Who Regulates The Insurance Industry

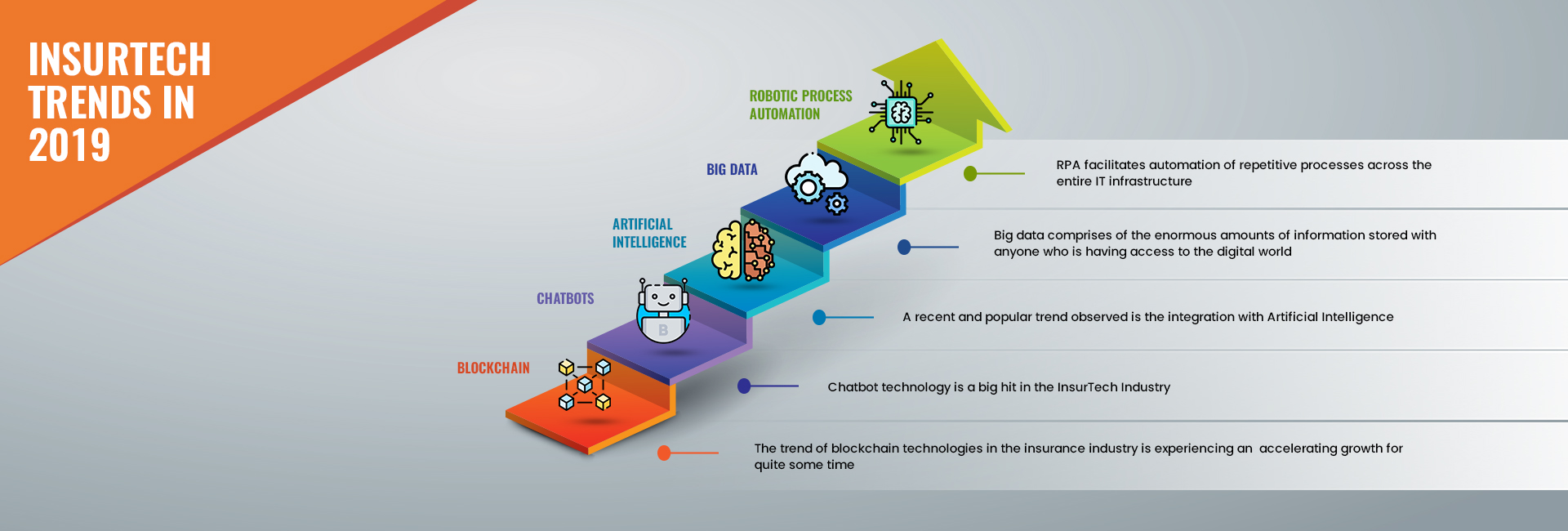

More insurance trends and insights.

Who regulates the insurance industry. Asic regulates insurance and expects your insurer to treat you honestly and fairly. Insurance continues to be regulated by the states despite several challenges to their authority over the years. Find out about asic s role in insurance and how to deal with insurance disputes. Insurance companies are regulated by the states.

The general insurance industry in australia is governed by a number of laws most importantly the insurance act 1973 the insurance contracts act 1984 and the corporations act 2001. Each state has a regulatory body that oversees insurance matters. The question of who should regulate the insurance industry has been debated in the united states since the time of the civil war. Explore deloitte s 2020 insurance outlook for insight on why insurers success depends on the ability to integrate technology talent and business model innovation into legacy environments.

Insurance regulatory law is the body of statutory law administrative regulations and jurisprudence that governs and regulates the insurance industry and those engaged in the business of insurance. How asic regulates insurance. Examples are the office of the insurance commissioner washington and the division of financial regulation oregon. Insurance regulatory law is primarily enforced through regulations rules and directives by state insurance departments as authorized and directed by statutory law enacted by the state legislatures.

This is known as the twin peaks system of regulation. The body which regulated the uk financial services industry the financial services authority fsa was replaced by two new regulatory bodies. Understand how new insurance technology and regulatory technology are enabling transformative shifts in insurance compliance in our insurance regulation and. How asic regulates.

States began regulating insurance companies by granting charters that authorized their formation and operation within the state but there were few other requirements. New hampshire created the 1 st state insurance commission in 1851. The two key regulators are the australian prudential regulation authority and the australian securities and investments commission. Insurance product disclosure statements pds resolving problems with insurance companies.

This body is often called the department of insurance but some states use other names. As the insurance industry grew states started creating commissions that had oversight of the industry.