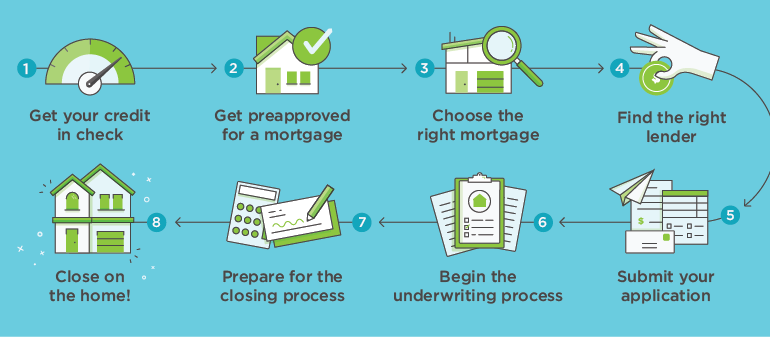

Steps To Get Preapproved For A Mortgage

What the trend means for buyers sellers and agents.

Steps to get preapproved for a mortgage. Estimate your mortgage payments. How to get the lowest mortgage rate. Sellers would prefer to see a preapproval letter from the lender to know this is a serious buyer over a prequalified buyer says nancy newquist nolan a real estate agent at coldwell banker in santa barbara calif. Most borrowers can get preapproved by multiple lenders and as long as you re getting those preapprovals within 30 days they shouldn t affect your credit score too harshly.

Getting preapproved for a mortgage carries more weight because it s a more comprehensive application process more on that below. Get pre approved to speed up the buying process. Know the maximum amount of a mortgage you could qualify for. By contrast getting pre approved requires a more in depth review of your finances.

After you re pre qualified your next step is to get pre approved. Know your credit score. Getting preapproved for a mortgage loan isn t difficult if you do a little preparation beforehand. Follow these steps to ready yourself for the preapproval process.

A step by step guide house hunters now need preapproval letters to walk in the door. Know your credit score. You ll need to submit paperwork about your income assets employment. With a pre approval you can.

A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. Remember every preapproval requires a hard credit check and that can pull your score down a few points but if you apply to multiple lenders within a short period it should only report as a single inquir y. Getting preapproved for a mortgage loan isn t difficult if you do a little preparation beforehand. As you search for a home getting preapproved for a mortgage can be an important step to take.

Prequalification is helpful because it gives you a general sense of what you can borrow. 12 steps of a real estate closing. However the lender doesn t verify any of the information you give them so you really don t know what you can borrow. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)