Structured Settlement Payout

The structured settlement annuity is an irrevocable stream of regular payments from an insurance company that is structured in a way dictated by the court system.

Structured settlement payout. If a lawsuit was settled for your benefit then you may be awarded a structured settlement payout. A structured settlement can include a large lump sum payment upon termination of the contract. An example of this would be every month for 20 years. Sometimes settlement money is paid out in a lump sum within a settlement agreement.

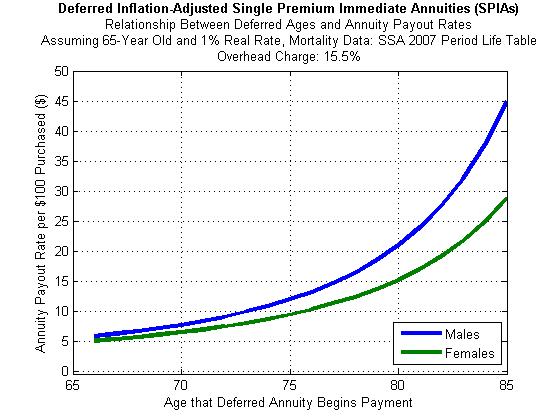

Structured settlement meaning the difference between lump sums and structured settlements is a structured settlement payout takes place over an extended period of time. For example a structured settlement buyer may offer to buy your payments at a 14 effective rate. In the above example this will amount to close to 27 000. Structured settlements are a form of an annuity product structured to provide a specific financial payout over a specified period.

Not all annuity settlements are structured in a payment schedule. A child recipient may receive regular payments while they are a minor and then one large lump sum to pay for their college tuition when they graduate from high school. A structured settlement will enable you to take all or part of your personal injury compensation in the form of tax exempt or tax free periodic payments rather than a single immediate lump sum payment. However many legal settlements offer a lump sum payment option which provides a one time sum of money.

A structured settlement is a negotiated financial or insurance arrangement through which a claimant agrees to resolve a personal injury tort claim by receiving part or all of a settlement in the form of periodic payments on an agreed schedule rather than as a lump sum.