Start A Traditional Ira

/iras-5bfc31f246e0fb0051bf0553.jpg)

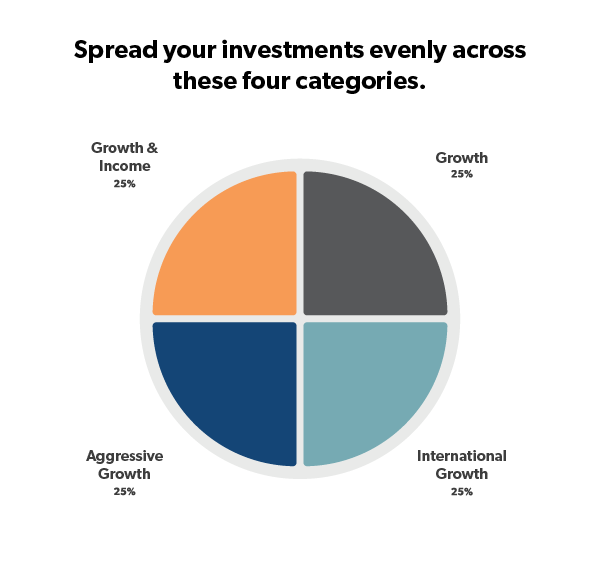

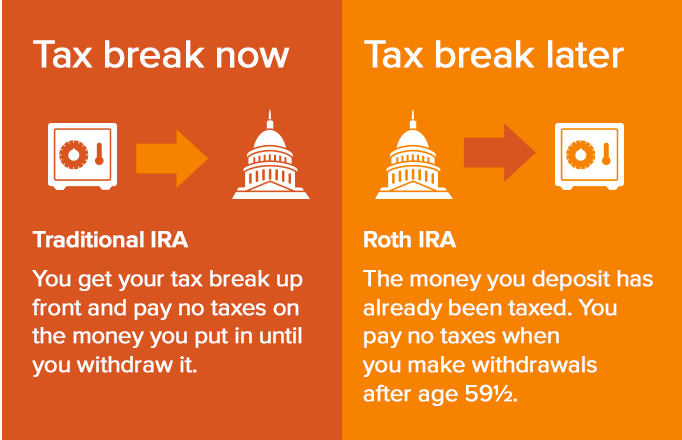

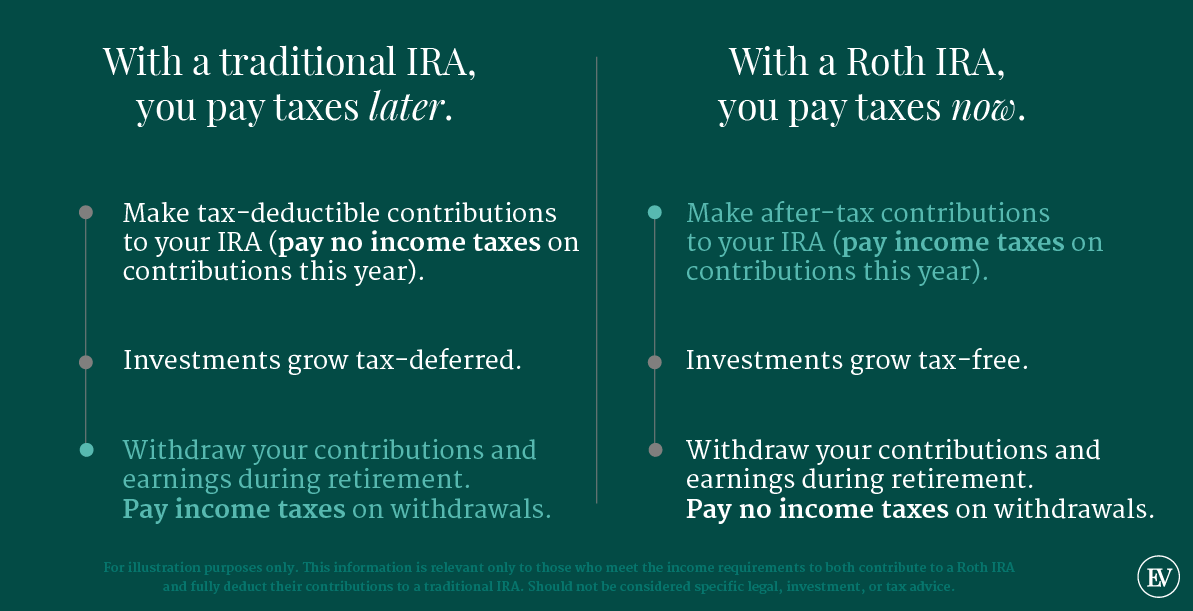

A traditional ira gives you the ability to save with pre tax dollars this works similar to a 401 k 403 b or 457 accounts sponsored by an employer but there is one big difference.

Start a traditional ira. Filing status 2019 magi. 18 normal iras also existed before erisa. A traditional ira is an individual retirement arrangement ira established in the united states by the employee retirement income security act of 1974 erisa pub l. Traditional is the keyword here because different rules apply to roth iras.

6 000 7 000 if age 50 or older. You can start taking money out of your ira penalty free at age 59. Traditional ira withdrawal rules. Since the account is tax deferred the government needs you to.

Irs notice 2020 18 relief for taxpayers extended the ira contribution deadline from april 15 to july 15 2020. But you don t have to start at that age you can choose to let the account sit and grow for another 11 years if you choose. Here are the traditional ira income limits in 2019 and 2020 these traditional ira income limits apply only if you or your spouse have a retirement account at work. The earlier you start a roth ira the better but opening a roth ira when you re close to retirement can still make sense under some circumstances.

Iras are specifically designed to hold retirement savings. Irs rules say that the money is to be withdrawn during retirement so if you withdraw funds from a traditional ira early before you reach age 59 1 2 the irs will assess a 10 early withdrawal penalty tax. Early ira withdrawals. The irs requires that you start taking minimum required distributions when you reach 70 years old.

Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a traditional ira. But you can t put 6 000 or 7 000 into a roth ira and another 6 000 or 7 000 into a traditional ira. The top age prior to the law was 70. Participation in an employer sponsored retirement plan such as a 401 k 403 b or 457 plan may impact an investor s ability to deduct traditional ira contributions on their.

You can control your investments and fees entirely if you want. With a traditional ira the dollars you deposit to your account are in most cases deductible. The secure act signed into law on december 20 2019 removed the age limit in which an individual can contribute to an ira. 829 enacted september 2 1974 codified in part at 29 u s c.

Applications postmarked by this date will be accepted.

/istock512752254.kroach.ira.cropped-5bfc32dac9e77c00519c008c.jpg)