Risk Management Insurance Company

On the other hand insurance companies themselves face a variety of risks they need to mitigate.

Risk management insurance company. Worldwide these companies write policies that deal with specific risks and in many cases even underwrite exotic risks. Insurance companies need to implement a management process that minimizes the likelihood of sensitive data cybersecurity breach. Insurance management company is an insurance agency concentrating in commercial industrial institutional construction property liability workers compensation cyber surety. Risk management in the insurance business is a bit of a head scratcher.

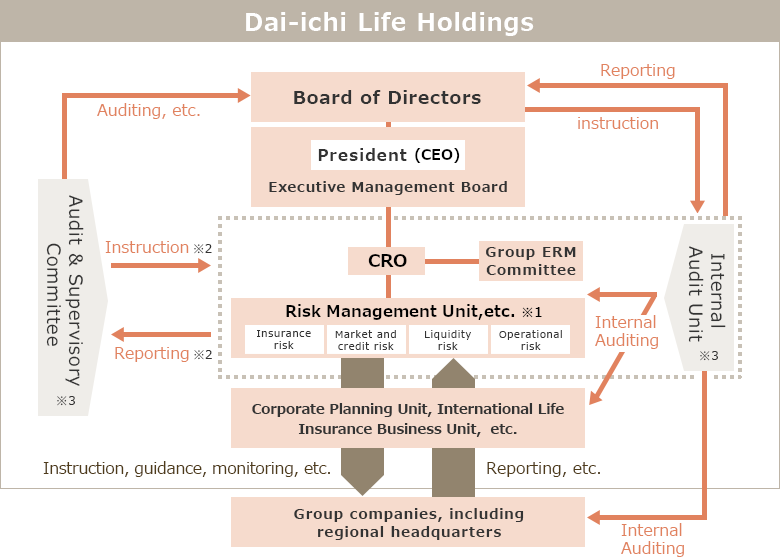

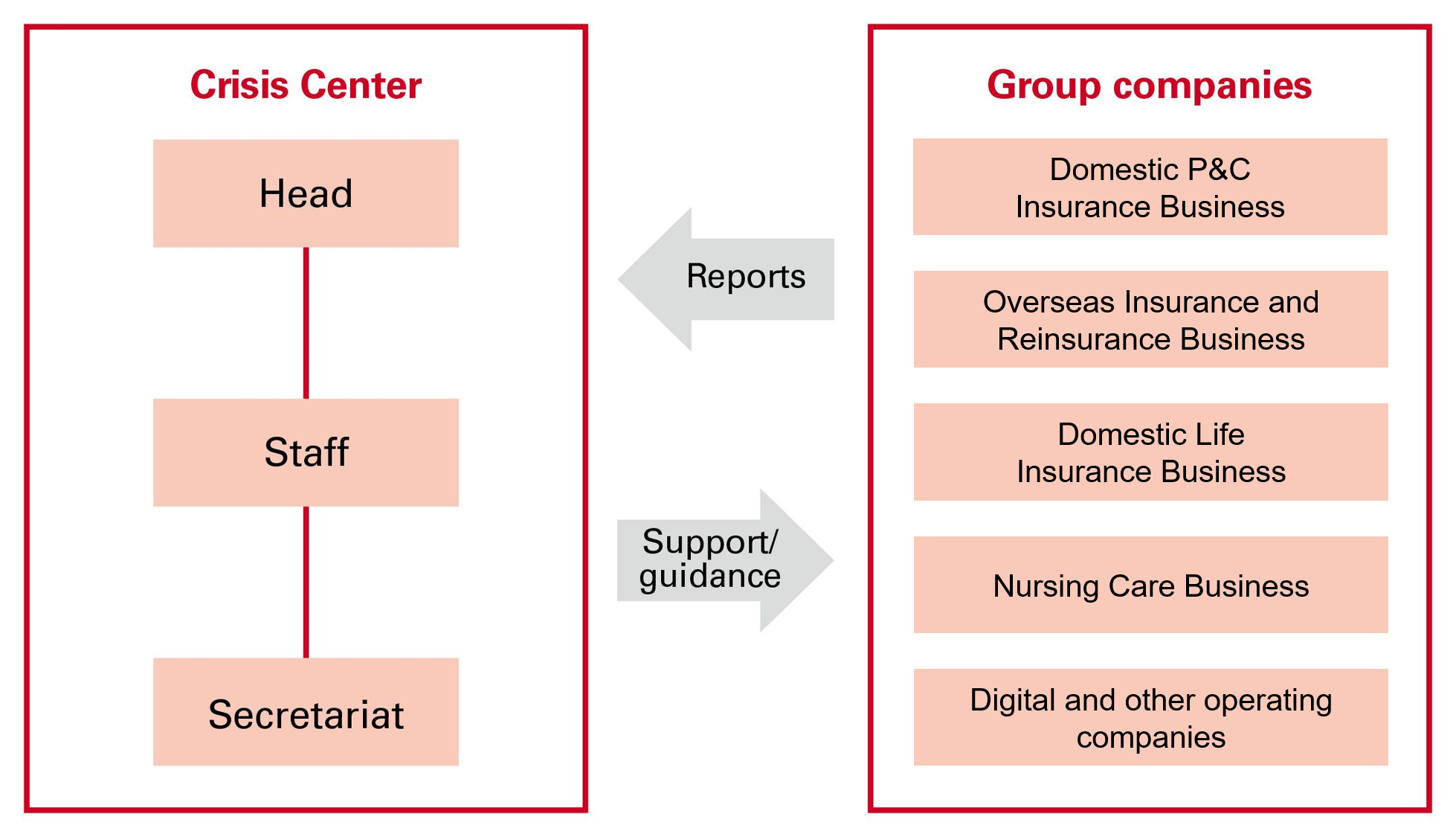

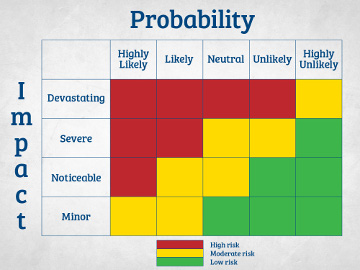

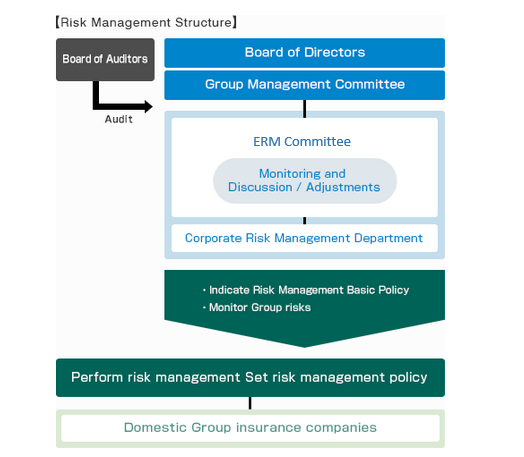

Risks with lower probability of occurrence and lower loss are handled in descending order. For example the second largest insurance company in the world allianz has already centralised a group wide risk framework. Principles that should be embedded in a risk management framework. Learn about the safety and risk management support services available to our clients.

The solvency ii risk based capital regime proposed by the eu is forcing europe s insurers to consider what the effect of a stricter regime will be and how they can improve their existing risk management policies. A systematic approach to risk management. However the payoff to all parties is invaluable. Because of increased consumer awareness and expectations evolving business models new technologies with emerging risks new waves of regulations and an unprecedented.

