Reverse Mortgage Age Limits

Find information on reverse mortgage age requirements including scenarios when one spouse is not at the 62 year age limit with alpha mortgage.

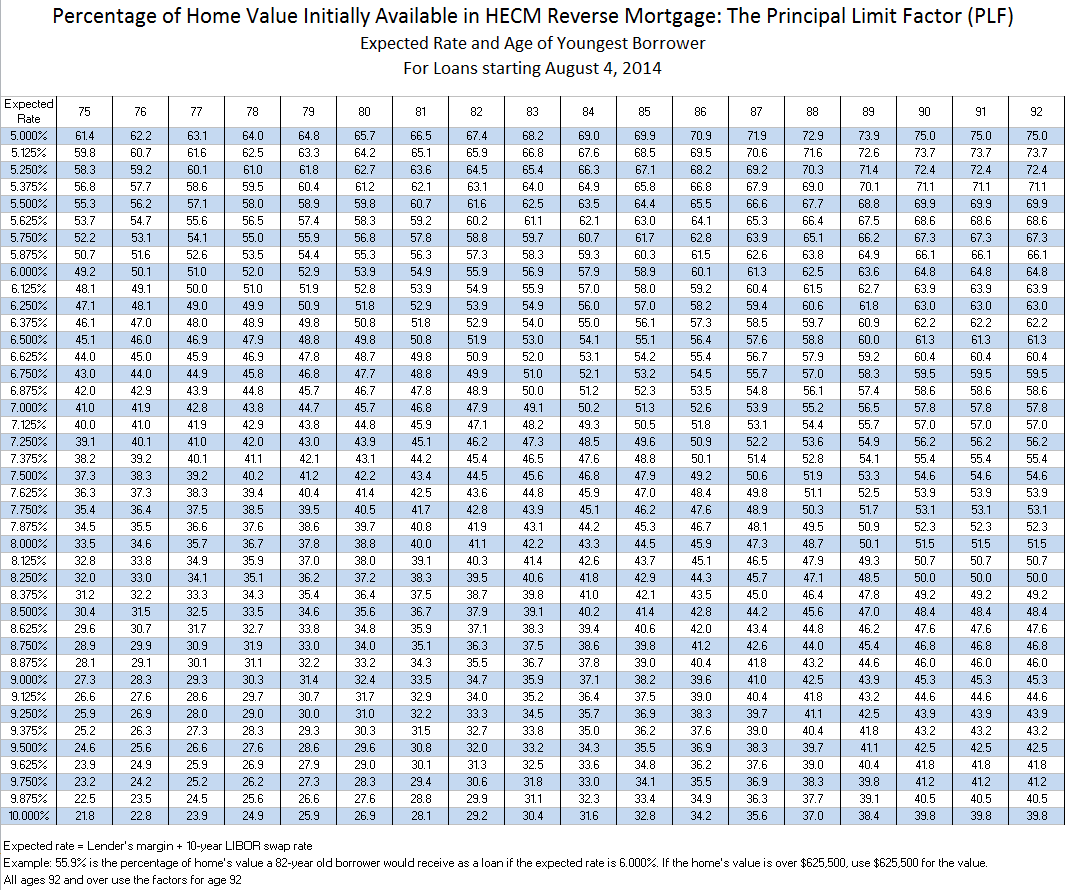

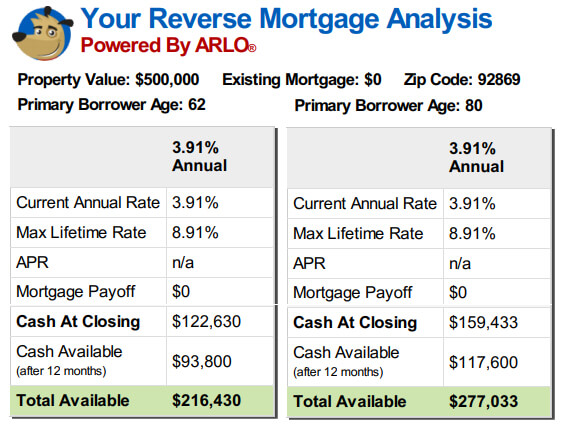

Reverse mortgage age limits. This reverse mortgage age chart was updated in march of 2020. Further these amounts change weekly based on the performance of the 10 year libor swap rate. Reverse mortgage age limits. If there is a spouse of a borrower who is not yet 62 the older spouse can still get a reverse mortgage and the younger spouse can remain on title and would be known as an eligible non borrowing spouse.

Reverse mortgage loan limits. The age of the youngest borrower or eligible non borrowing spouse. The loan s current interest rate. The hud hecm allows for an eligible non borrowing spouse under the age of 62 that although they cannot access the reverse mortgage funds if the eligible borrower were to leave the home they can remain in the home for life by following the same reverse mortgage provisions live in the home as their primary residence pay the taxes insurance and any other property charges in a timely.

The lesser of the appraised value of your home the hecm mortgage limit in your area or the actual sales price of your home. Follow the link below for a more up to date chart. All limits and restrictions are set by individual lenders. The minimum age is 62 years and there are no exceptions for disability or social security status.

Call us toll free today. Frequently asked questions regarding reverse mortgage eligibility. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The vast majority of reverse mortgages.

Reverse mortgage age table march 2020. 855 367 4326 855 for hecm. Reverse mortgage borrowing limits if you get a proprietary reverse mortgage there are no set limits on how much you can borrow. Can a homeowner that has a mortgage still get a reverse mortgage loan.

However if there is still a significant mortgage balance remaining then payout may be minimal. A reverse mortgage is a financial tool in which lenders provide loans to retirees based on the value of their permanent home. Up to the maximum lending limit of 726 525 and age of the youngest borrower.