Refinance Mortgage Vs Home Equity Loan

One key difference between a home equity loan and a traditional mortgage is that you take out a home.

Refinance mortgage vs home equity loan. Both mortgages and home equity loans use your home as collateral. Home equity loan vs. Home equity loans also often have fixed rates and shorter terms than primary mortgages but you ll be making monthly payments on both your home equity loan and original mortgage. If you don t make your payments your lender can take your house.

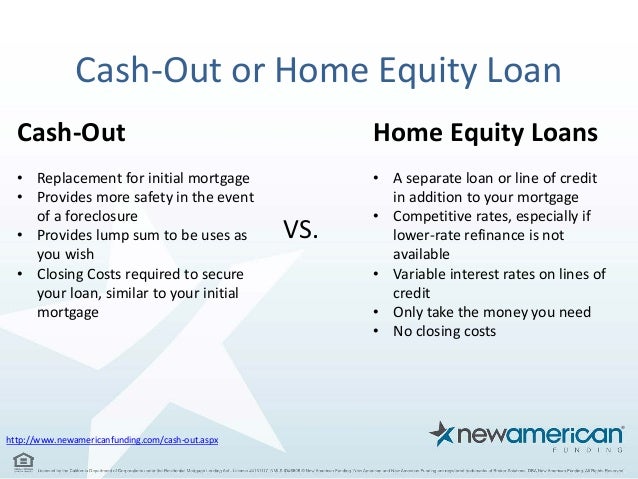

Cash out refinance pays off your existing first mortgage. This results in a new mortgage loan which may have different terms than your original loan meaning you may have a different type of loan and or a different interest rate as well as a longer or shorter time period for paying off your loan. They also tend to have much lower closing costs. The cash out refinance loan is a loan that refinances your first mortgage into a larger mortgage and allows you to take the difference in cash.

Getting a home equity loan may be quicker if the lender doesn t require an in person appraisal and some lenders cover the closing costs on the loan. If you refinance into a longer term loan or a lower interest rate it can mean a smaller monthly payment and less interest paid over time. Instead it s a second mortgage with a separate payment. Instead it replaces your existing home loan.

Pay off your existing mortgage. Unlike a home equity loan a refinance isn t a second mortgage. Home equity loans are cheaper than full refinances typically home equity loans and lines come with higher interest rates than cash out refinances. Mortgages and home equity loans are both loans in which you pledge your home as collateral.

Your home is not just a place to live and it is also not just an investment. You ll also find that the. Assuming you have an adequate amount of equity in your home a cash out refinance loan enables you to. Refinancing with a 15 year mortgage vs.

Unlike a cash out refinance a home equity loan doesn t replace the mortgage you currently have. A 15 year home equity loan in this scenario refinancing with a home equity loan is cheaper for the first 48 months because closing costs are less. Your home can moreover be a handy source of ready cash to cover.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/Remodel-Project-Financed-By-Home-Equity-1500-x-1000-56a49eb45f9b58b7d0d7df93.jpg)