A lot goes into determining how much risk each policyholder presents to an insurance company. Incorporating risk management strategies into your dental practice takes discipline. As a direct corollary therefore insurance companies should be good at managing. Insurance industry by shriram gokte background insurance companies are in the business of taking risks.

Insurance data that is at risk of cybersecurity threats. Related to this item. Risk management is the practice of identifying and analyzing exposures to loss and taking steps to minimize those exposures. Managing compliance risk is crucial in the challenging environment of the insurance industry.

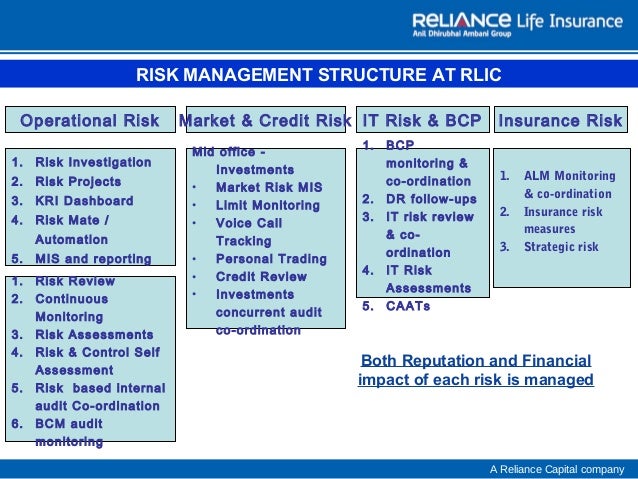

A widely used vocabulary for risk management is defined by iso guide 73 2009 risk management vocabulary in ideal risk management a prioritization process is followed whereby the risks with the greatest loss or impact and the greatest probability of occurring are handled first. To operate efficiently insurers must assess and control credit risks market risks operational risks reputational risks and much more while adhering to ever broadening regulations. Risk management practices to identify and mitigate insurers exposure to the risk of insurance fraud.

.png?width=600&name=Identify%20Risks%20(1).png)