Setting Up Ira Account

This type of trust is referred to by a few different names including an ira trust an ira living trust an ira inheritor s trust an ira stretch trust an.

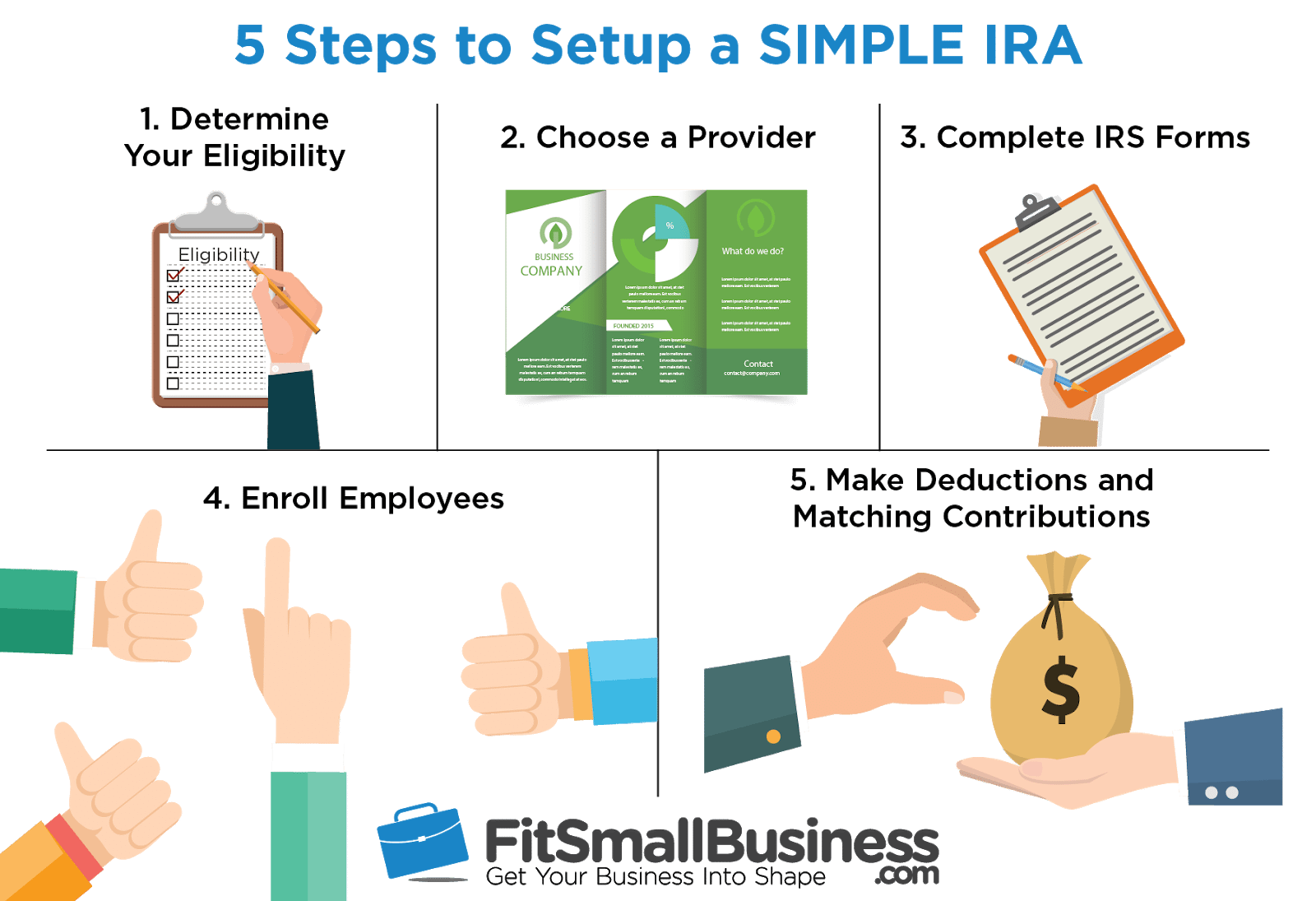

Setting up ira account. They may be set up with banks insurance companies or other qualified financial institutions. If you have an existing traditional ira the same company can probably open a roth ira for you. Set up a sep ira for each employee. And like any roth ira the money will grow tax free.

Almost all investment companies offer roth ira accounts. Name beneficiaries for your ira. If you hold significant assets in one or more individual retirement accounts you might want to consider setting up a special type of revocable living trust that s specifically designed to act as the beneficiary of your iras after you die. Decide where to open your roth ira account.

A sep ira must be set up by or for each eligible employee. Consider setting up automatic transfers. It will require an extra step in paperwork but it s worth the time to ensure that you re putting away money for retirement consistently. And because you never see that money you won t even miss it.

When you set up your roth ira you can arrange to have the money you invest in it taken directly out of your checking account. All sep contributions must go to traditional iras. Move money directly from your bank to your new vanguard ira electronically. An ira is an account set up at a financial institution that allows an individual to save for retirement with tax free growth or on a tax deferred basis.

Once your child reaches the age of majority they can take over management of the account. Just remember that iras have annual contribution limits. We ll send instructions once your ira is open avoid the 20 annual account service fee by registering your accounts online and signing up for e. Employees are responsible for making investment decisions about their sep ira accounts.

How to set up a roth ira for your child. The setting every community up for retirement enhancement secure act has changed the distribution options for certain beneficiaries who inherit an ira on or after january 1 2020. As an investor all you have to do is open your roth ira link your bank account and follow the steps the provider uses to build your portfolio. Your beneficiary category will determine your options for distributing the money.

You ll need your account number and routing number.

/iras-5bfc31f246e0fb0051bf0553.jpg)

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

:max_bytes(150000):strip_icc()/dotdash_final_6-Late-Stage-Retirement-Catch-Up-Tactics_Feb_2020-4c3d3dd8ab49428bb2f04afdb7b72948.jpg)