Short Term Loan From 401k

When you must find the cash for a serious short term liquidity need a loan from your 401 k plan probably is one of the first places you should look.

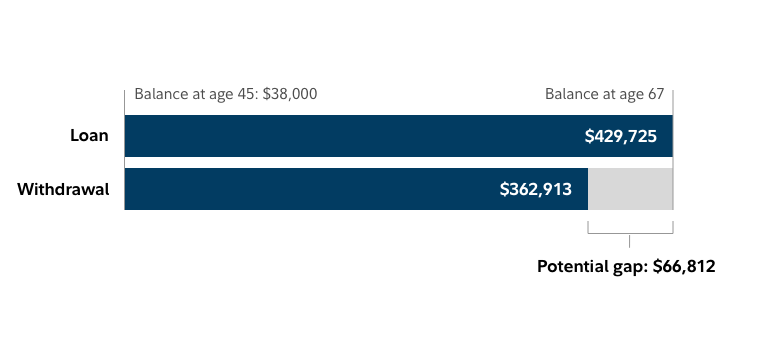

Short term loan from 401k. Loans and withdrawals from workplace savings plans such as 401 k s or 403 b s are different ways to take money out of your plan. However if it s used in the short term and repaid immediately the consequences will be negligible. Employer provided retirement accounts like a 401 k or 403 b. When the 401k loan is repaid to the plan account with interest an individual can stay on track with their retirement savings even while addressing short term cash needs.

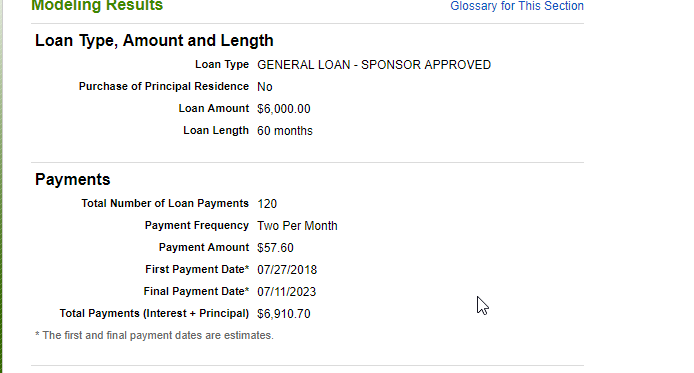

401k loan rules maximum 401k loan. The interest rate on your 401 k loan is determined by the rules in your 401 k plan but it is typically set up as a formula such as prime 1 although you pay the interest back to yourself taking a 401 k loan hurts your future retirement savings most of the time. 401k loans carry low interest rates e g compared to personal loans. But loans that are not repaid can put retirement savings at risk.

It s usually a bad idea to take out a line of credit against your retirement funds. Although federal tax rules allow 401 k loans of up to half the account balance or 50 000. Compared to a loan a withdrawal seems like a much more straightforward way to get the money you need to buy a home. Making a 401 k withdrawal for a home.

While the new withdrawal exemption may help cover the short term expenses associated with coronavirus. The money doesn t have to be repaid and you re not limited in the amount you can withdraw which is the case with a 401 k loan. When you must find cash for a serious short term liquidity need a loan from your 401 k plan probably is one of the first places you should look. When a 401 k loan makes sense.

It can also make sense to borrow against a plan for a short term loan that you know you can pay back. If you have a high credit score and are eligible for favorable terms taking out a loan can be a good short term tactic.

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-01-f213028d0331407980819f8e344c1e30.jpg)

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-01-f213028d0331407980819f8e344c1e30.jpg)

:strip_icc()/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif)