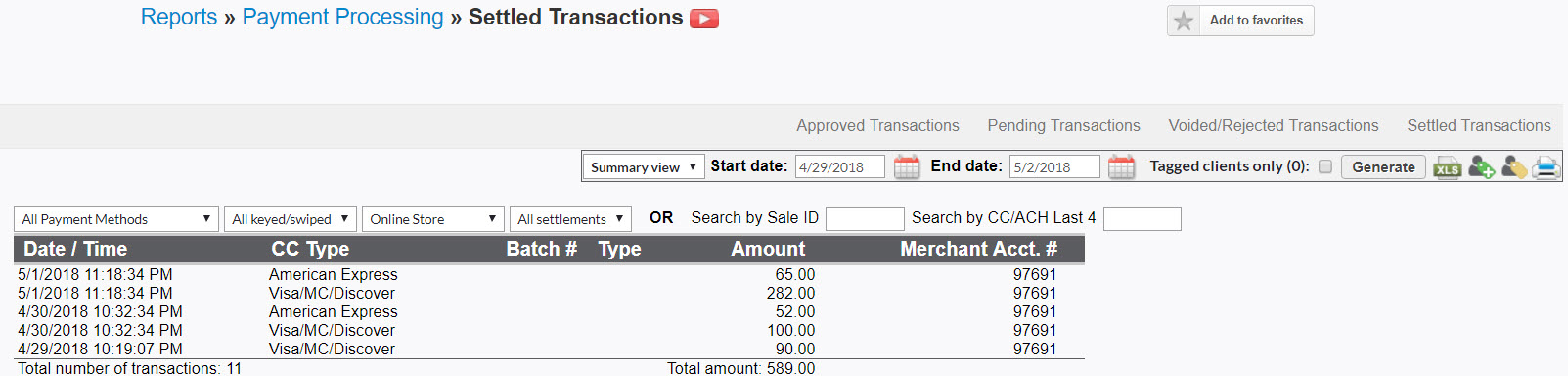

Settled Payment

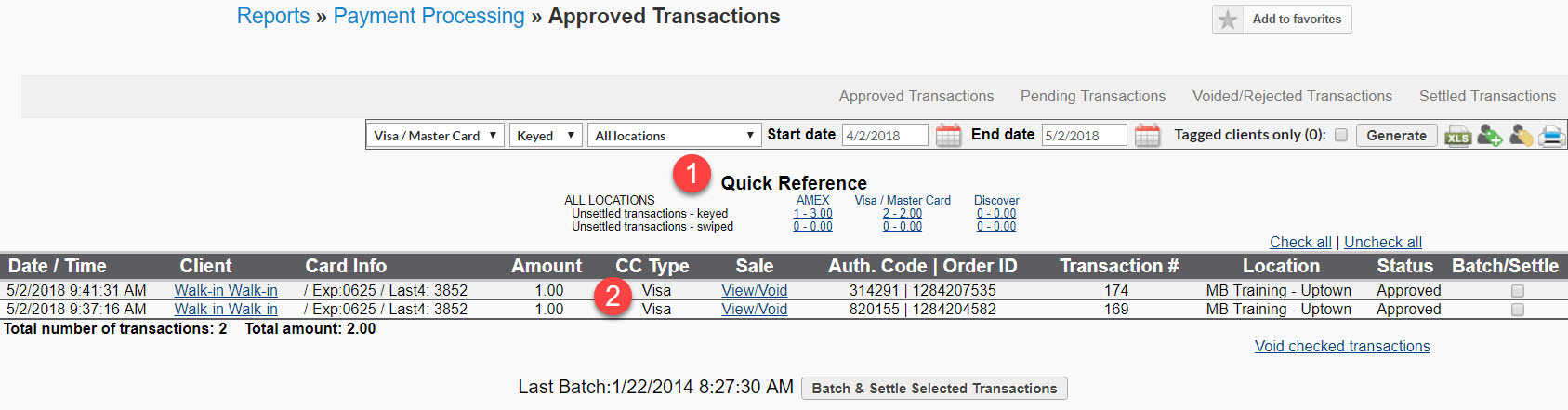

Modern payment systems in a market economy can be modeled in three major segments.

