeowners may set up a sinking fund for a house down payment and companies usually establish sinking funds to pay off bonds. Sff sinking fund factor. In order to calculate the sff for 4 years at an annual interest rate of 6 use the formula below. A sinking fund is a strategic way to save a little bit every month to pay for large expenses that are planned.

For instance when a real estate investor wants to start setting aside money in order to have enough available at some future date. Money put into the sinking fund is invested to increase the value of the fund. Definition of sinking fund formula. What are sinking funds.

The table below shows how the sinking fund payments of 0 228591 per year compound to 1 at the. Then you ve created a sinking fund. A sinking fund is an account a corporation uses to set aside money earmarked to pay off the debt from a bond or other debt issue. You can use a sinking fund for pretty much any major purchase or bill.

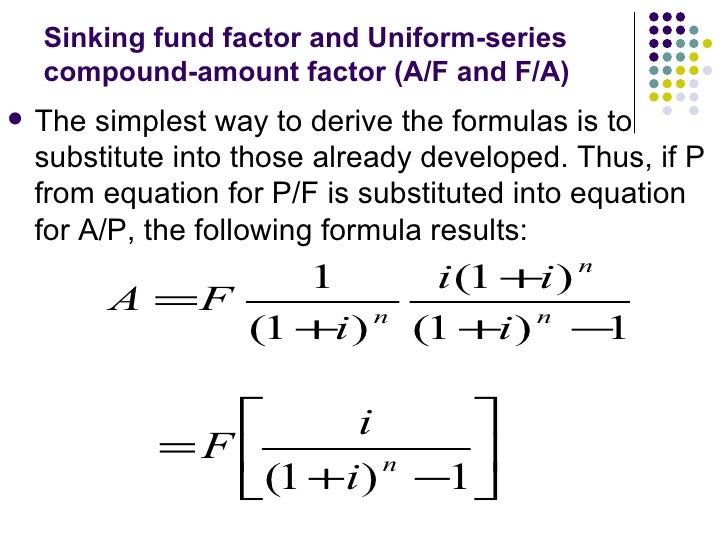

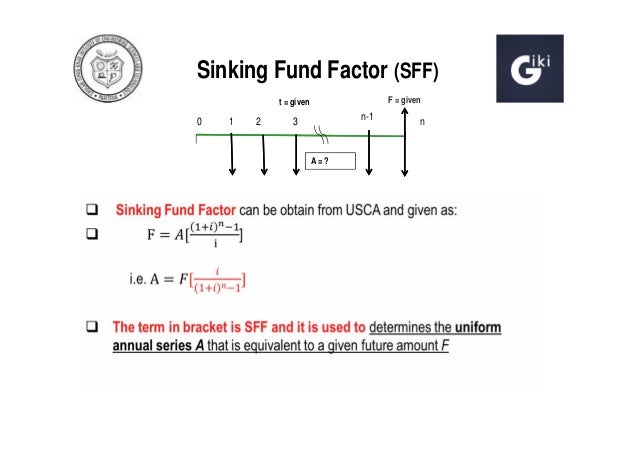

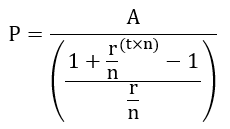

The sinking fund payment is the total cash reserves that need to be saved each month to achieve the target sinking fund. The sinking fund factor provides the annuity payment that must be made each conversion period at a given rate of compound interest to have available a specified sum at some given future time period to take care of scheduled capital expenditures or other expenses. Have you ever saved up money to buy something you wanted. First and the foremost benefit which we have discussed above is that the by sinking funds the likelihood of default becomes very negligible due to less principal outstanding and thus lowering default risk.

The fund will also grow from additional deposits made by the issuer. I periodic interest rate often expressed as an annual percentage rate. Companies are required to disclose their.