Refinancing Private Student Loan Debt

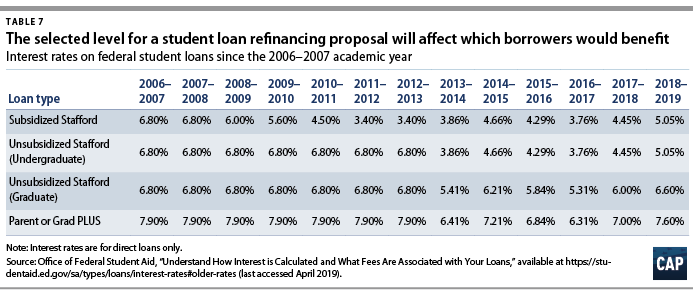

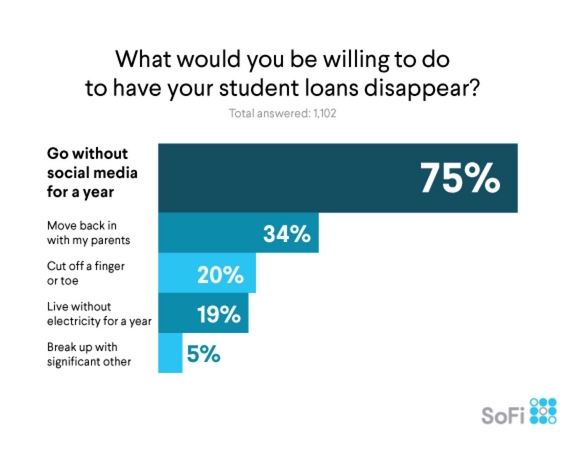

45 million americans carry 1 64 trillion in federal and private student loan debt the second biggest debt burden in the country following mortgages so it s no surprise that the student loan debt crisis has been a major issue in this year s political cycle.

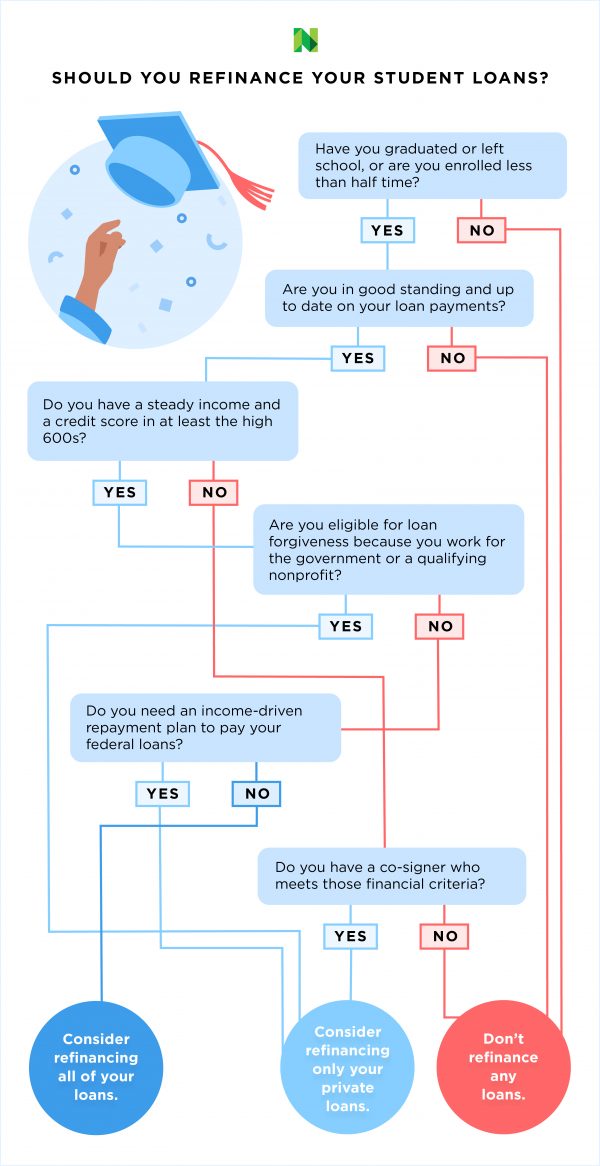

Refinancing private student loan debt. Student loan refinancing saves borrowers money by replacing existing education debt with a new lower cost loan through a private lender. That s different from federal student loans you get by completing your fafsa. Your safest bet is to refinance high interest private loans. For starters student loan consolidation which is included in the student loan refinance process simplifies the management of your monthly payments into a single loan.

Learn about the different ways to consolidate student loans the differences between federal private student loan consolidation repayment plan options forgiveness. You apply for a consolidation loan through a private lender and qualify based on your credit score. What is private student loan consolidation. A private student debt consolidation loan works in much the same way as a credit card debt consolidation loan.

Its undergraduate student loan. Sofi is perhaps best known as a student loan refinance lender but it also makes loans to undergraduates graduate students law and business students and parents. For those qualification is. Student loan refinancing allows you to consolidate both your private and federal loans including parent plus loans select a repayment term that makes sense for you and often get a lower interest rate.

You choose a repayment term that gives you monthly payments that work for your budget. Loan qualification and the applied interest rate are typically based on your credit score. Consolidating your federal and or private student loans with wells fargo may help you take control of your finances by creating a single private loan with a new interest rate one monthly payment and a new repayment term of your choice. Credit scores at least in the.

Student loan refinancing can mean big savings in the. To qualify you ll need. Places with the most student loan debt in 2020. In contrast consolidating your federal loans neither changes the interest that accrues on them nor your ability to get more federal student loans.

Borrowers must not have more than 150 000 in total student loan debt. Refinancing terms for your new private student loan are based on many factors including your annual income debt employment and credit.

:strip_icc()/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/rescue-592684016-5c1a697b46e0fb0001312f8c.jpg)

.jpg)