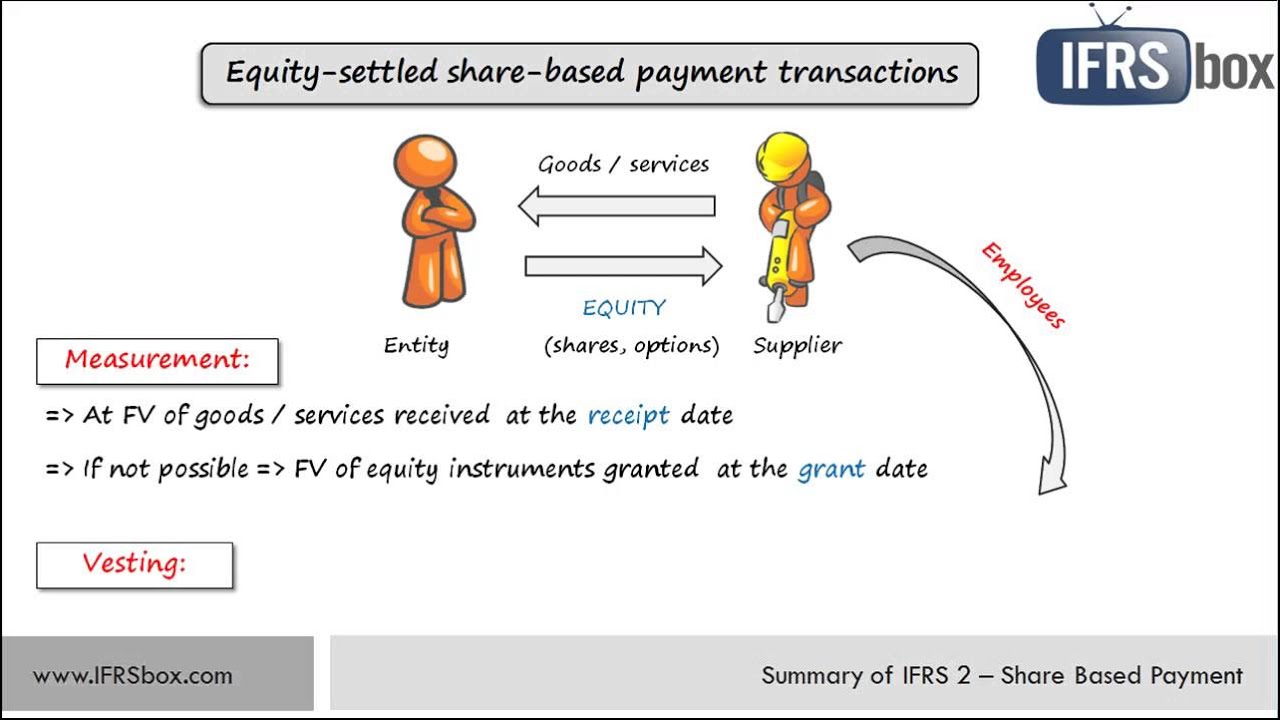

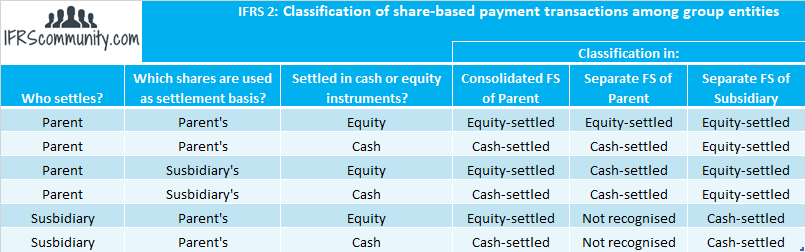

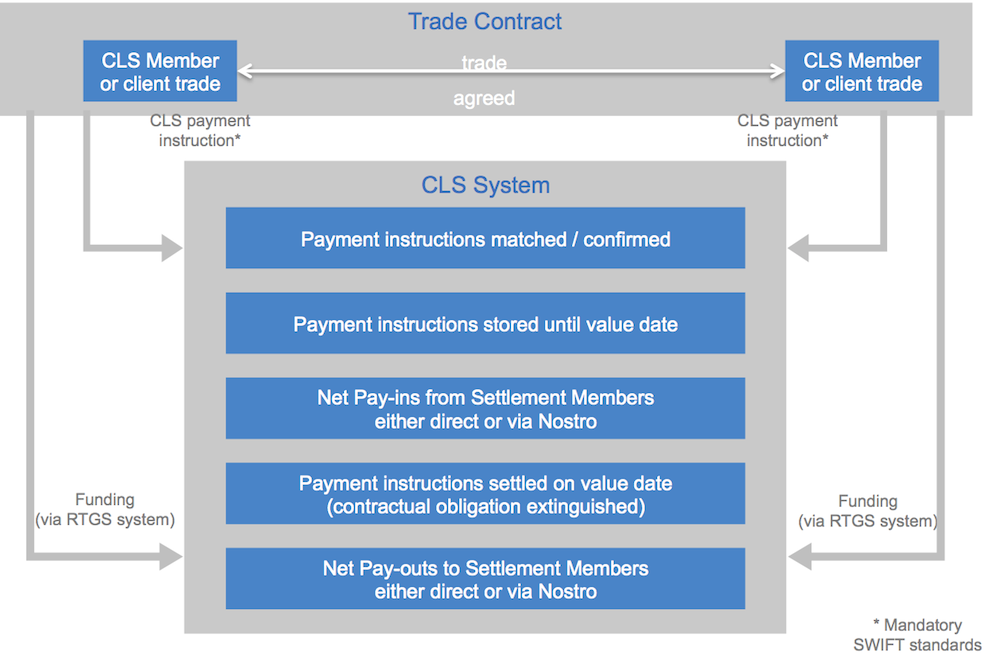

Settled payment. Settlement of securities is a business process whereby securities or interests in securities are delivered usually against in simultaneous exchange for payment of money to fulfill contractual obligations such as those arising under securities trades. 1 2 role of mas in payment clearing and settlement systems 1 2 1 settlement agent mas acts as a settlement agent for banks in singapore by allowing funds transfers to take place across their rtgs accounts maintained in meps. First the instruments used to deliver payments then second the clearing and settlement process involved in a payment transaction and finally the actual transfer of funds between institutions. C