Va Refinance Home Loan

The funding fee varies from 2 15 to 3 3 of the loan amount for cash out.

Va refinance home loan. You can borrow more than this amount if you want to make a down payment. These mortgage loans are available to qualified service members veterans or spouses who currently have conventional loans fha loans usda loans or va loans. On a no down payment loan you can borrow up to the fannie mae freddie mac conforming loan limit in most areas and more in some high cost counties. The va home loan program provides qualified homeowners with a simple way to take advantage of lower rates and decrease their monthly mortgage payment.

The funding fee on an irrrl is 0 5. If you have a va home loan then there is a good chance that you have already come into contact with unsolicited offers to refinance your mortgage that appear official and may sound too good to be true. Va refinance loans typically come with the same fees as other mortgage refinances but there is one fee that s unique to the program the va funding fee. Va loan refinance rates one of the most common home loan in canada is the five year fixed rate shut home loan as opposed to the u s.

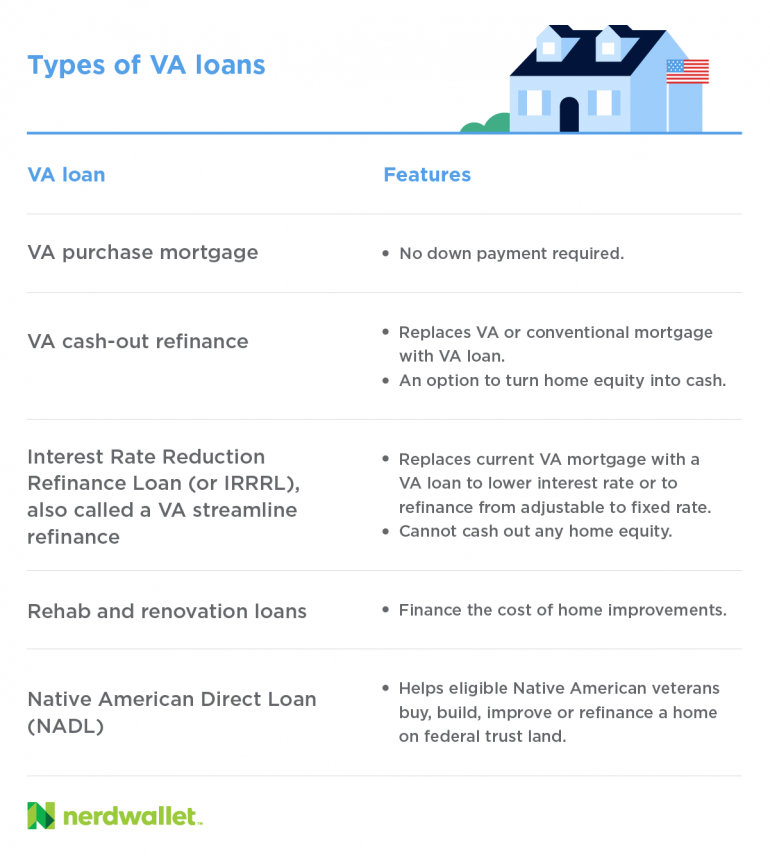

Beyond that military homeowners can get cash back on a va refinance and use the proceeds for a variety of needs from paying off debt or making home improvements and much more. In contrast loan providers who choose to make nonconforming loans are exercising a greater threat tolerance and do so knowing that they deal with more obstacle in marketing the loan. Refinance a non va loan into a va backed loan. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs.

As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy. Va home loans are also offered without private mortgage insurance or pmi which typically tacks on another 05 to 1 percent on your mortgage amount annually until you have at least 20 percent equity. Although va loans don t have mortgage insurance they do have a funding fee that s paid at closing. Learn more about va home loan limits.

Va helps servicemembers veterans and eligible surviving spouses become homeowners.

:strip_icc()/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)