investors who buy shares through a broker at company a and immediately sell the shares through another broker at company b must make advance payment to company a on trade date before 8pm via eps or internet bill payment so that the shares can be settled in time for delivery on trade date 2 market days before 1 30pm.

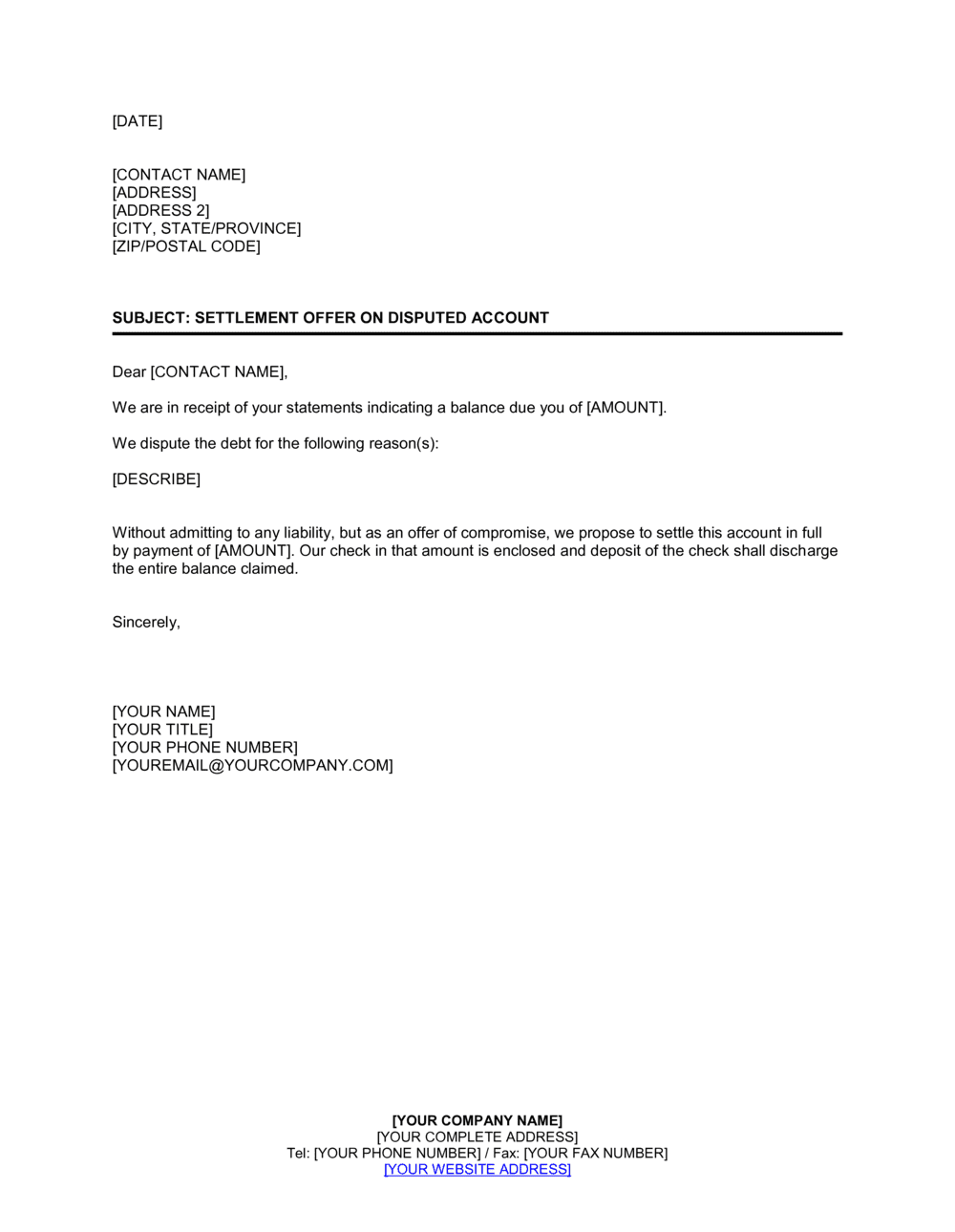

In the united states the settlement date for marketable. Settlement agreements settlement agreements came into effect on 29 july 2013. In addition to the code acas has also produced a. Mas also handles government related payments and receivables that usually take the form of funds transfers between the.

Settlement payments or transactions are settled into the settlement bank. Nowadays settlement typically takes place in a central securities depository.